Fact Check: Do the Epstein Files Show Israel Took Control of Bitcoin?

The post Fact Check: Do the Epstein Files Show Israel Took Control of Bitcoin? appeared first on Coinpedia Fintech News

As the Epstein files continue to be released, new claims are surfacing almost every day, raising serious concerns. One recent claim circulating on X and within crypto circles alleges that Israel secretly gained control of the Bitcoin network more than a decade ago.

The claim also tries to connect the newly discussed Epstein files with Bitcoin core developers, Blockstream, and Tether.

So Coinpedia stepped in to fact-check whether the claim is real or just another false allegation.

Who Made This Claim?

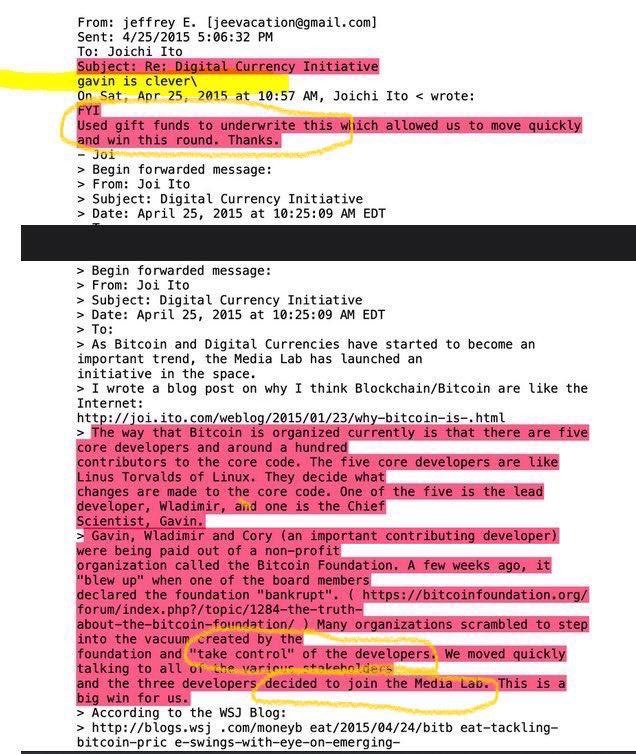

The claim was made by SwanDesk CEO Jacob King, who cited an alleged Epstein file document. He says the document shows a conversation between Jeffrey Epstein and Joichi Ito, a Japanese entrepreneur, suggesting that some Bitcoin core developers received hidden gifts.

King also claimed that Israel paid the salaries of about 60% of Bitcoin developers. He further alleged that Epstein and Israel were major investors in Blockstream, and that Blockstream and Tether could influence Bitcoin’s price and code.

But is all this claim true? Let’s break it down.

Coinpedia’s Key Findings: What’s Actually True?

No Evidence Israel Controlled Bitcoin Developers

The recent release of millions of documents by the U.S. Department of Justice (DOJ) under the Epstein Files Transparency Act has found no substantiated evidence that Israel hijacked control of the Bitcoin network

Also, the claim that Israel paid 60% of Bitcoin core developers is unsupported. Meanwhile, no document proves Israeli state payrolls or centralized hiring.

Epstein Had a Minor, Indirect Blockstream Investment

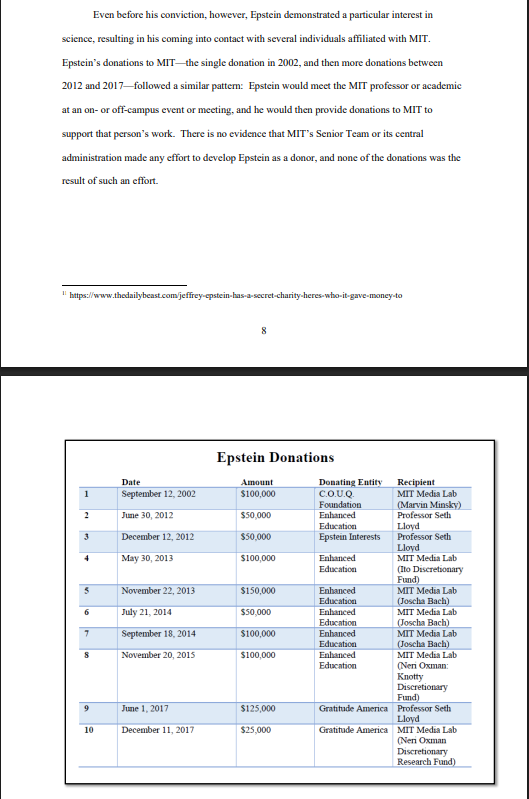

MIT Digital Currency Initiative (DCI) records show that Jeffrey Epstein donated around $850,000 to MIT between 2002 and 2017. Perhaps, this does not amount to control or major ownership.

In 2015, part of this money was reportedly used by MIT’s Digital Currency Initiative to pay salaries of Bitcoin Core developers like Gavin Andresen and Wladimir van der Laan. This support came after the Bitcoin Foundation shut down, and funding for developers became uncertain.

Why is Israel being linked to the Bitcoin Foundation and MIT Media Lab?

The main Israel link comes through former Prime Minister Ehud Barak. Records show Barak stayed at Jeffrey Epstein’s New York home several times between 2013 and 2017, the same period when claims of Israeli control over Bitcoin.

Epstein also reportedly acted as a backchannel for Israeli interests, helping arrange security deals in several countries.

In 2015, Epstein donated $850,000 to the MIT Media Lab. Prominent Israeli figures, such as designer Neri Oxman, were senior researchers at the Media Lab during the period it was accepting Epstein’s funds.

Epstein was also connected to Bitcoin infrastructure as well. In 2014, he joined an $18 million funding round for Blockstream, a company that employs important Bitcoin developers.

However, Blockstream CEO Adam Back later clarified that Epstein’s stake was quickly sold and the company has no financial ties to him today.

Tether Allegations Are Unrelated and Unproven

Claims that Bitcoin’s price can be manipulated using “unbacked Tether” are separate allegations. These claims do not prove that anyone controls the Bitcoin network, controls Bitcoin developers, or that any government is manipulating Bitcoin.

Summary Table: Coinpedia’s Evidence Against the Theory

| Claim Made by Theory | Coinpedia’s Counter-Evidence |

| Does Israel Hijack Control of the Bitcoin Network? | U.S. Department of Justice (DOJ) said their were no substantiated evidence to support this claim |

| Did Epstein funded Bitcoin takeover? | Minor, but that was also through indirect investment of only $50,000 and $500,000 |

| Were 60% of devs paid by Israel | No Document to support these claims. |

Conclusion

| Claim | Do the Epstein Files Reveal Israel Hijacked Control of the Bitcoin Network? |

| Verdict |  False False |

| Fact-Check by Coinpedia | As per Coinpedia research and a review of official sources, there is no credible evidence that Israel controls Bitcoin, pays core developers, or manipulates the network through Blockstream or Tether. Until then, this claim remains unverified and speculative. |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates