How to make money with ETH? Share 16 profit strategies with APR over 20%

Author: Stephen , Crypto KOL

Compiled by: Felix, PANews

It is not common to have a sustainable and scalable ETH yield > 20% at present. Crypto KOL Stephen has listed strategies to keep the annual percentage rate (APR) above 20%.

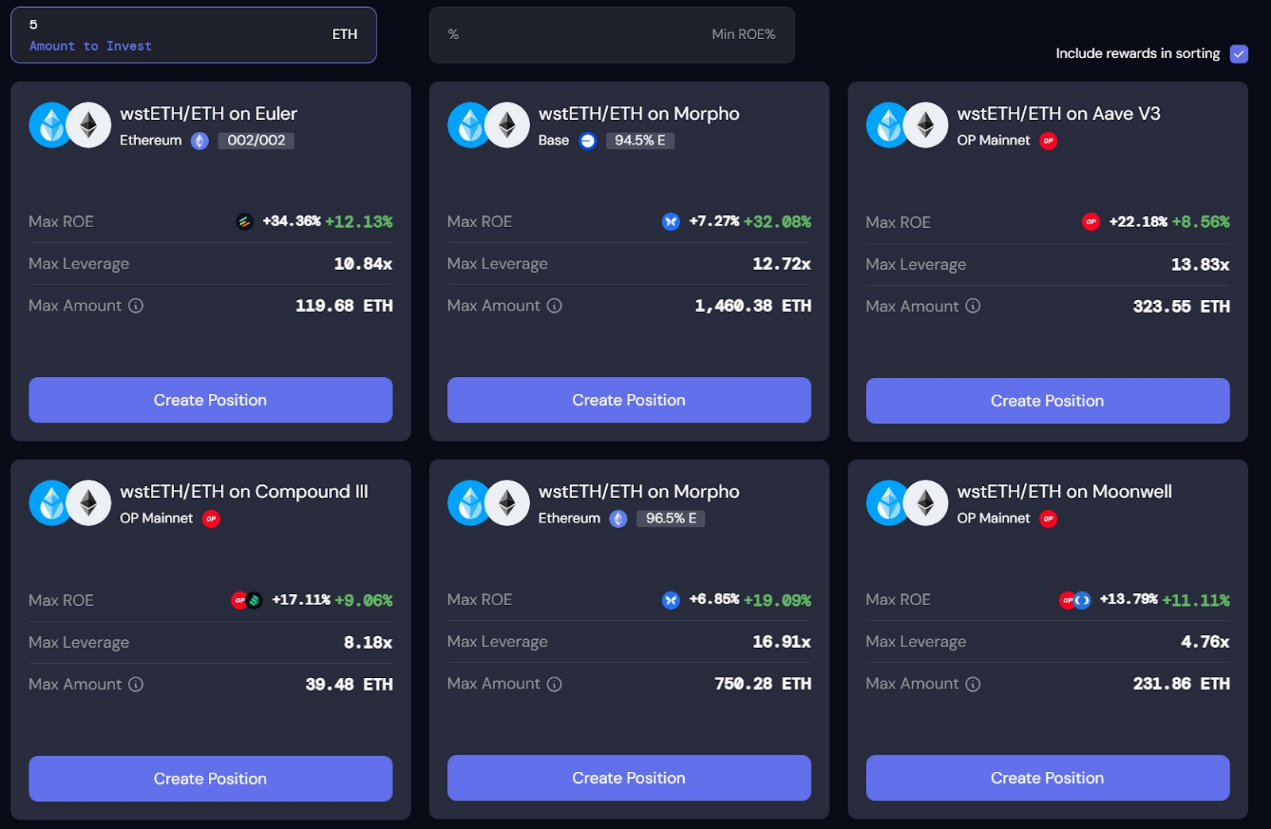

wstETH

wstETH is arguably the most popular, competitive, and scalable strategy in history. Even in the worst bear markets, the APR is usually between 8% and 30%.

The working principle of wstETH is to use the staking yield of ETH (about 3%) to offset the cost of borrowing ETH (about 2%).

There are four great places to do this:

- Morpho Labs

- Aave

- Compound Growth

- Euler Labs

The current APR for this strategy is between 26% and 46%. Of course, you can use Contango to automatically leverage these positions to generate TANGO points, OP emissions, etc.

