Daily Market Update: Bitcoin Holds $89K as Stock Markets Hit Record High Before Fed Decision

TLDR

- Bitcoin traded near $89,000 on Wednesday while Ethereum rose 2% to just under $3,000 as traders waited for the Federal Reserve’s rate decision

- Global stock markets hit record highs led by technology shares, with the S&P 500 closing at a fresh peak on Tuesday

- The U.S. dollar fell to its weakest level since early 2022, dropping to around 95.5 on the dollar index

- The Fed is expected to keep interest rates unchanged between 3.5% and 3.75%, with markets pricing in two quarter-point cuts by end of 2026

- Major tech companies including Microsoft, Meta, Tesla, and Apple are reporting earnings this week while crypto has lagged behind gold and silver rallies

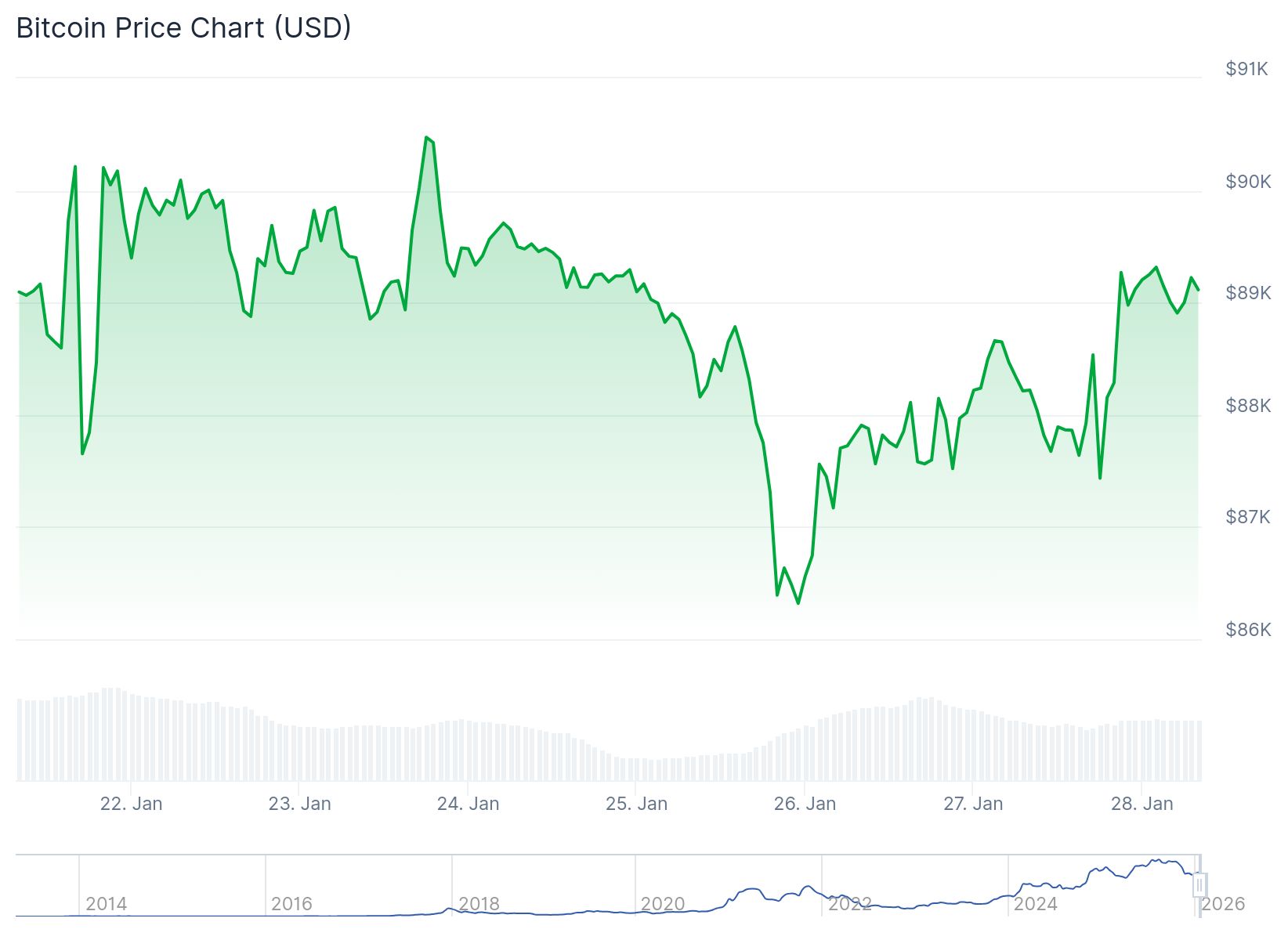

Bitcoin traded in a tight range near $89,000 on Wednesday as global stock markets pushed to new highs. Traders across both crypto and equity markets positioned themselves ahead of the Federal Reserve’s first rate decision of 2026.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The largest cryptocurrency hovered around $88,800 during Asian trading hours. It posted modest gains after a choppy start to the week. Ethereum climbed about 2% to reach just under $3,000.

Most major tokens showed small gains according to CoinGecko data. The moves were measured rather than directional. Markets appeared to be waiting for clearer signals from the Fed.

Global equity markets extended their recent rally. Asian stocks hit record highs during Wednesday trading. U.S. index futures pointed higher after the S&P 500 closed at a fresh peak on Tuesday.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Technology shares led the stock market gains. Optimism around artificial intelligence spending drove investor interest. A heavy slate of megacap earnings reports was scheduled for this week.

The Nasdaq Composite also outperformed in Tuesday’s session. The Dow Jones Industrial Average slid however. UnitedHealth shares tumbled nearly 20% and dragged the index lower.

Dollar Weakness Supports Risk Assets

The U.S. dollar steadied after falling to its weakest level since early 2022. The dollar index dropped to around 95.5 earlier in the week. Investors weighed signals from the Trump administration about its stance on currency strength.

