NFT buyers rise 120% despite sales staying flat at $61.5 million

The NFT market recorded $61.5 million in sales volume over the past week, posting a modest 1.52% increase from the previous period.

- NFT sales hit $61.5M, while buyers surged 121% and sellers rose nearly 99%.

- Ethereum led blockchains with $29M in NFT sales and a 421% jump in buyers.

- Bitcoin NFTs dominated top sales as BTC reclaimed $95K and ETH crossed $3.2K.

While the sales figures show minimal movement, the real story lies in market participation. NFT buyers jumped 120.90% to reach 134,743, while sellers increased by 98.69% to 111,756.

This has happened at a time when Bitcoin (BTC) has staged a recovery to the $95,000 level, while Ethereum (ETH) has reclaimed the $3,200 mark.

The global crypto market cap now stands at $3.22 trillion, up from last week’s $3.09 trillion.

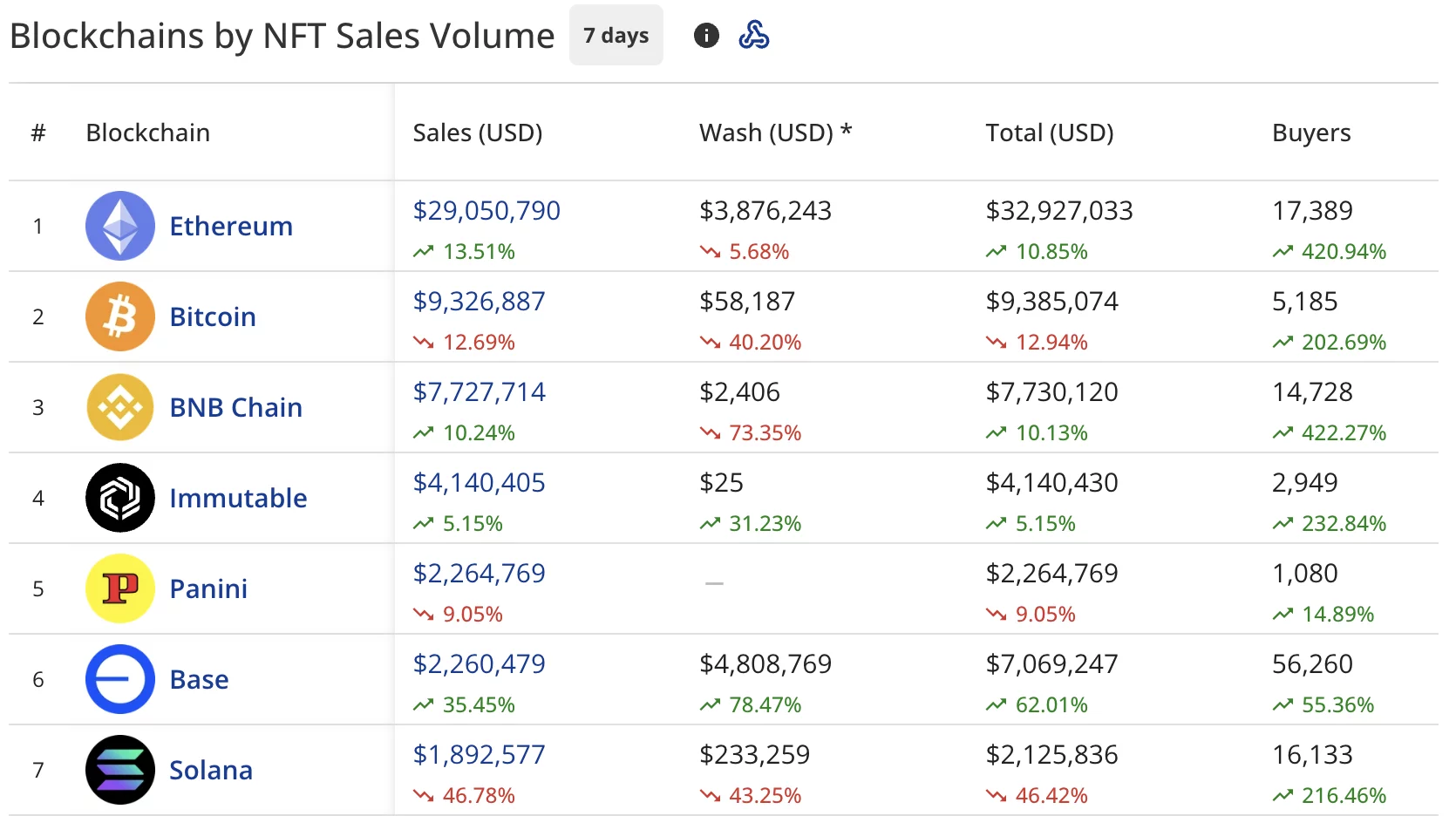

Ethereum maintains dominance with $29 million in sales

Ethereum continues to lead all blockchains with $29.05 million in NFT sales, posting a 13.51% gain over the seven-day period.

The network saw 17,389 buyers, up by 420.94% from the prior week. Wash trading on Ethereum totaled $3.88 million during this timeframe.

Bitcoin claimed second place among blockchains with $9.33 million in sales, though this is a 12.69% decline from the prior week. The network drew 5,185 buyers, up 202.69% week-over-week.

BNB Chain (BNB) ranked third with $7.73 million in sales, climbing 10.24% and drawing 14,728 buyers who increased by 422.27%.

Immutable (IMX) secured fourth position at $4.14 million in sales, up 5.15%, while Panini rounded out the top five with $2.26 million, down 9.05%.