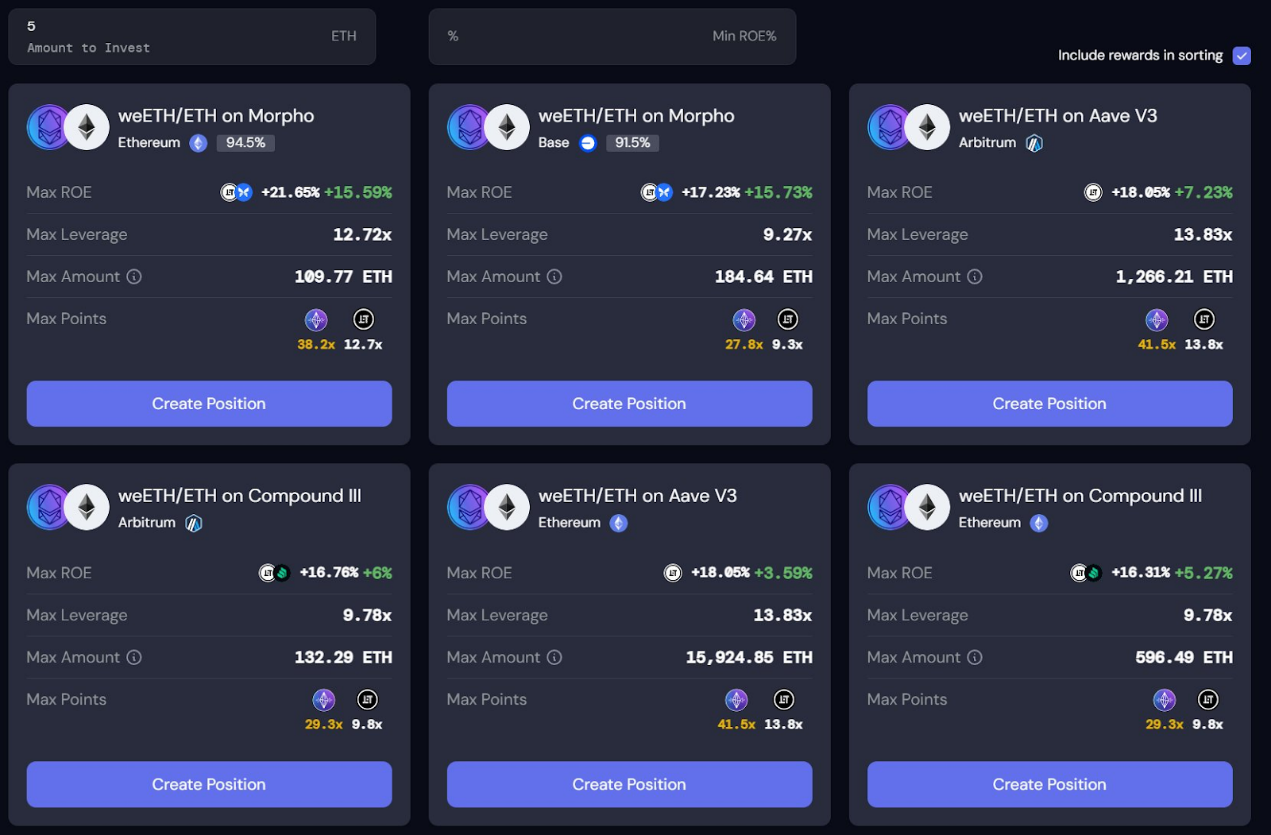

Leveraged weETH

This strategy is the same as the previous one, except that it is also eligible for various points and emissions. Therefore, the average return of this strategy is slightly higher:

- ether.fi Points

- Veda Points

- LRT2 Points

- EigenLayer procedural rewards (such as $LRT2)

Three blue chip currency markets are the best places to leverage:

- Compound Growth

- Aave

- Morpho Labs

Before factoring in LRTsquared, EtherFi S4 and Veda credits, the APR ranges from 22% to 36%. Actual yields after factoring in credits can be over 50%.

Note: Although Morpho currently has the highest APR, the top three protocols are not far apart, so hedging between them will usually allow you to get the most competitive and consistently high APR (which can hedge against unstable borrowing rates).

