- Rogers

- CPKC

- CGI

- Cascades

- Empire

Stock news for investors: Rogers sees revenue gain, lifted by Blue Jays’ playoff success

Build your retirement savings with 1.50% interest, tax-deferred contributions and zero fees.

Earn a guaranteed 2.75% in your RRSP when you lock in for 1 year.

See our ranking of the best RRSP accounts and rates available in Canada.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

Blue Jays playoff run helps boost Q4 profit and revenue at Rogers Communications

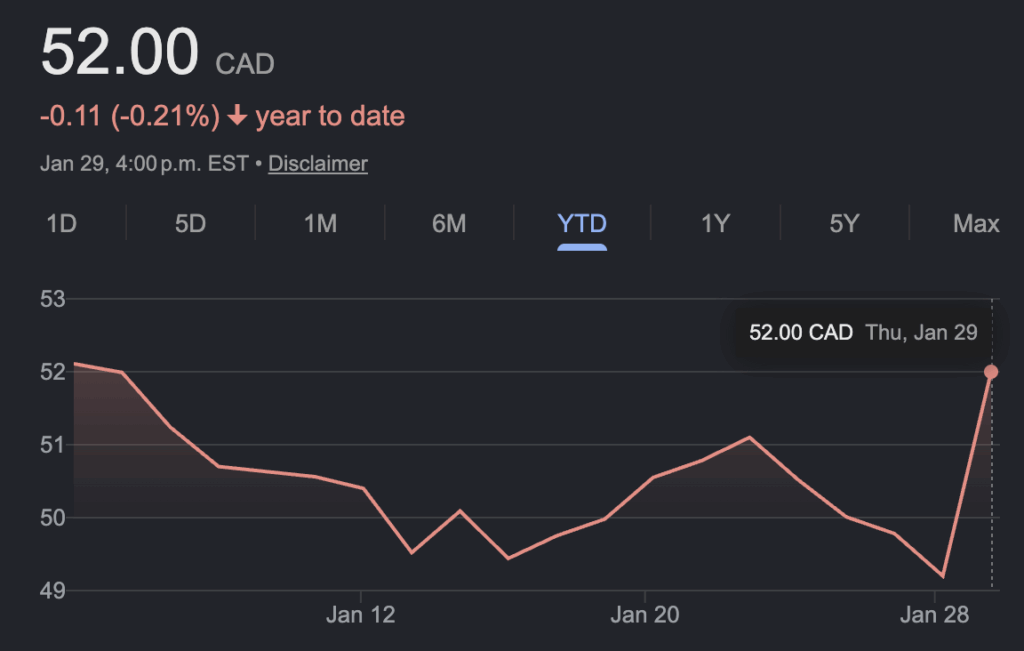

Rogers Communications Inc. (TSX:RCI.B)

Numbers for its fourth quarter:

- Profit: $743 million (up from $558 million a year ago)

- Revenue: $6.17 billion (up from $5.48 billion)

The Toronto Blue Jays and their playoff run to Game 7 of the World Series helped Rogers Communications Inc. grow its fourth-quarter profit and revenue compared with a year earlier.

The cable and wireless company, which also owns the baseball team, says it earned a profit attributable to shareholders of $743 million or $1.37 per diluted share for the quarter ended Dec. 31. The result was up from a profit of $558 million or $1.02 per diluted share in the last three months of 2024. On an adjusted basis, Rogers says it earned $1.51 per diluted share in its latest quarter, up from an adjusted profit of $1.46 per diluted share a year earlier.

Revenue totalled $6.17 billion, up from $5.48 billion in the same quarter as year earlier. The increase came as media revenue at Rogers, which includes the Jays, rose to $1.24 billion for the quarter, up from $547 million a year earlier. Wireless revenue for the quarter totalled $2.97 billion, compared with $2.98 billion a year earlier, while cable revenue held steady at $1.98 billion.

The Jays took the Los Angeles Dodgers to extra innings of Game 7 before losing the baseball championship.

Source Google

Source Google

CPKC profits fall in fourth quarter despite revenue gain from grain, container cargo

