TRUMP Coin Price Struggles Near $4 as On-Chain Transfers Weigh on Sentiment

- TRUMP Coin trades near $4.24, down ~12% weekly and ~95% below ATH.

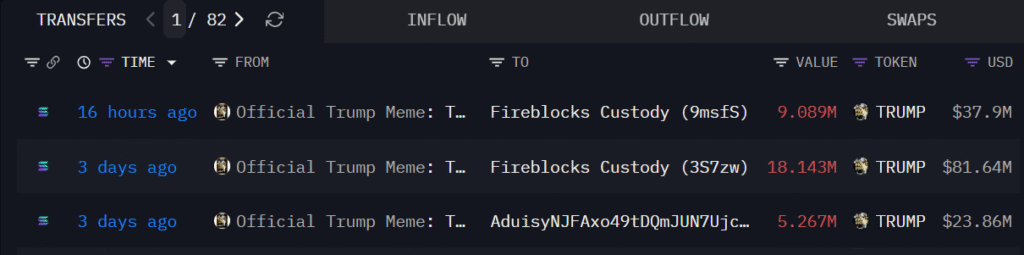

- About 27.23M TRUMP tokens (~$119.5M) were recently moved from the Official Trump Meme wallet to custody wallets, adding to market caution.

Official TRUMP Coin traded near $4.24, up about 2.66% over the past 24 hours, but the broader trend remains weak. The token is still down around 12% on the weekly timeframe and nearly 20% over the past month, showing that recent gains have not changed the overall direction. TRUMP is also trading more than 94% below its all-time high of $75.35, reached in January 2025, highlighting how far the price has fallen from peak levels.

According to the CMC data, TRUMP Coin market cap stands around $986.6 million, while 24-hour trading volume dropped by over 35% to about $245 million. The fall in volume suggests reduced trading activity.

Alongside the price weakness, on-chain data shows notable movements from the Official Trump Meme wallet in recent days. Around 9.08 million TRUMP tokens (~$37.9 million) were transferred to Fireblocks Custody about 16 hours ago, following earlier transfers of 18.14 million TRUMP (~$81.6 million) and 5.26 million TRUMP (~$23.8 million) three days ago.

Source: Arkham

Source: Arkham

Such large transfers to custody and external wallets often raise concerns around potential liquidity movements or preparation for distribution, adding to near-term selling pressure on the token.

TRUMP Coin Technical Outlook Stays Weak on Daily Chart

From a technical view, TRUMP Coin remains in a broader downtrend. On the daily chart, price continues to form lower highs and lower lows, keeping the bearish structure intact. The short-term moving average remains below the longer-term average, showing that selling pressure is still dominant.

(Source: TradingView)

(Source: TradingView)

Momentum indicators also reflect weakness. The RSI is in the lower range, close to oversold territory, suggesting that selling pressure has been heavy in recent sessions. However, this does not yet confirm a trend reversal. The MACD remains in negative territory, indicating that downside momentum has not fully eased.

For now, support is seen around the $4.00–$4.20 zone, which has acted as a short-term floor. On the upside, resistance sits near $4.80–$5.20, where previous rebounds have faced selling. Unless volume improves and price reclaims these resistance levels, TRUMP Coin is likely to remain under pressure in the near term.

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End