TronZap Review: How Renting TRON Energy Helps Cut USDT (TRC-20) Transaction Fees

The post TronZap Review: How Renting TRON Energy Helps Cut USDT (TRC-20) Transaction Fees appeared first on Coinpedia Fintech News

Abstract

Since USDT began to explode in 2021, USDT (TRC-20) has become the number one currency for on-chain payments and transfers, and one of the most popular rails for stablecoin transfers.

But frequent users quickly find out that USDT (TRC-20) transfers aren’t necessarily “cheap” by default. Transaction costs are closely linked to the availability of resources like TRON Energy.

TronZap addresses this friction and offers on-demand TRON Energy and Bandwidth rental so that users can process USDT transfers with less cost, without staking TRX or locking their funds. This review explores how TronZap works, its primary use cases, and how it fits within the wider infrastructure stack of TRON.

What Is TronZap?

TronZap is a TRON blockchain infrastructure service that efficiently minimizes the cost of transactions on the network while renting the blockchain resources (Energy and Bandwidth) to users.

On TRON, when users are utilizing smart contracts that interact with TRC-20 tokens like USDT, they need Energy, and in this case, this Energy is not sufficient; the TRON blockchain burns TRX to fill that gap. TronZap alternatively lets users rent such Energy temporarily so they may not have to burn TRX while interacting with contracts.

Their service is publicly presented in the TRON ecosystem, and they are proud members of TBL. Besides, TronZap publicizes their product and roadmap in the TRON DAO forum, making it easy for developers and users to understand how to interact, what to expect, and what the foundations.

Why TRON Energy Matters for USDT Transfers

TRON’s resource-based fee system is a little different compared to the gas-based blockchains we’re used to, like Ethereum. Instead of paying a flat fee per transaction, users pay using the energy and Bandwidth that is allocated to your account.

For a standard USDT (TRC-20) transfer:

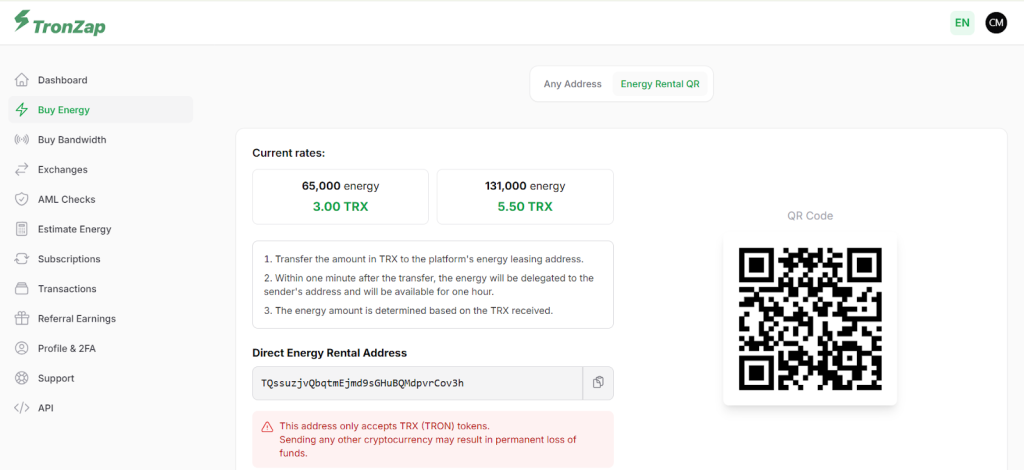

- A typical transfer will consume ~65,000 Energy

- Transfers to new addresses can require up to 131,000 Energy

If a wallet doesn’t have enough Energy to pay for a transfer, TRON automatically burns some TRX to pay for it, which is why you often see USDT transfers costing 13 TRX or more even on the TRON blockchain. TronZap’s main promise is a simple one – rent out the Energy you need instead of burning TRX, reducing transfer costs while making them more predictable.