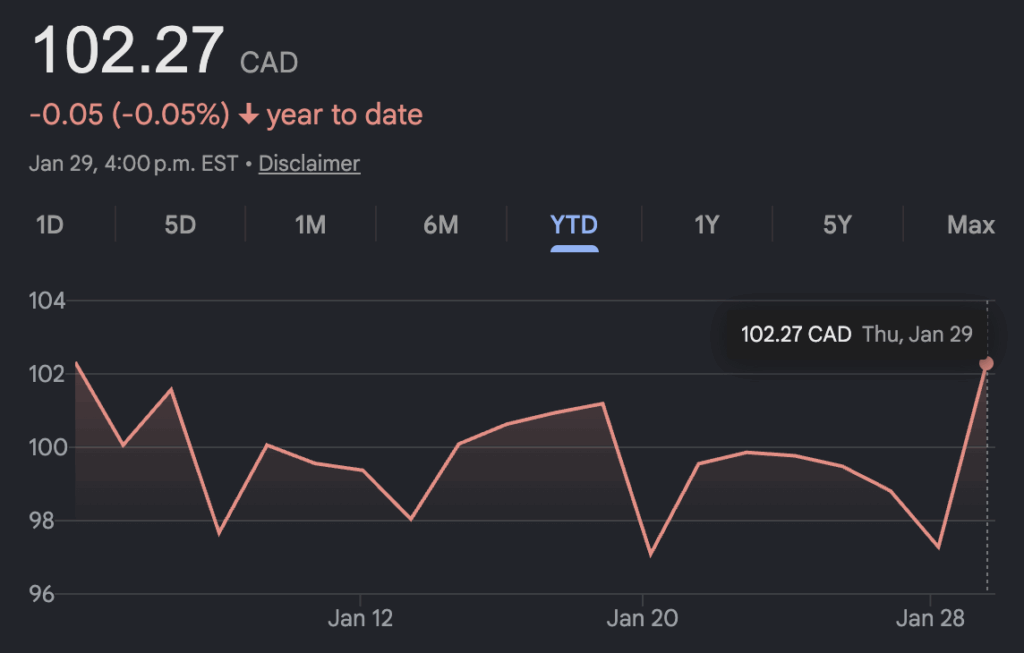

CPKC (TSX:CP)

Numbers for its fourth quarter:

- Profit: $1.08 billion (down from $1.20 billion a year ago)

- Revenue: $3.92 billion (up from $3.87 billion)

Canadian Pacific Kansas City Ltd. says profits fell 10% in its latest quarter, despite an uptick in revenues that capped off a year of solid earnings growth. CPKC says net income declined to $1.08 billion in the quarter ended Dec. 31 from $1.20 billion in the same period a year earlier.

The Calgary-based railway says fourth-quarter revenues rose 1% to $3.92 billion from $3.87 billion the year before amid a 3% boost in grain and container revenue.

It says core adjusted diluted earnings rose 3% to $1.33 per share from $1.29 per share.

For the full year, CPKC says net income jumped 11% to $4.14 billion and revenues climbed almost 4% to $15.08 billion.

For 2026, the company is predicting low double-digit growth in core adjusted diluted earnings per share, volume growth in the mid-single digits and a 15% reduction in capital expenditures to $2.65 billion.

Source Google

Source Google

Business and tech consulting firm CGI reports Q1 profit and revenue up from year ago

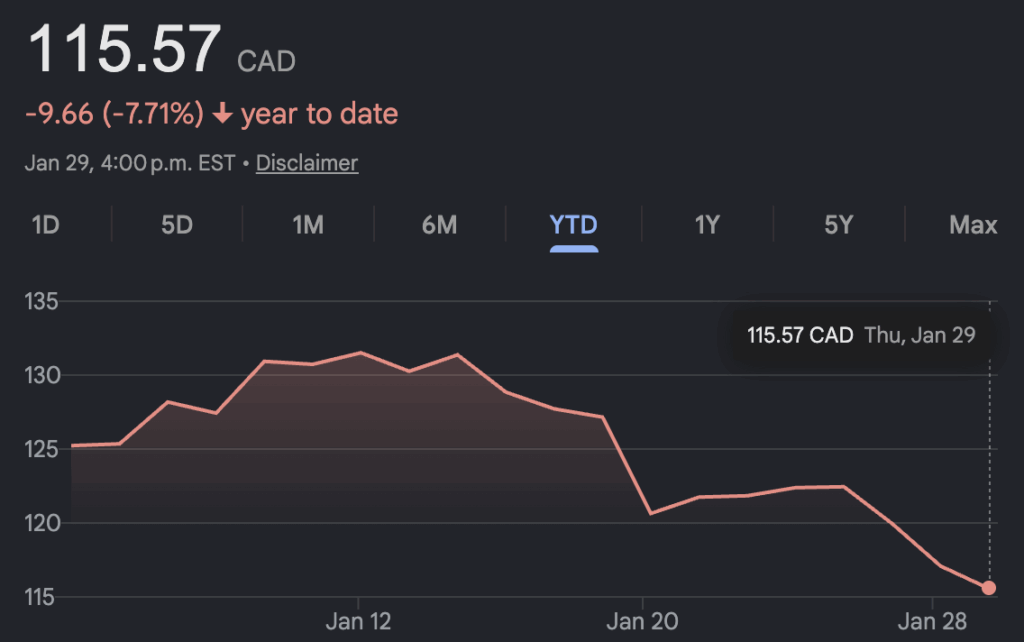

CGI Inc. (TSX:GIB.A)

Numbers for its first quarter:

- Profit: $442 million (up from $438.6 million a year ago)

- Revenue: $4.08 billion (up from $3.79 billion)

CGI Inc. reported a first-quarter profit of $442.0 million, up from $438.6 million a year earlier, as its revenue rose nearly 8%. The business and technology consulting firm says the profit amounted to $2.03 per diluted share for the quarter ended Dec. 31, up from $1.92 per diluted share a year earlier.

