Hyperliquid (HYPE) Price Extends Rally as Silver Futures Trigger Volume Shock

The post Hyperliquid (HYPE) Price Extends Rally as Silver Futures Trigger Volume Shock appeared first on Coinpedia Fintech News

Hyperliquid (HYPE) is extending its upward rally for a third straight session, rising over 25% today, as capital continues to rotate into Hyperliquid, driven by an unexpected surge in commodity-based trading. While the broader crypto market remains selective, HYPE’s rapid rally into commodity perpetuals, particularly Silver, has reshaped short-term demand for the HYPE token.

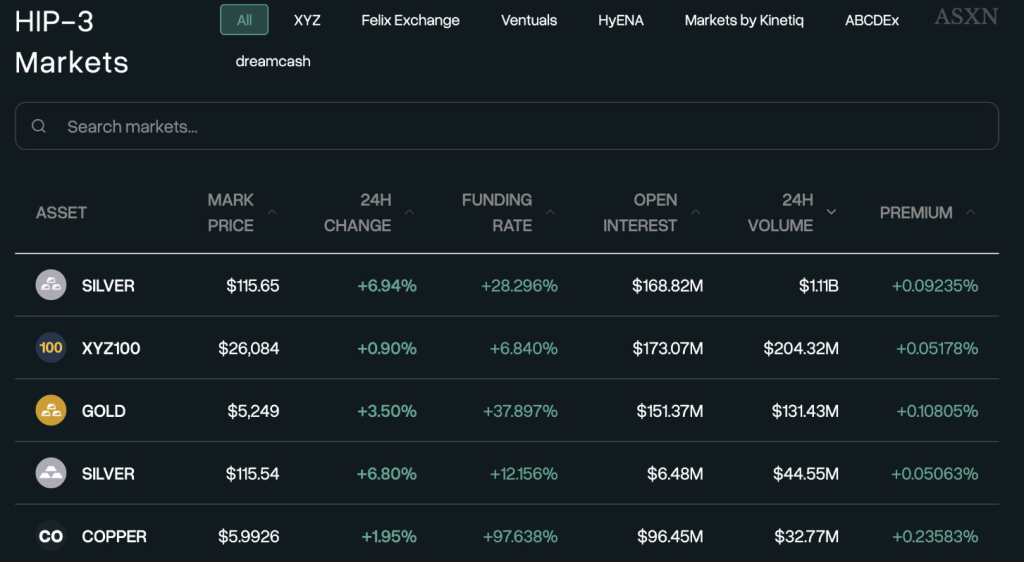

Silver Perpetuals Push Hyperliquid Volume Past $1B

The immediate catalyst behind HYPE’s rally has been explosive growth in commodity perpetual contracts on Hyperliquid. Silver futures, introduced as part of the platform’s HIP-3 expansion, quickly became one of the most actively traded instruments, pushing daily notional volume beyond the $1 billion mark across commodity markets.

This surge matters because it introduces a new class of traders to Hyperliquid, participants who are less sensitive to crypto-native volatility and more focused on macro and commodities exposure. As these positions scale, they directly feed into Hyperliquid’s fee engine, strengthening the economic loop that underpins HYPE’s token model. Unlike short-lived incentive-driven volume, this activity has remained elevated across multiple sessions, suggesting sustained engagement rather than one-off positioning.

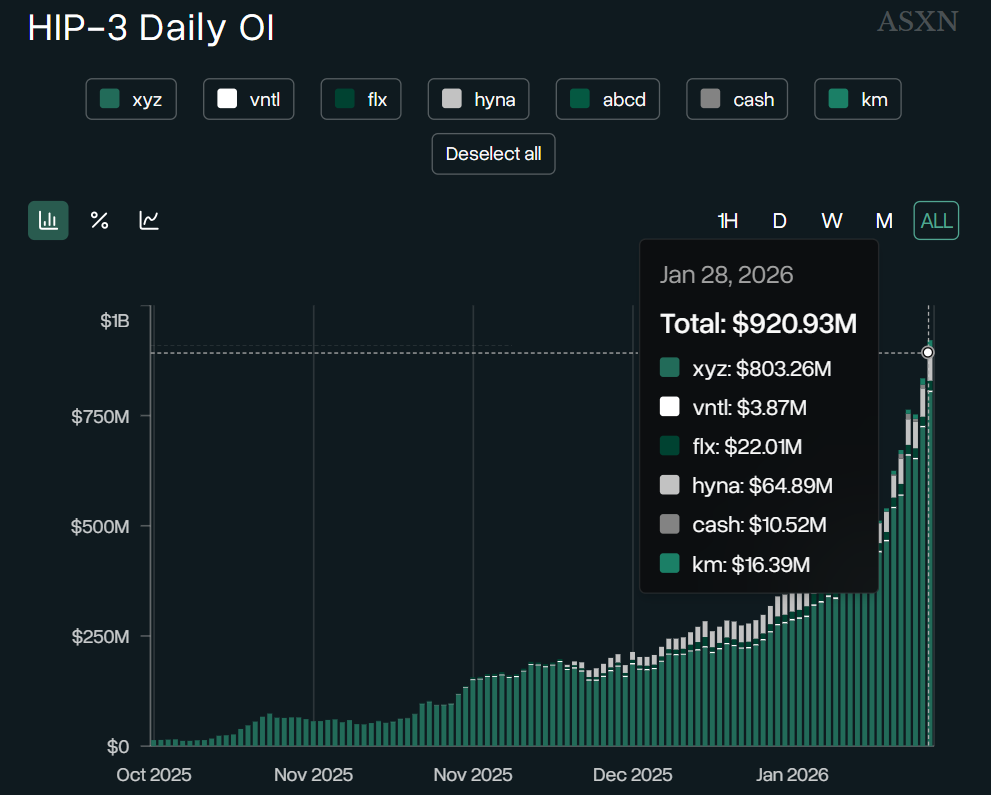

HIP-3 Open Interest Signals Real Capital Commitment

HIP-3 market data shows a decisive structural shift in how traders are positioning on Hyperliquid. Recent data of Jan 28, 2026 shows that total Open interest has climbed to $920.9 million, marking one of the strongest sustained growth since the product’s rollout. The growth is not evenly distributed.

One contract alone accounts for the bulk of positioning, with xyz contributing roughly $803.3 million. This concentration suggests large directional exposure rather than fragmented retail participation. Other HIP-3 markets, including HYNA ($64.9M), FLX ($22.00M). This activity reinforces the view that the capital is flowing across the broader HIP-3 suite rather than chasing a single trade.

Importantly, the rise in Open Interest has occurred alongside elevated trading volume, reducing the risk that the move is purely leverage-driven. When OI and volume rise together, it points to conviction-based positioning, often associated with institutional buying signs.

HYPE Price Structure Signals Further Gains Ahead

Hyperliquid chart structure favors bullish outlook as it replicates massive accumulation in the past sessions. After breaking out of the descending channel, HYPE price has rallied more than 40% and is still aiming higher. HYPE’s current price action replicates a trend reversal and the short-term moving averages have started to curl upwards which suggests a shift in structure.

As Hyperliquid price has showcased a bullish streak, surpassing multiple hurdles in a single shot, bulls were eyeing to reach the 200 day EMA hurdle of $38. However, if commodity volumes and HIP-3 participation remain elevated, HYPE’s momentum would continue and further rally may be possible. A clean move above $38 keeps the next psychological resistance zone of $50 in focus, while a retracement below $30 would mark a higher low formation toward $28 followed by $25 the near term.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8