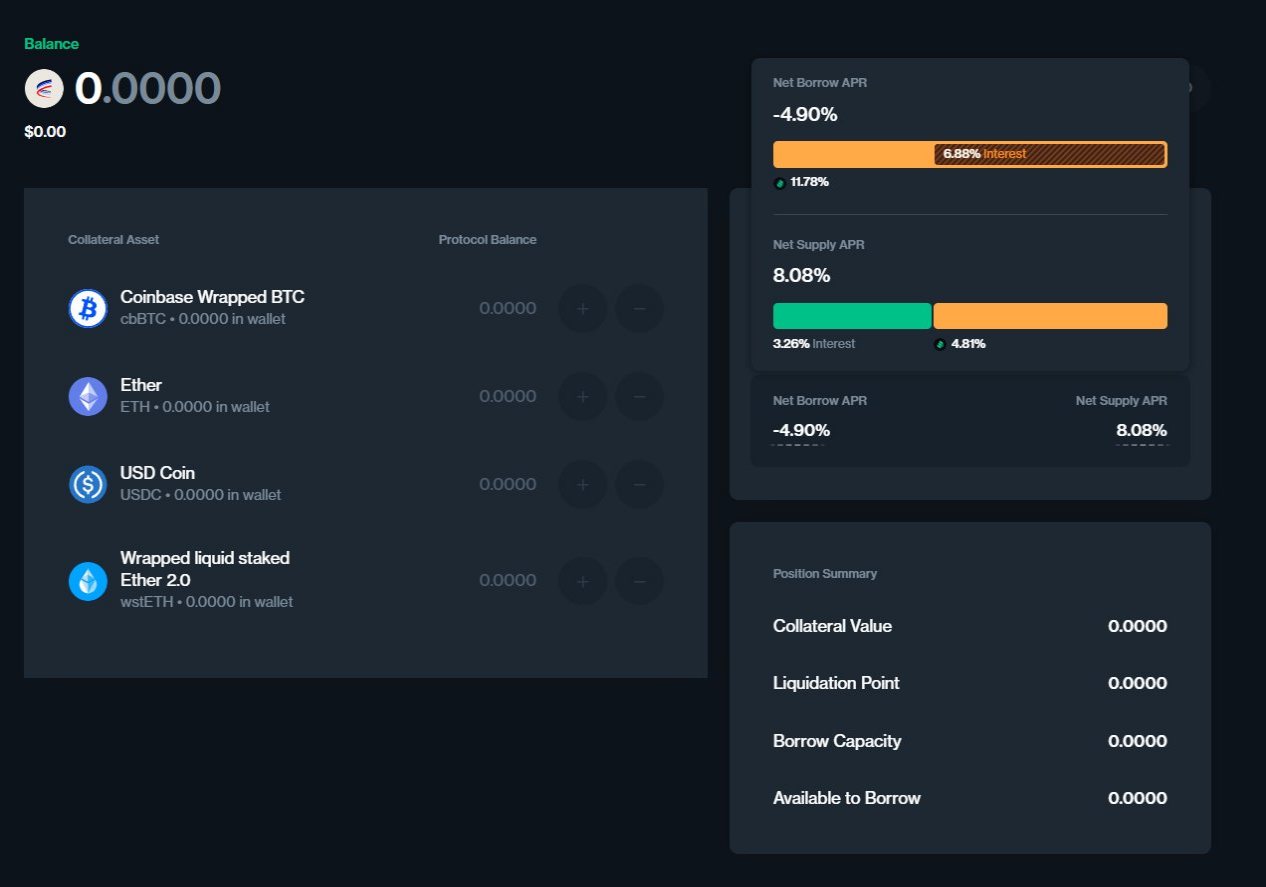

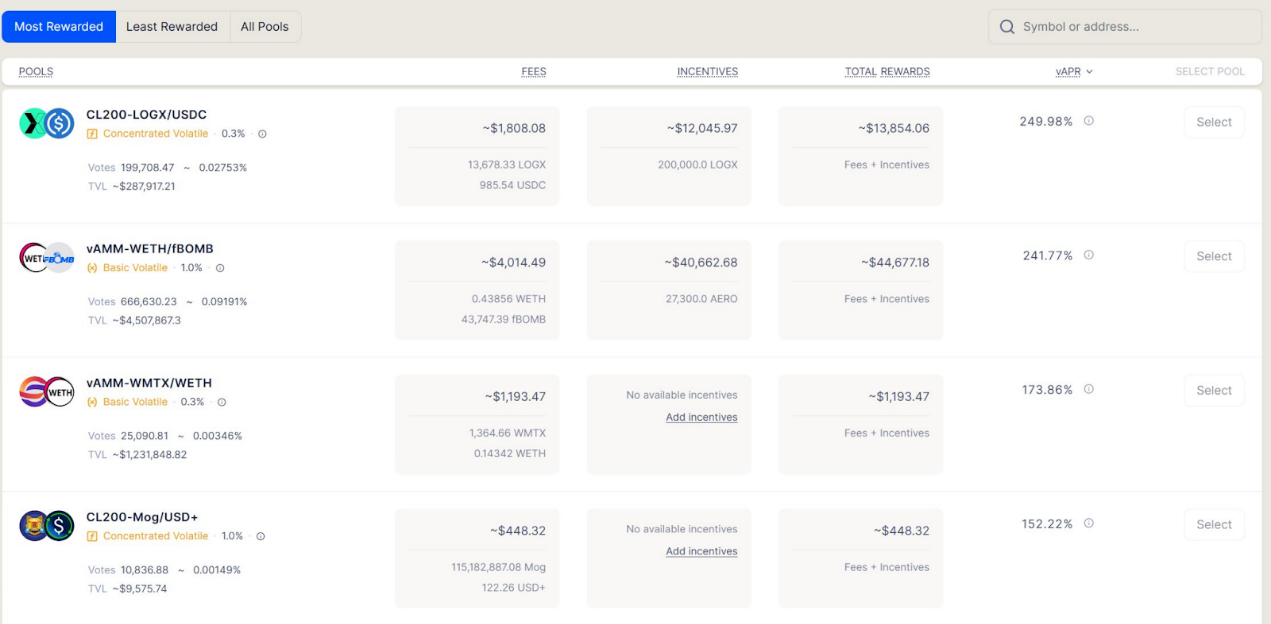

AERO Mining

Compound Growth is currently paying users to borrow AERO against cbETH, ETH, and wstETH.

At the same time, you can get about 200% APR of AERO by voting on Aerodrome.

Of course, the liquidation loan-to-value ratio (LLTV) is 65%, so here are some reasonable positions:

