Dormant Solana Whale Moves 80,000 SOL Worth $10.7M After a Year of Inactivity

- A dormant wallet for a year, moved 80,000 SOL worth about $10.7 million from Binance.

- While SOL faces near-term weakness, currently trading at $136.

In a notable development, a previously inactive Solana whale has re-entered the market today after reactivating the wallet. According to on-chain data published by Lookonchain on X, the wallet has been idle for about a year, has withdrawn 80,000 SOL from Binance and transferred it to a private wallet.

As the data mentioned that the wallet is identified as 7Z4KKD and it has moved SOL from binance before 5 hours of the post, as the transferred 80,000 SOL is now worth around $10.78 million, which brings in the positive sentiment among the Solana community as it indicates the possibility of Solana price rally soon.

The decision to transfer a considerable SOL funds from Binance to a private wallet illustrates possible accumulation. As the move reflects deliberate repositioning amid market uncertainty rather than immediate liquidation.

Solana Price Faces Short-Term Weakness

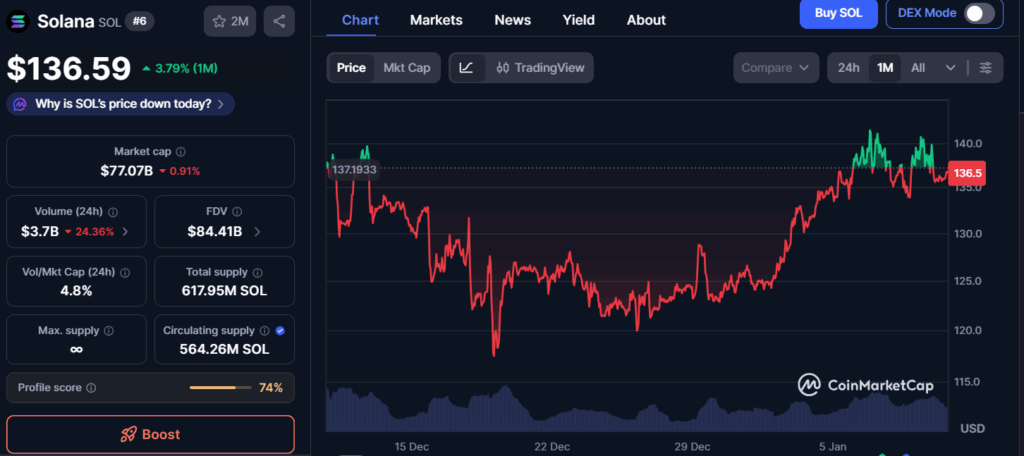

SOL is trading at $136.59, with 0.84% down, at the time of writing this article, as the uncertainty revolves around the market. With that, the 24-hour trading volume also declined by about 24.36%, reaching $3.7 billion.

Source: CoinMarketCap

Source: CoinMarketCap

Analysing the 1-month price of SOL, which is trading below the previously observed level at $137, indicates short-term weakness, as the price is still holding above the critical $135 support zone. If the coin breaks above $137.5 – $138 range, it could signal a renewed upward trend toward $140.

SOL may be positioned for further growth in 2026 as a result of its ambitious technology roadmap, which is led by the impending Alpenglow upgrade. As per the data of Delphi Digital, the upgrade intends to cut transaction finality times from 12.8 seconds to 100-150 milliseconds, resulting in a 100x improvement over current rates. The upgrade is projected to be implemented gradually, with initial activation scheduled for early to mid-2026.

Highlighted Crypto News Today:

Chainlink (LINK) Shake-Up: Will It Slide to Test the $10 Barrier as Bears Circle?

You May Also Like

Trump claims he has never felt happy until he makes America great again.

Fed Lowers Rates By 25bps: How Bitcoin And Crypto Prices Responded And What’s Next