NFT sales jump 29% to $159.6m, Pudgy Penguins surges 247%

Non-fungible tokens, or NFTs, are roaring back to life alongside crypto’s bull run, with soaring sales, surging participation, and million-dollar JPEGs reentering the chat.

Weekly NFT sales jumped 29% to $159.6 million as Ethereum (ETH) and Bitcoin (BTC) rallied to new heights, boosting both investor confidence and transaction volume. Ethereum remains the top chain for NFT activity, but Bitcoin isn’t far behind—fueled by a 3,000% spike in Ordinals.

Collections like Pudgy Penguins and CryptoPunks are leading the charge, as whales return and trading floors heat up across ecosystems. With buyer and seller counts nearly doubling, the NFT market may be staging its loudest comeback yet. Read on for a more detailed look.

Ethereum ranking stays intact

Market participation has rebounded with NFT buyers increasing by 89.32% to 176,807, and NFT sellers rising by 86.08% to 112,430. NFT transactions have also grown by 20.61% to 1,627,841.

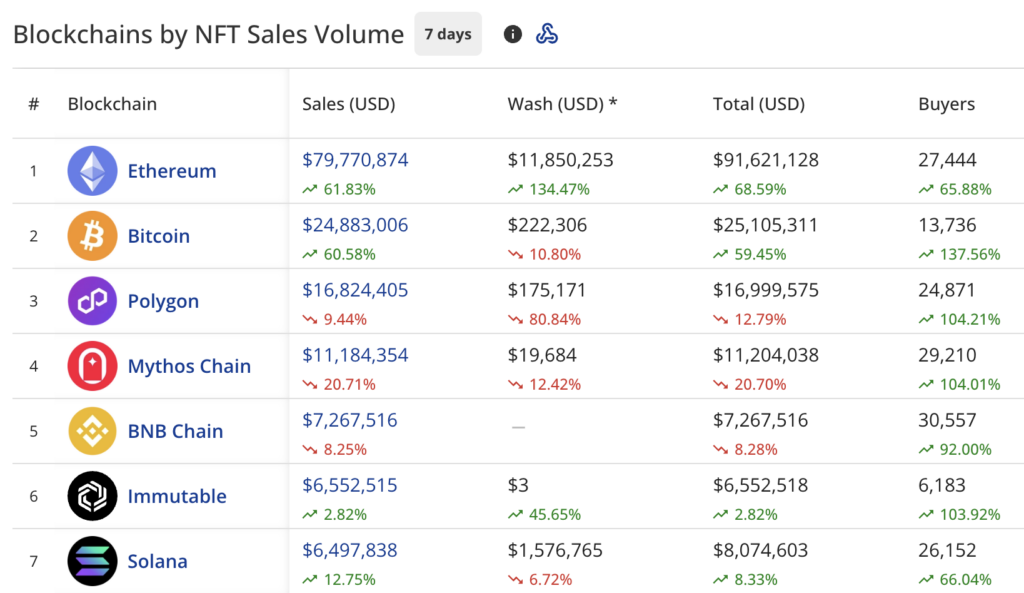

Ethereum has maintained its dominant position with $79.7 million in sales, surging 61.83% from the previous week. Ethereum’s wash trading has exploded by 134.47% to $11.8 million.

Bitcoin has held second place with $24.8 million, jumping 60.58%. Polygon (POL) remains in third position with $16.8 million, declining 9.44%. The blockchain’s wash trading has plummeted by 80.84% to $175,171.

Mythos Chain sits in fourth with $11.1 million, falling 20.71%. BNB Chain (BNB) holds fifth place with $7.2 million, down 8.25%.

Immutable (IMX) has climbed to sixth with $6.5 million, rising 2.82%. Solana (SOL) rounds out the top seven with $6.4 million, up 12.75%.

The buyer count has increased substantially across all blockchains, with Bitcoin leading at 137.56% growth, followed by Polygon at 104.21% and Mythos Chain at 104.01%.

Pudgy Penguins sale jumps close to 250%

Courtyard on Polygon has retained the top spot in collection rankings with $14.1 million in sales, though declining 13.07%. The collection has seen growth in both buyers (445.76%) and sellers (1,135.16%).

Pudgy Penguins has surged to second place with $9.3 million, jumping by 247.32%. The collection has more than doubled its transactions (115.31%) and seen substantial growth in buyers (45%) and sellers (51.72%).

Uncategorized Ordinals on Bitcoin has climbed to third place with $8.6 million, posting growth of 3,095.72%. This collection has benefited from Bitcoin’s strong performance.

DMarket has fallen to fourth place with $6 million, declining 32.25%. f(x) wstETH position holds fifth with $5.9 million, down 62.27%.

Bitcoin’s BRC-20 NFTs sit in sixth with $5.8 million, up 33.41%. CryptoPunks has entered the top seven with $4.8 million, surging 118.16%.

Notable high-value sales from this week include:

- Uncategorized Ordinals sold for 68.9989 BTC ($8,193,864)

- V1 CryptoPunks Wrapped #5822 sold for 200 ETH ($725,130)

- Autoglyphs #157 sold for 380,000 USDC ($380,000)

- Autoglyphs #480 sold for 75 WETH ($252,448)

- Pudgy Penguins #4039 sold for 65 ETH ($201,661)

At last check on Saturday, Bitcoin’s price hovered just below the $118,000 level, retracing after hitting a new all-time high of $123,000. Ethereum, meanwhile, has seen a 21% spike in the last seven days, reaching $3,581.

The global crypto market cap is currently $3.93 trillion, up from last week’s $3.68 trillion.

You May Also Like

MoneyGram Taps Stablecoins To Shield Colombians From Peso Weakness

BDACS Launches KRW1 Stablecoin Backed by the Won