Bitcoin Exchange Reserve Surges, Market Needs Fresh Demand

Bitcoin BTC $78 063 24h volatility: 0.8% Market cap: $1.56 T Vol. 24h: $59.35 B recently dropped to $74,000 after failing to hold the November lows, extending a sharp pullback that has weakened short-term momentum. At the time of writing, the cryptocurrency is trading around $78,000 as the market sees a short-term relief.

The 14-day Relative Strength Index has fallen into deeply oversold territory amid intense downside pressure. According to Glassnode, spot trading volume has rebounded during the move, but it is more consistent with risk repositioning than fresh demand.

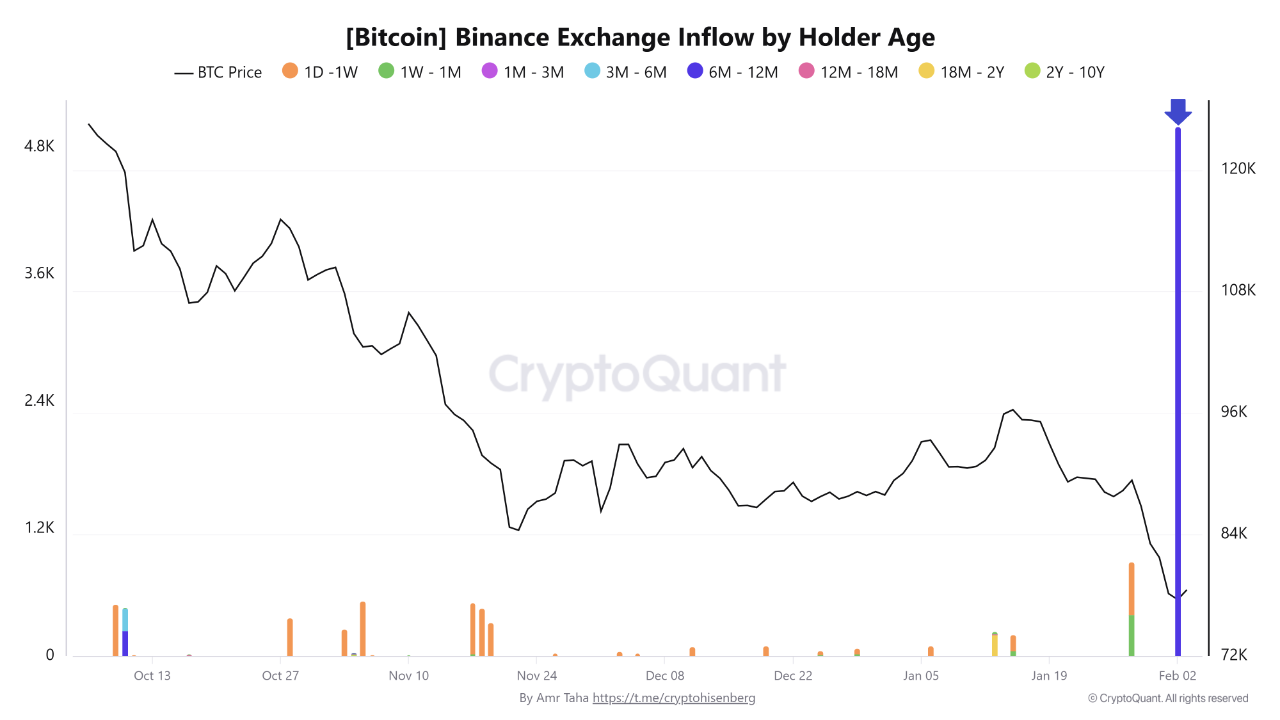

On-chain data shows a notable rise in Bitcoin transfers to Binance from whales and mid-term investors. On Feb. 2, 6 to 12-month-old coins deposited around 5,000 BTC to Binance. This was the first inflow of this size from that cohort since early 2024.

