NFT sales pump 37% to $144.8m, Immutable dethrones Ethereum

The NFT market has experienced a strong rally, with sales volume jumping by 37.10% to $144.8 million.

According to data from CryptoSlam, this marks the biggest weekly gain in recent months for the sector.

The spike coincides with Bitcoin’s (BTC) recent climb to the $105,000 mark. Ethereum (ETH) also had a slight 2.5% increase during the previous seven days. Last week, the total global cryptocurrency market cap increased from $3.28 trillion to $3.29 trillion.

Market participation has surged greatly with NFT buyers increasing by 50.56% to 1,061,348, and NFT sellers rising by 8.09% to 38,494. NFT transactions have also grown by 7.88% to 1,749,437.

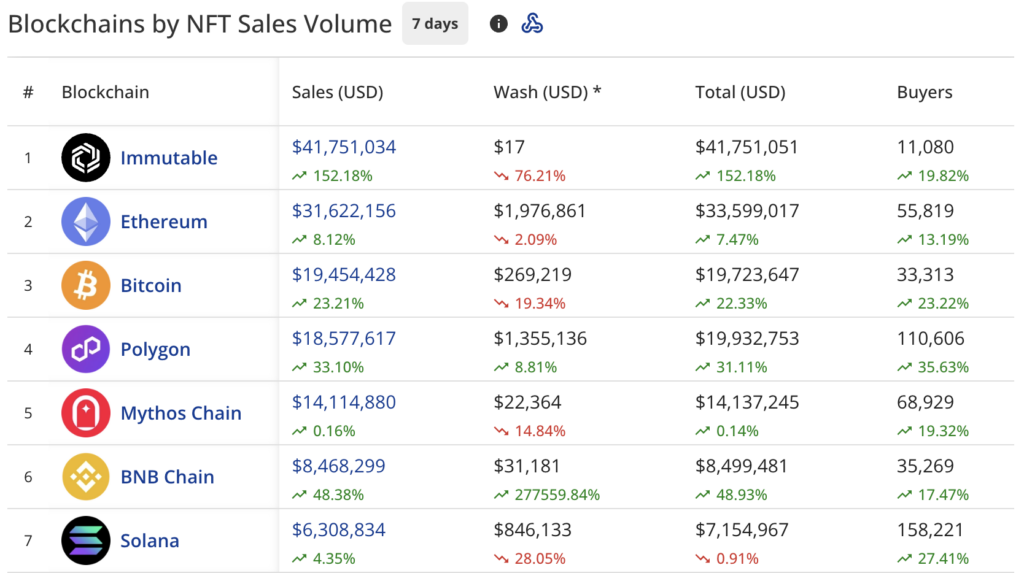

Immutable dethrones Ethereum in sales

Interestingly, Immutable (IMX) has overtaken Ethereum to claim the top position with $41.7 million in sales. It has surged by 156.01% from the previous week. This is one of the first times Ethereum has lost its leading position in months.

With $31.5 million in sales, Ethereum has fallen to second position, although it is still showing strong growth of 6.69%. At $1.9 million, Ethereum’s wash trading has dropped by 2.91%.

Bitcoin, at $19.4 million, is still in third place after rising 22.55%. Polygon (POL) has increased 32.91% and is now in fourth place with $18.5 million. Mythos Chain, with $14.1 million, completes the top five.

BNB (BNB) Chain has entered the top rankings in sixth place with $8.4 million, jumping 47.59%. Solana (SOL) sits in seventh with $6.3 million, up 5.30%.

The buyer count has increased across all major blockchains, with Polygon leading at 35.63% growth, followed by Solana at 27.41% and Bitcoin at 23.22%.

Guild of Guardians Heroes has taken the top spot in collection rankings with $24.7 million in sales. It has more than doubled with 132.53% growth. This gaming collection has benefited directly from Immutable’s surge.

Courtyard on Polygon has moved to second place with $17.2 million with a strong growth of 36.33%. Guild of Guardians Avatars holds third position with $10.3 million, more than doubling with 108.61% growth.

DMarket maintains fourth place with $8.9 million, with a minimal growth of 0.15%. Uncategorized Ordinals on Bitcoin have entered the top five with $7.6 million, with a surge of 1,556.66%.

CryptoPunks has disappeared entirely from the top collection rankings, a notable drop from its previous sixth-place position.

Notable high-value sales from this week include:

- CryptoPunks #1831 sold for 150 ETH ($389,846)

- CryptoPunks #9778 sold for 150 ETH ($377,958)

- CryptoPunks #4868 sold for 76.5 ETH ($201,933)

- CryptoPunks #5586 sold for 70.07 ETH ($185,292)

- CryptoPunks #7516 sold for 60 ETH ($158,378)

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

BlackRock boosts AI and US equity exposure in $185 billion models