Loan-to-Value ( LTV ) 50%

Relative AERO liquidation increase: 30%

ETH staking total yield: 100% APR

Loan-to-value ratio 25%

Relative AERO liquidation increase: 160%

ETH staking total yield: 54% APR

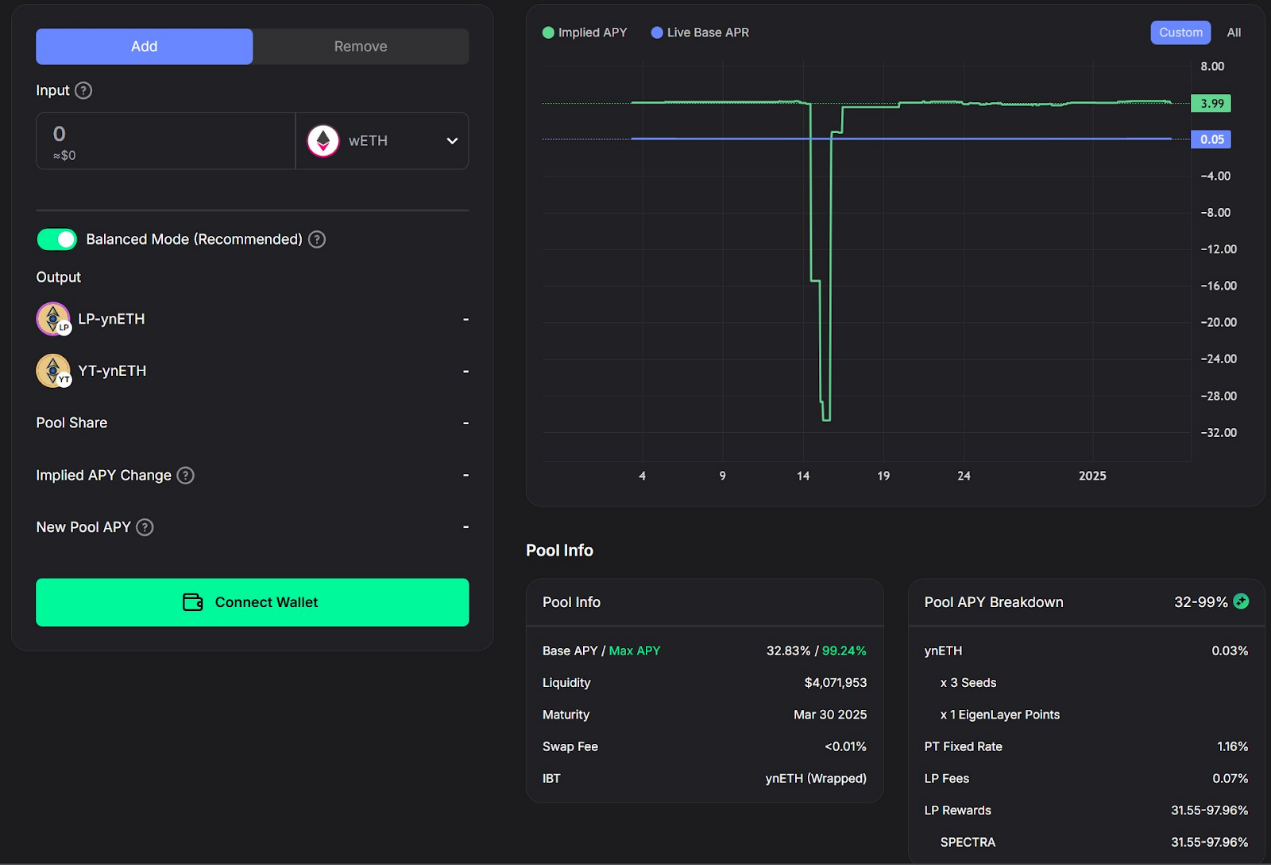

ynETH

Spectra is a competitor of Pendle, and although it has recently caused some craze with its USR pool, its launched ynETH pool also provides certain market opportunities.

With 0 boost, the APR is 33%, and with boost, the APR can reach 100%.

It's worth noting that holding/locking in SPECTRA could work out well if Spectra becomes a real competitor, so adding some yield-enhancing exposure might not be a bad idea.