Bitcoin exchange inflow by holder age | Source: CryptoQuant

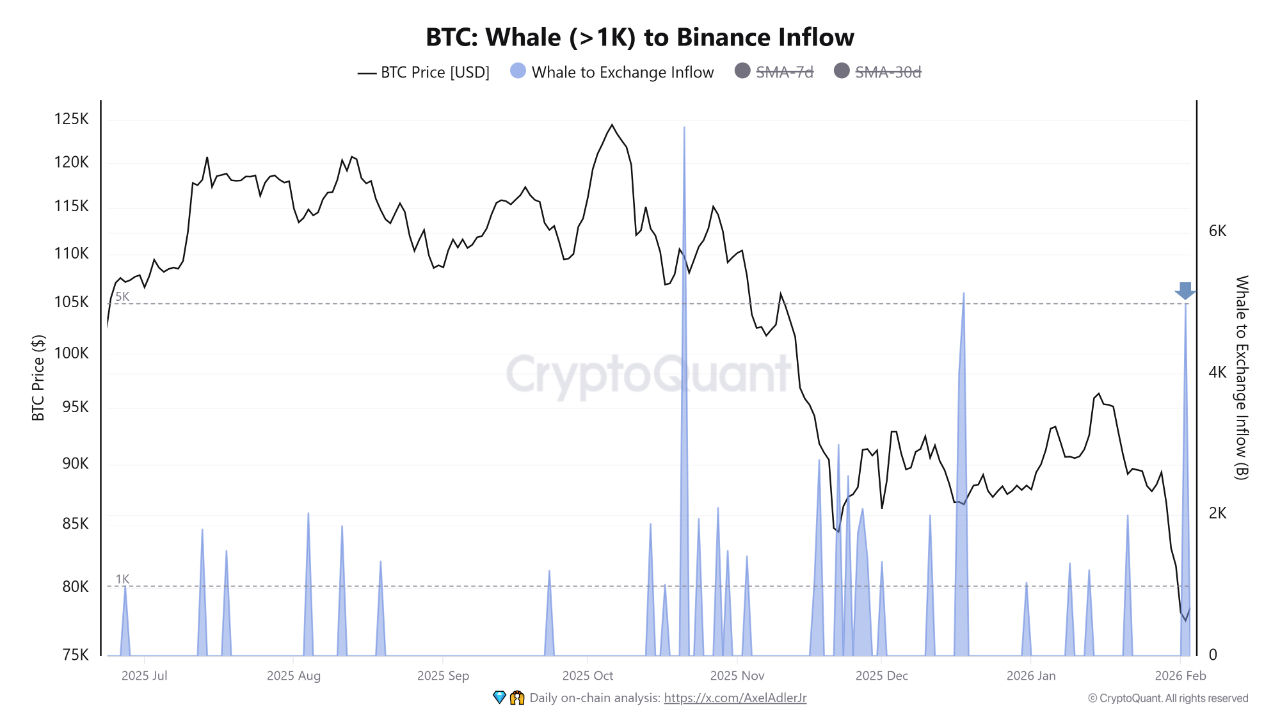

Whale behavior also shows a similar pattern. Wallets holding more than 1,000 BTC transferred roughly 5,000 BTC to Binance on Feb. 2. It was the second inflow of this size after a similar spike on Dec. 18.

Notably, after the December event, Bitcoin did not fall immediately, but later declined below $80,000.