Base blockchain recorded $2.26 million in sales with a 35.45% gain, while Solana (SOL) posted $1.89 million in sales but suffered a steep 46.78% decline compared to the previous week.

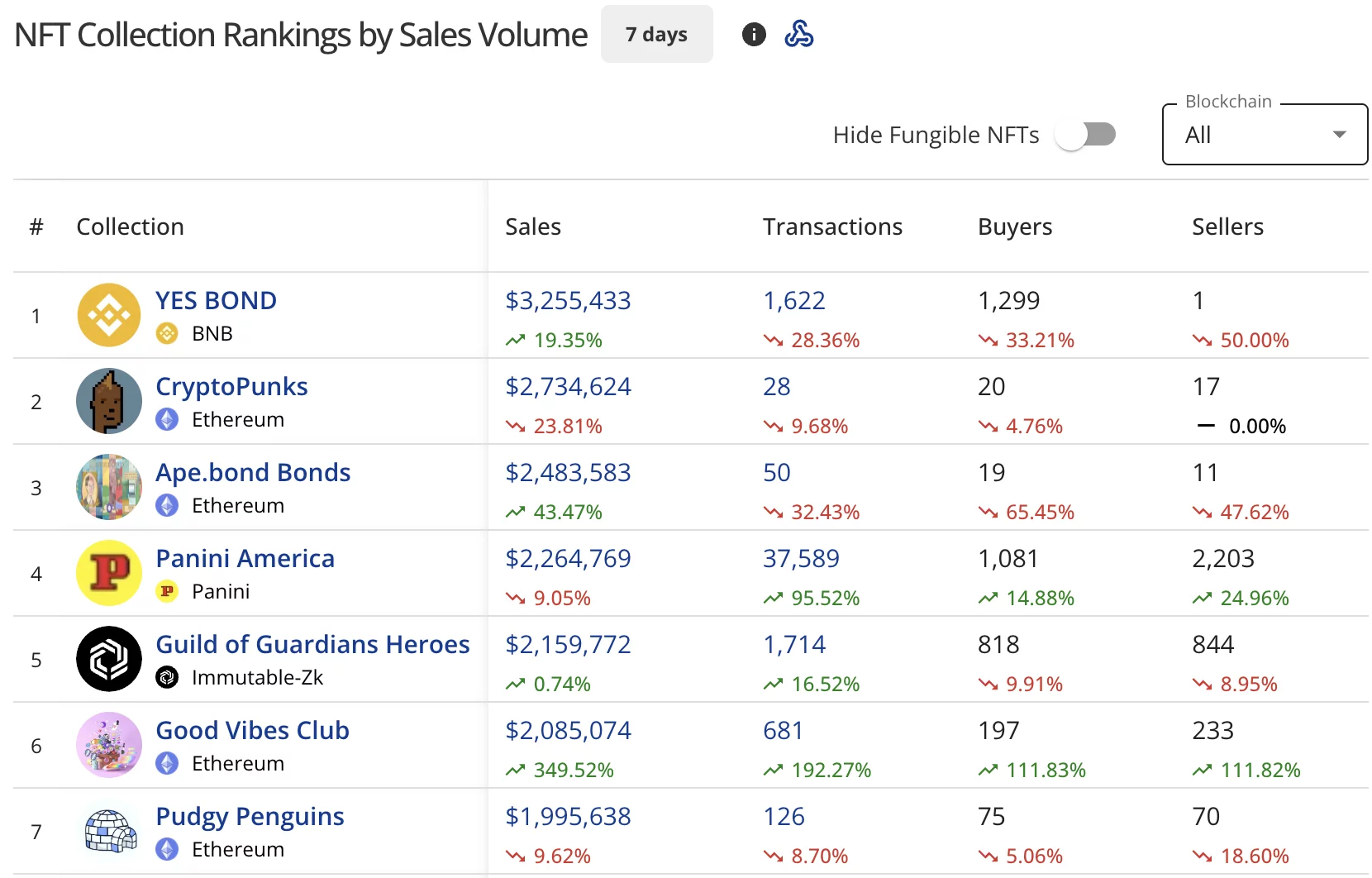

YES BOND tops collection rankings

YES BOND on BNB Chain dominated the collection rankings with $3.26 million in sales, climbing 19.35% over the week. The collection processed 1,622 transactions from 1,299 buyers.

CryptoPunks took second place with $2.73 million in sales despite a 23.81% drop. The blue-chip Ethereum collection completed 28 transactions from 20 buyers. Ape.bond Bonds landed in third with $2.48 million in sales, surging 43.47%.

Panini America generated $2.26 million in sales with a 9.05% decline, while Guild of Guardians Heroes posted $2.16 million in sales, up 0.74%.

Good Vibes Club on Ethereum recorded $2.09 million in sales with a 349.52% gain. Pudgy Penguins rounded out the top seven with $2 million in sales, down 9.62%.

High-value sales led by Bitcoin NFTs

The week’s highest-value sales were dominated by $X@AI BRC-20 NFTs on Bitcoin. The top sale reached $1.10 million (12.0247 BTC), followed by another $X@AI piece at $898,131 (9.8453 BTC). Both transactions occurred three days ago.

CryptoPunks claimed three spots in the top five individual sales.

- CryptoPunks #5705 sold for $163,672 (53 ETH) six days ago.

- CryptoPunks #3043 fetched $123,926 (40 ETH)

- CryptoPunks #4773 brought in $111,223 (35.9 ETH), both selling three days ago.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8