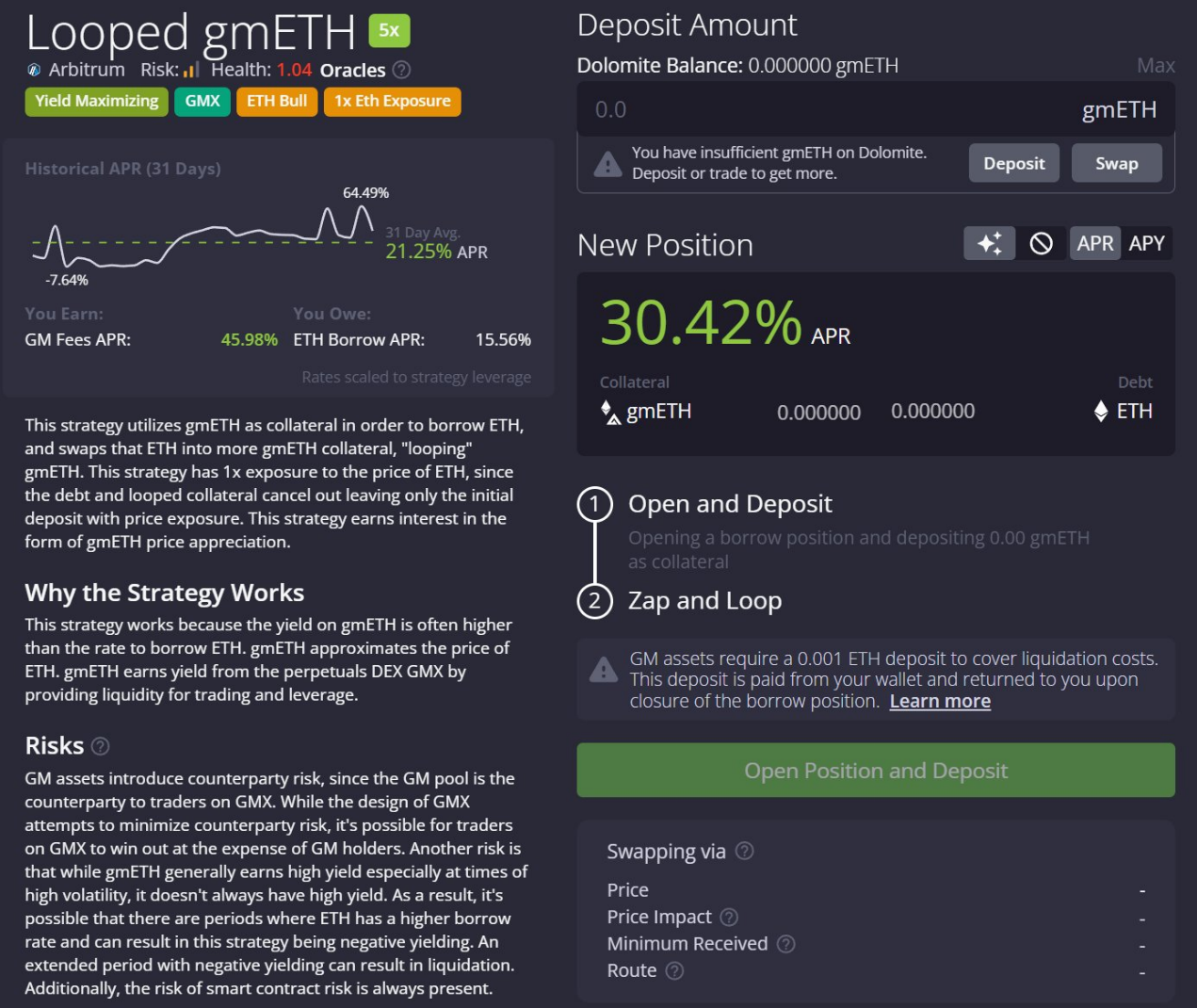

gmETH

This strategy is somewhat controversial as gmETH has experienced capital losses in the past.

gmETH is the so-called “Counter Party Vault”. When traders on GMX earn excess returns, it will fall relative to ETH. Vice versa is also the norm in the past.