Core Capabilities of TronZap

Rent TRON Energy

TRON Energy rental is TronZap’s core feature. Users can rent preset amounts of Energy for a preset amount of time (normally one hour). This takes care of the majority of USDT transfers and eliminates the surprise burns of TRX.

Buy TRON Bandwidth

In addition to Energy, TronZap allows for TRON Bandwidth rental too – for the basic transactions that aren’t smart contracts. This is useful for people with different transaction types across the TRON network.

No-Registration Energy Purchases

One of TronZap’s distinguishing features is that registration is optional. Users can simply:

- Send TRX to the address displayed on the TronZap website

- Receive delegated Energy back to the same wallet automatically

- Use the Energy immediately for transactions

No staking, no account creation, and no private key sharing are required.

Telegram Bot Integration

TronZap also operates an official Telegram bot (@tronzap_bot), offering a faster workflow for users who prefer chat-based interaction. Through the bot, users can:

- Buy Energy instantly

- Rent Bandwidth

- Estimate Energy requirements

- Track transactions

- Manage subscriptions

The bot is non-custodial, and all delegations occur on-chain.

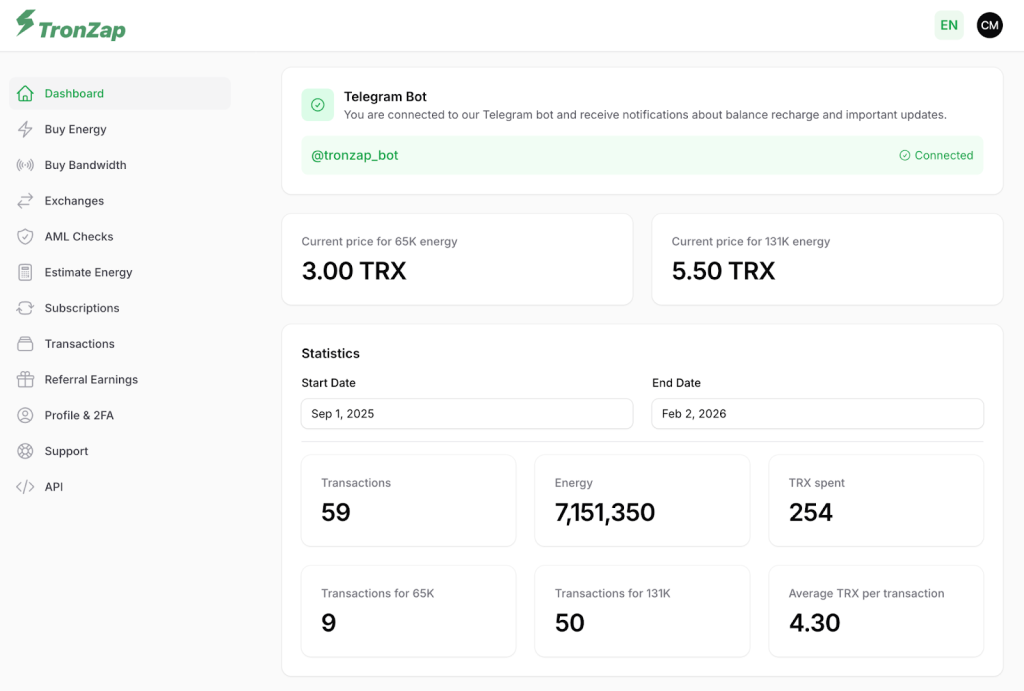

Dashboard & Account Features

Users who choose to register gain access to a personal dashboard where they can:

- Track Energy purchases

- View transaction history

- Manage recurring usage

- Monitor account activity

This is particularly useful for frequent users and businesses.

TronZap API: Energy Automation for Developers and Services

For teams building on TRON, TronZap has a dedicated TRON Energy API that expands its on-demand resource rental model beyond individual users.

The API allows developers and businesses to automate TRON Energy provisioning and further reduce USDT (TRC-20) transaction costs across high-frequency and backend-driven operations.

