Dow Jones ticks higher despite EU, Mexico tariff hike: Fed under fire while Bitcoin breaks $120k

U.S. stocks posted minor gains with tariffs in focus, while Bitcoin continued to print new all-time highs.

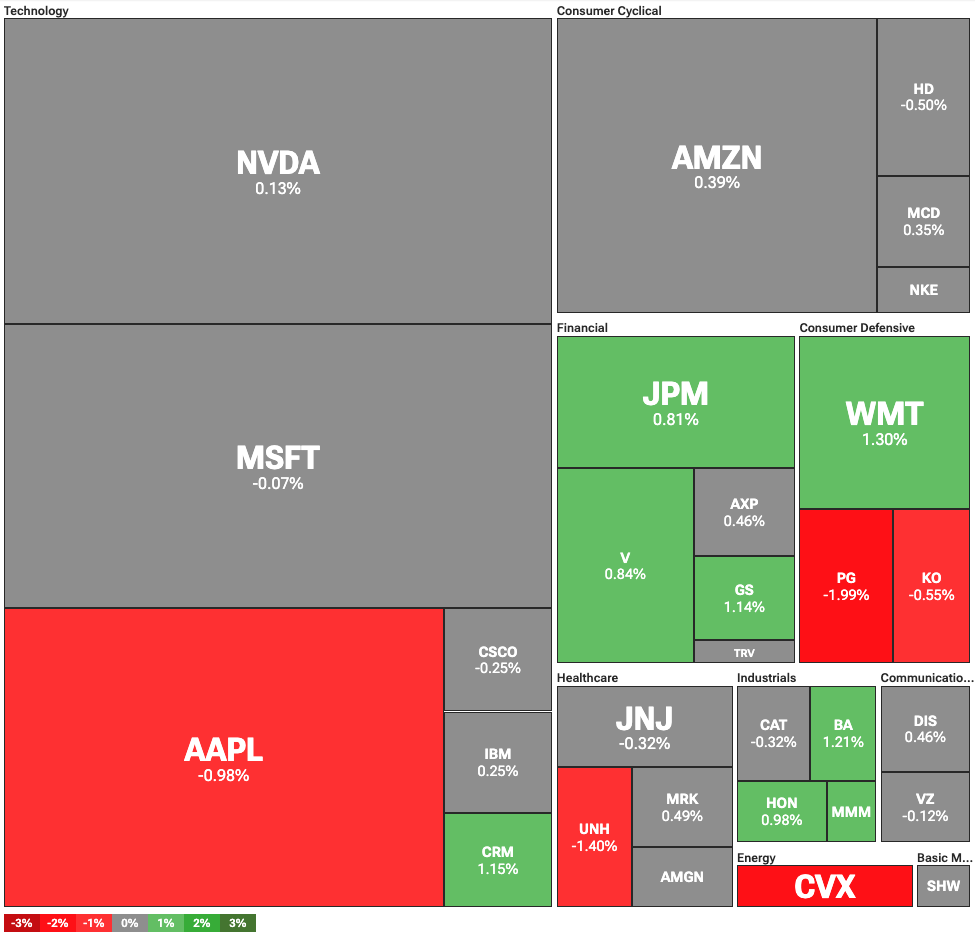

U.S. stock indices edged higher as investors focused on tariffs and the Federal Reserve. On Monday, July 14, the Dow Jones was up 50 points, or 0.11%. The S&P 500 gained 0.11%, while the tech-heavy Nasdaq rose 0.32%.

Traders showed a lower risk appetite after President Donald Trump announced a 30% tariff on Mexico and the European Union, set to take effect on August 1. Both are key U.S. trading partners, putting pressure on market sentiment. Currently, Mexico and the EU are pushing for a lower tariff rate.

At the same time, markets are weighing whether the new tariffs represent a long-term policy shift or a negotiating tactic aimed at securing more favorable trade deals for the U.S.

Despite the cautious tone in equities, crypto markets are showing strong performance. Bitcoin (BTC) once again reached a new record, climbing to an all-time high of $123,091. Boosted by rising demand for ETFs and increasing allocations to corporate treasuries, the Bitcoin bull run continues and is also lifting the altcoin market.

Fed under fire for $2.5B renovation

Pressures on the Federal Reserve intensified after the controversial $2.5 billion renovation of its main building came into focus. Both the White House and potential contenders for the top position in the nation’s central bank slammed the agency over the proposed renovation of its Washington headquarters.

White House economic adviser Kevin Hassett condemned the plan, citing a $700 million cost overrun, and stated that the administration will investigate further. Former Fed governor Kevin Warsh also criticized the proposal, calling the costs “outrageous.”

Since President Trump’s inauguration, the administration has consistently pressured the Fed to cut interest rates. The controversy surrounding the renovation could become a political lever to undermine current Fed Chair Jerome Powell.

You May Also Like

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy

When Will Altcoin Season Start? FED Rate Cut Fuels Bitcoin, but Ethereum Still Lagging