You can implement this strategy at Dolomite, which currently offers an annual interest rate of about 30% and a historical average annual interest rate of about 20%.

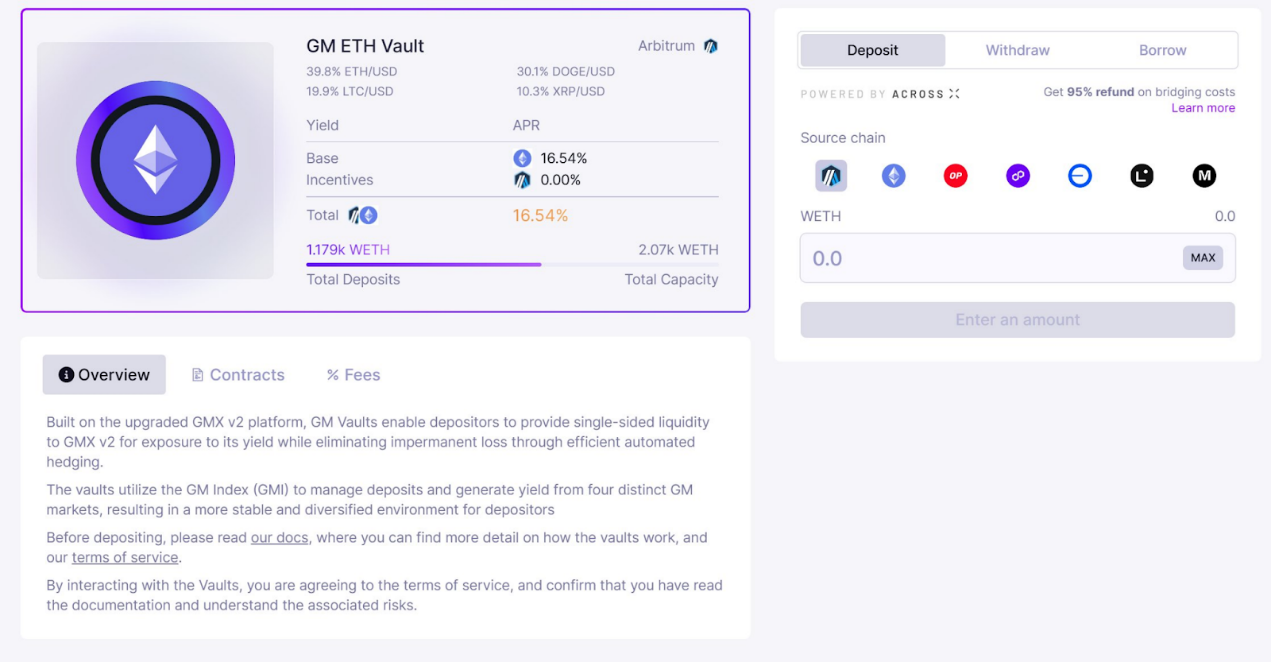

GMWETH ( Umami )

This strategy is very similar to the previous position, but it hedges most of the delta and risk.