- Programmatic Energy Management: Buy and delegate your TRON Energy within your application flows, with the ability to anticipate USDT transfers in a predictable and programmable fashion without needing to buy TRX or stake TRX for a longer period.

- Secure and Developer-Friendly: API requests are authenticated via bearer-token and SHA-256 hashed signatures, securely balancing everything to cater for high volume use-cases.

- Ready-to-Use Tooling: Official open-source TRON Energy SDK on GitHub for PHP, Node.js, and Python, along with a Postman collection, simplify integration and testing for wallets, DeFi platforms, payment services, and bots.

TRON Energy Subscriptions

Subscription plans: for those with predictable transaction patterns, rather than paying to rent Energy as required, get it automatically on an ongoing basis – a perfect fit for bots, wallets, and payment services.

AML Crypto Checks

TronZap AML crypto checks: identity and transaction risk checker. There are growing compliance demands in crypto, and this service will meet demands across the industry.

How TronZap Works in Practice?

TronZap operates through on-chain Energy delegation. Once TRX is paid, Energy is delegated directly to the user’s wallet for a limited period, usually one hour.

Key operational points:

- Energy is temporary, not permanent

- There is no TRX locking or staking requirement

- Energy purchases are non-refundable, as TRX is immediately staked to generate resources

- Delegation typically completes within one minute

To avoid failed transactions or unexpected fees, TronZap recommends renting 131,000 Energy when sending USDT, especially to new or inactive wallets.

Sending USDT Without Holding TRX

One practical advantage of TronZap is that people can send USDT without having to own TRX. Because Energy is delegated externally, you can use a wallet that only holds USDT to make transactions – as long as you have enough rented Energy.

This removes a common friction point for people who are accustomed to using just stablecoin balances.

Cost Structure and Fee Optimization

Without Energy:

- A USDT (TRC-20) transfer may cost ~13–14 TRX

With rented Energy:

- The same transfer typically costs ~3 TRX

The difference becomes significant for users making frequent transfers. Rather than staking large amounts of TRX to maintain Energy, TronZap offers a more flexible, pay-as-you-go alternative.

Who Is TronZap Best Suited For?

TronZap is designed for:

- Users who send USDT on TRON frequently

- Businesses handling recurring TRC-20 payments

- Developers building TRON-based services

- Bots and automated wallets

- Users seeking predictable transaction costs

It is less relevant for users who only send USDT occasionally.

Limitations and Considerations

While TronZap solves a real problem, users should understand its limitations:

- Energy is time-limited and must be used promptly

- Purchases are non-refundable

- Incorrect Energy estimation can still lead to TRX burns

- It is not a replacement for long-term staking strategies

Understanding these factors is essential for effective use.

Pros & Cons

Pros

- Reduces USDT (TRC-20) transaction costs

- No registration required for basic use

- Telegram bot

- API and SDKs for developers

- Subscription options for recurring usage

- AML compliance tools

- 24/7 live support

Cons

- Energy duration is limited

- Purchases are non-refundable

- Requires a basic understanding of TRON resources

- Less useful for infrequent transactions

Final Verdict

TronZap solves one of TRON’s biggest usability headaches: unpredictable transaction costs for USDT transfers. By wrapping Energy and Bandwidth rental into a simple on-demand service, it gives everyday users greater control over fees, without requiring them to stake or commit to longer-term use.

For frequent TRON users, TronZap is a useful infrastructure, not a speculative product. TronZap relies on optional registration, Telegram integration, and simplicity for developers.

While it wouldn’t replace staking by any means, it fills a clear niche—enabling efficient resource management to reduce the cost of USDT transfers on TRON—and does so transparently and as part of the ecosystem.

You May Also Like

“Vibes Should Match Substance”: Vitalik on Fake Ethereum Connections

Why Bitcoin Crashed Below $69,000 — Causes & Outlook