Bitcoin whale to Binance inflow | Source: CryptoQuant

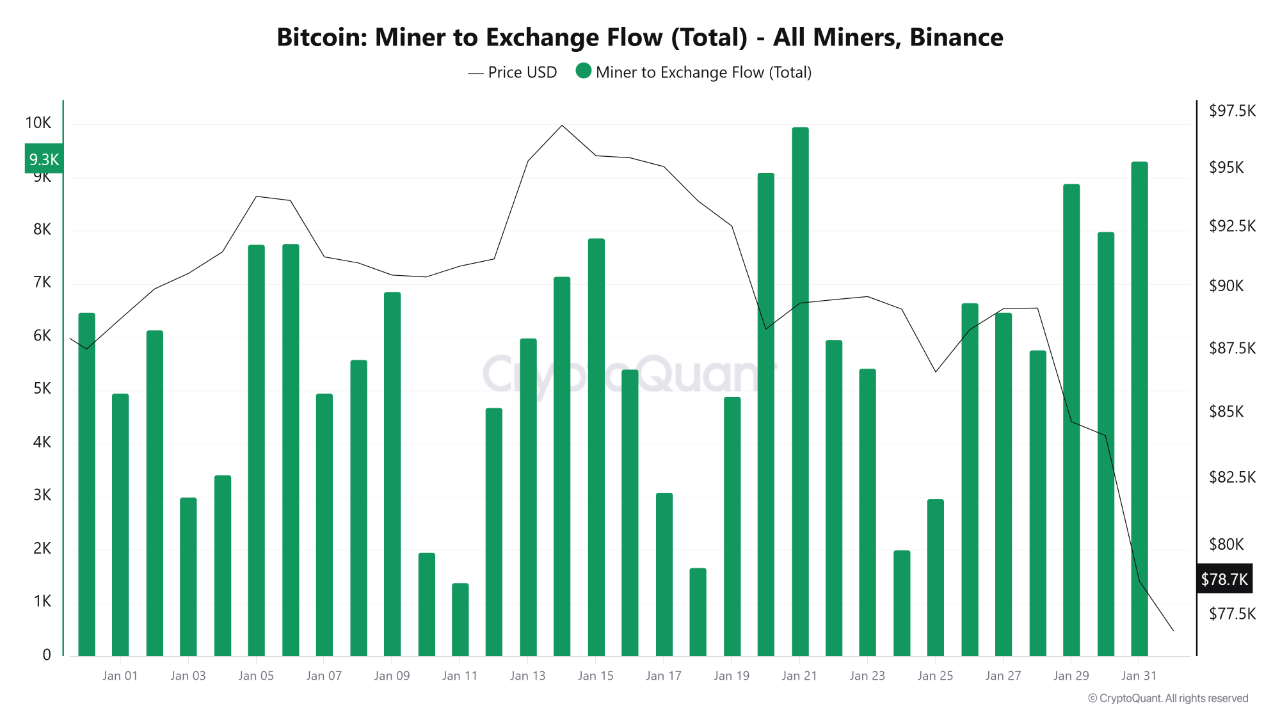

Miner Transfers Add to Exchange Supply

CryptoQuant data shows that miners transferred about 175,000 BTC to Binance during January. Several days recorded sharp spikes, with miner outflows nearing 10,000 BTC per day. This points to targeted selling or liquidity management rather than routine operations.

Bitcoin miner to exchange flow in January | Source: CryptoQuant

These transfers happened while Bitcoin traded near $95,000 earlier in the month, before sliding toward $78,000 by late January.

Large transfers do not guarantee instant selling, but they increase spot market supply. If demand stays low, the added liquidity can result in a price drop in the short term.

Broad Risk Off Conditions

Glassnode reported that spot market conditions remain weak, with Spot CVD reaching new lows and confirming sustained sell-side dominance. ETF outflows have slowed slightly, yet still points to ongoing distribution.

In derivatives markets, futures open interest has eased, and funding rates have cooled, showing fading long demand. Perpetual CVD continues to worsen, indicating aggressive selling by leveraged traders.

Glassnode sees a clear risk-off phase as profitability falls and realised losses dominate.

nextThe post Bitcoin Exchange Reserve Surges, Market Needs Fresh Demand appeared first on Coinspeaker.

You May Also Like

What Would Happen If Amazon Were To Incorporate XRP Into Its Services?

Xgram Launches Private USDT ERC20 to XMR Swaps