Revenue for the three-month period totalled $4.08 billion, up from $3.79 billion. On an adjusted basis, CGI says it earned $2.12 per diluted share in its most recent quarter, up from $1.97 per diluted share a year earlier.

Earlier this week, CGI announced a collaboration deal with OpenAI that will see it expand the use of artificial intelligence across its business and help clients adopt it in their operations.

CGI has 94,000 consultants and professionals across the globe that provide business and technology consulting services.

Source Google

Source Google

Cascades selling packaging plant to Crown Paper Group in a deal worth $65.5M

Cascades Inc. has agreed to sell a packaging plant to Crown Paper Group, located in Richmond, B.C.

The transaction is valued at $65.5 million, including real estate assets, and is expected to close in the coming days, subject to closing conditions. Cascades says the plant offered limited integration within its operational network due to its geographic position.

Hugues Simon, the Cascades CEO, says in a news release that the move comes amid a commitment from the company to improve its profitability and optimize operations. The transaction comes after Cascades signed a deal to sell a flexible packaging plant to Texas-based Five Star Holding for $31 million.

Cascades makes cardboard packaging, toilet paper, paper towels and other products.

Source Google

Source Google

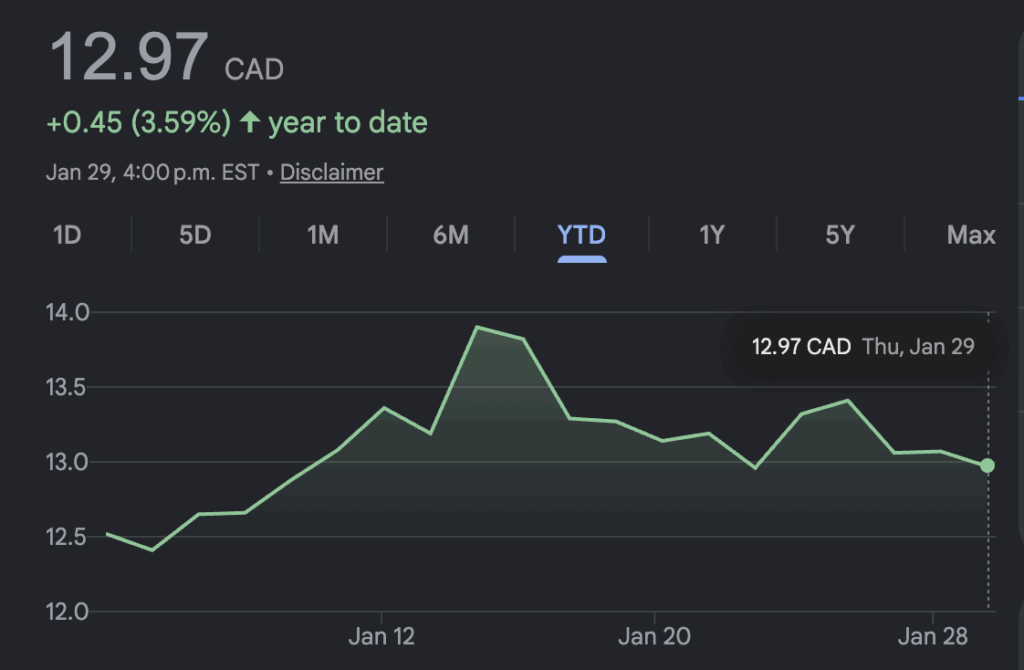

Sobeys parent company Empire shutters Voilà grocery delivery in Alberta

Sobeys parent company Empire Co. Ltd. says it is closing its Voilà grocery delivery facilities in Alberta and pausing the online service’s expansion in the Vancouver area as it failed to meet the grocer’s financial expectations.

The company says it will take $750 million in writedown because of the “underperformance of its e-commerce network” in Western Canada. Voilà will continue to operate in Ontario and Quebec, which is growing steadily, it says.

Empire says it has partnered with delivery app DoorDash for same-day deliveries, which will begin rolling out in the coming months. Chief executive Pierre St-Laurent says the move is a part of reshaping the e-commerce strategy as the grocer responds to changing customer needs and expectations.

Empire shares on the Toronto Stock Exchange were up as much as 8% Thursday morning before paring some of those gains to 4% at $45.40.

Source Google

Source Google

MoneySense’s ETF Screener Tool

Read more news:

- Why 2026 could be a year to rent, not buy

- Unpacking the proposed Canada Groceries and Essentials Benefit

- Air Transat plans new loyalty program with Desjardins and Visa

- How to turn your child’s first phone into a money lesson

The post Stock news for investors: Rogers sees revenue gain, lifted by Blue Jays’ playoff success appeared first on MoneySense.

You May Also Like

The Next “Big Story” in Crypto: Crypto Credit and Borrowing, Says Bitwise CEO

SEC New Standards to Simplify Crypto ETF Listings