Market analysts at CoinSwitch noted the weaker dollar lowered the opportunity cost of holding risk assets. This supported Bitcoin’s rebound from below $88,000 to around $89,300. The currency decline has fueled strong rallies in gold and silver.

Crypto has lagged behind precious metals in this trade. Bitcoin appears pinned in a narrow range. It is holding ground rather than chasing the broader risk move.

Downside pressure eased after Bitcoin traded into the $86,000 to $87,000 zone. A dense cluster of leveraged long liquidations likely triggered in that area. This reduced excess leverage and stabilized short-term market structure.

Fed Decision and Tech Earnings in Focus

The Federal Reserve is expected to leave interest rates unchanged on Wednesday. Policymakers will likely hold rates in a range of 3.5% to 3.75%. This puts the spotlight on Chair Jerome Powell’s commentary for guidance on future policy.

Markets are currently pricing in two quarter-point rate cuts by the end of 2026. This is according to CME FedWatch data. Traders are watching whether a Fed pause reinforces the recent bid in risk assets.

The rate decision comes during a period of political tension for the central bank. The Trump administration recently opened a criminal investigation against Powell. Markets are also watching for President Trump to announce Powell’s successor.

Several heavyweight tech companies are reporting earnings this week. Microsoft, Meta Platforms, and Tesla are scheduled to report after Wednesday’s market close. Apple will release its quarterly results on Thursday.

These earnings reports are expected to test confidence in the equity rally. That rally has pulled capital away from crypto in recent months. Futures tied to the S&P 500 inched up 0.2% in evening trading.

Nasdaq 100 futures rose about 0.5%. Dow futures remained near the flatline. The pattern suggests stabilization rather than strong momentum as markets head into a dense stretch of macro events.

The post Daily Market Update: Bitcoin Holds $89K as Stock Markets Hit Record High Before Fed Decision appeared first on CoinCentral.

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

NVIDIA Stock Price Analysis as OpenAI Issues Concerns About its Chips