Binance’s 2025 End-of-Year Report: Trust, Liquidity, and Web3 Discovery

Main Takeaways

-

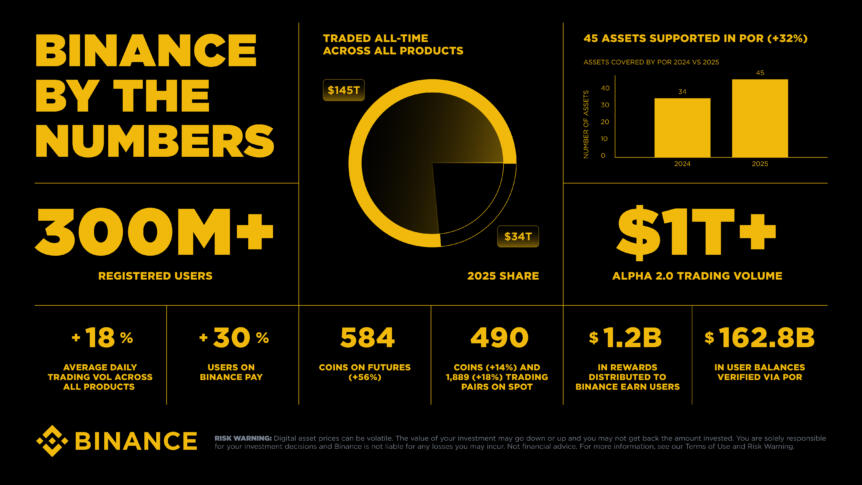

In 2025, Binance became the first global exchange to secure full authorization under ADGM’s internationally recognized framework and crossed 300 million registered users worldwide, signaling a new phase where scale and regulatory scrutiny advance together.

-

Binance remained a primary venue for global crypto liquidity, with $34 trillion traded on the platform in 2025 and spot volume exceeding $7.1 trillion, alongside an 18% increase in average daily trading volume across all products.

-

Crypto’s center of gravity expanded beyond the order book as Binance Alpha 2.0 surpassed $1 trillion in trading volume with 17 million users, while Binance’s security, compliance, risk, and governance efforts delivered measurable user protection outcomes at scale.

Binance’s State of the Blockchain 2025 year-in-review report is out, highlighting the most important themes and growth metrics across regulation, liquidity, Web3 discovery, institutional adoption, user protection, and the everyday use of crypto. For the full set of findings, product updates, and data points, you can read the full report available here in English.

Two milestones arrived close together at the end of 2025: Binance became the first crypto exchange to secure full authorization under the Financial Services Regulatory Authority (FSRA) of ADGM’s rigorous regulatory framework, allowing regulated global trading, and our community crossed 300 million registered users worldwide. Together, they reflect how expectations in our industry are changing as crypto platforms are increasingly judged as financial infrastructure – on governance, resilience, user protection, and the ability to perform under stress, in addition to scale, liquidity, and the strength of the user community.

Trust as Infrastructure: Regulation, Resilience, and Measurable Outcomes

The ADGM framework covers governance, risk management, custody, clearing, and consumer protection, aligning crypto market structure more closely with the expectations placed on traditional financial venues.

The report also emphasizes that trust can be measured in outcomes. Since 2023, Binance has reduced direct exposure to major illicit funds categories by 96%. In 2025, Binance’s controls helped prevent $6.69 billion in potential fraud and scam losses for 5.4 million users. Over the same period, Binance processed 71,000+ law enforcement requests, supported the confiscation of around $131 million linked to illicit activity by law enforcement partners, and delivered 160+ law enforcement training sessions.

Trust is also built by reducing unnecessary friction for legitimate users. One example that the report highlights is Enhanced Due Diligence redesign, where we simplified submission steps and improved pass rates in a short implementation cycle, aiming to make compliance stronger without making user experience harder than it needs to be.

Where Liquidity Lives: Depth, Participation, and New Discovery Flows

Liquidity still determines the trading experience users actually get: spreads, slippage, and execution reliability. In 2025, Binance processed $34 trillion in trading volume across all products, with spot trading volume above $7.1 trillion. All-time traded volume reached $145 trillion across all products.

At the same time, participation is becoming more diverse. Binance expanded spot markets to 490 coins and 1,889 spot trading pairs, and futures coverage to 584 coins. Tools also shifted user behavior toward more structured participation, including simulation and automation. Binance Demo Trading, a unified spot and futures demo environment with virtual funds, was used by more than 300,000 users as a way to learn interfaces and test strategies before trading with real funds. In futures, more than 1.2 million users subscribed to Smart Money, a live suite for tracking aggregated behavior signals from profitable traders.

The report also highlights a meaningful shift in where users discover and engage with new projects. Binance Alpha 2.0 became a major discovery surface integrated into the Binance experience, surpassing $1 trillion in trading volume and onboarding 17 million users in 2025. It distributed $782 million in rewards across 254 airdrops. With that scale came added integrity requirements: the report notes that risk controls blocked 270,000 dishonest reward participants attempting to game campaigns, helping keep rewards aligned with real users rather than bot activity.

Institutions in Motion: From Pilot Programs to Operational Workflows

Another theme running through the report is institutional adoption shifting from experimentation to integration. Institutions are increasingly looking for crypto infrastructure that fits governance, collateral, reporting, and settlement requirements they already use. The increasing scale of their presence was reflected on Binance over the past year as institutional trading volume grew by 21% compared to the year before, and OTC fiat trading volume shot up by 210%.

In 2025, tokenization moved closer to operational use cases, including tokenized funds used as eligible off-exchange collateral under Binance’s institutional collateral framework. The report also describes how modular offerings, including white-label rails through Crypto-as-a-Service, are enabling regulated firms to offer digital assets without rebuilding full exchange infrastructure from scratch. Account structures offered through Fund Accounts, Binance Wealth, and Binance Prestige reflect how capital is organized in traditional finance, with formats that support managed strategies, entity onboarding, and dedicated service models.

Everyday Crypto: Local Rails, Payments, and Earning

Beyond trading and discovery, crypto adoption depends on whether users can fund accounts in local currency, move value easily, and choose earning tools that match their risk preferences. In 2025, Fiat and P2P volume grew 38%; Binance Pay users grew 30% year over year, and acceptance expanded massively to more than 20 million merchants. Across its line of products, Binance Earn distributed $1.2 billion in rewards to users in 2025.

Final Thoughts

Digital finance is becoming more standards-driven, more liquid where execution is reliable, and more user-directed as discovery and participation become easier. Binance’s 2025 numbers show scale, but the deeper point is what that scale requires: regulatory anchors like ADGM authorization, resilience and security programs that prevent real losses, strong data protection and AI governance, and product design that reduces friction for legitimate users while raising the cost of abuse. This blog only summarizes a selection of the report’s findings. The full report includes deeper breakdowns, supporting context, and additional product and infrastructure updates.

Read the complete State of the Blockchain 2025 report here.

This article was originally published as Binance’s 2025 End-of-Year Report: Trust, Liquidity, and Web3 Discovery on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Momentous Grayscale ETF: GDLC Fund’s Historic Conversion Set to Trade Tomorrow

The UA Sprinkler Fitters Local 669 JATC – Notice of Privacy Incident