While the current APR is around 16.5%, it is historically quite high (around 50%), and in the medium-term future, the average APR will be over 20%.

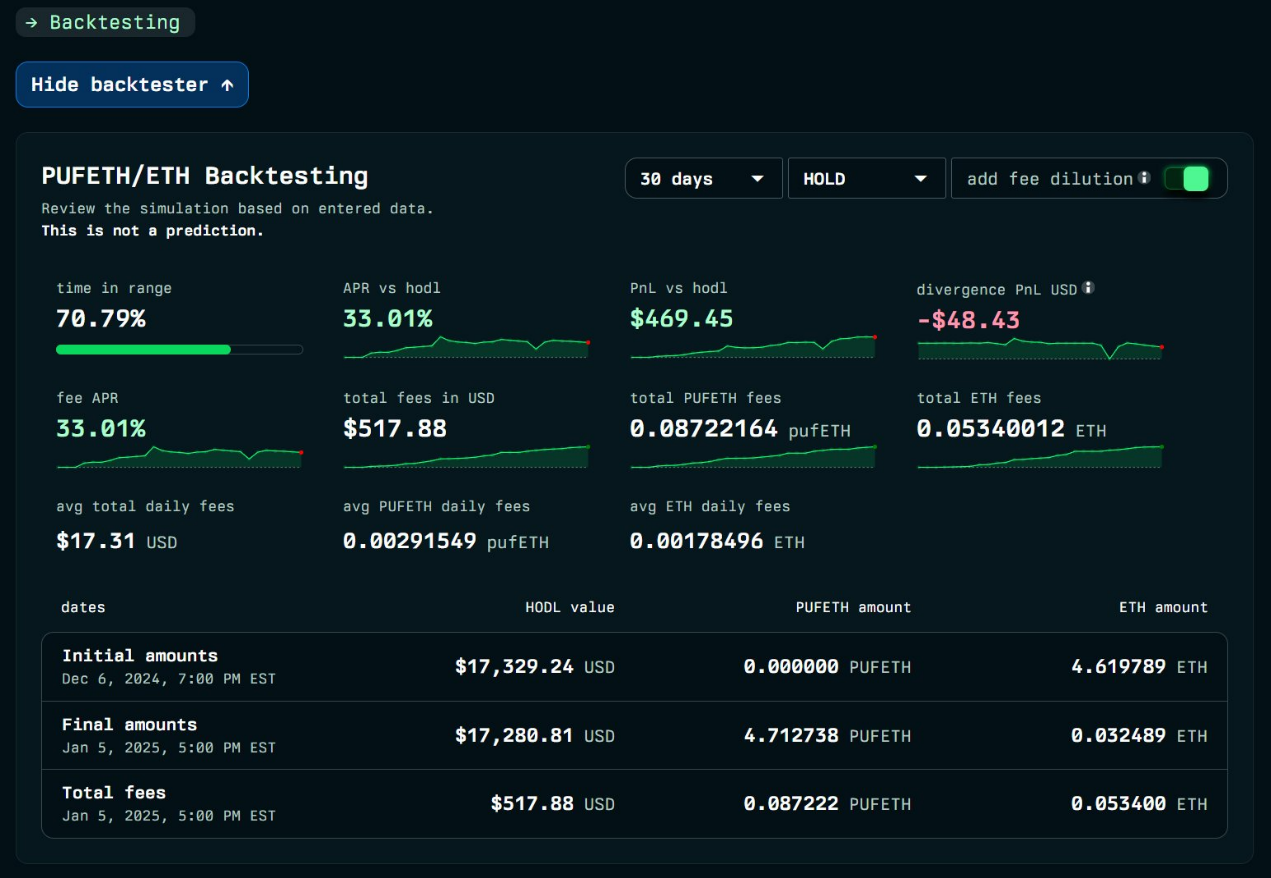

pufETH

Despite more recent competition, pufETH has long been a gold mine. This LP (30bps fee tier) has historically had an APR between 15-50% with minimal rebalancing.

It's like a hidden gem, though it won't last forever.

Sustainable and scalable ETH yields >20% are uncommon.

You can find some smaller but still incredible opportunities at places like D2LFinance, but when it comes to smaller positions for smaller gains, it’s self-defeating to make them too public.

Related reading: An article reviews the seven major DeFi staking platforms in 2025: How to maximize returns?

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures