Did China ban crypto (again)? Here’s why the myth won’t die

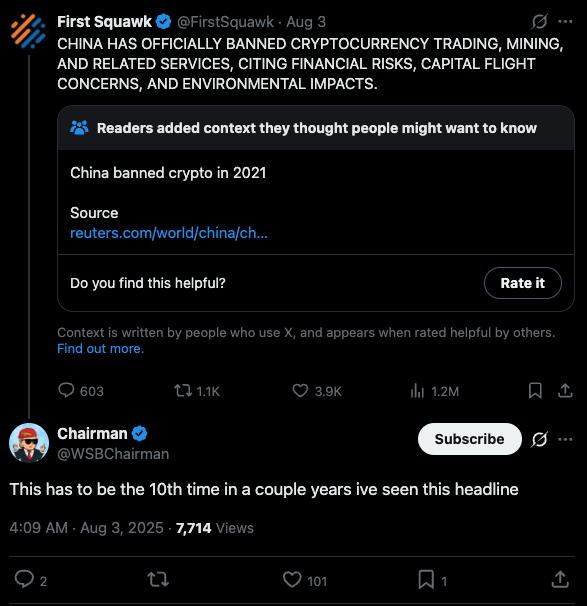

The social media rumor mill once again started circulating news of a supposed fresh Chinese ban on all crypto assets.

- Rumors on social media suggest that China bans crypto

- Similar rumors circulated in the past

- There were no notable changes in Chinese crypto policy

If you follow the crypto community on X, it seems like China bans crypto every few months. On August 3, several social media accounts reported a supposed Chinese ban on crypto assets. These accounts claimed that the ban applies to both crypto trading and mining, as well as “related services.”

Still, it didn’t take long for users to point out past instances of supposed Chinese crypto bans. One user shared an overview of reports from 2013 to 2021, showcasing how rumors can have a significant impact on crypto.

In reaction, some users shared a humorous meme referencing South Park. The meme pokes fun at the crypto market’s irrational reaction to supposed big regulatory news from China.

Why the Chinese crypto ban rumor won’t die

In reality, top Chinese regulators, led by the People’s Bank of China, implemented a full ban on all crypto transactions and mining in September 2021. Authorities cited concerns over energy usage as the main reason for the mining ban.

In addition, regulators were concerned about crypto’s use in illegal activities, as well as its role in facilitating capital flight. The country subsequently cracked down on illegal mining operations, pushing many of them to countries like Kazakhstan. Still, illegal mining operations persist in China, and crypto is still being used in bribery.

For crypto markets, regulatory news often has the biggest impact. Huge economies like China have the potential to significantly influence demand for crypto assets. At the same time, few traders outside of China follow its politics closely enough to verify unproven rumors.

For this reason, social media users looking for engagement will likely report that China banned crypto again in a few months.

You May Also Like

“Vibes Should Match Substance”: Vitalik on Fake Ethereum Connections

Why Bitcoin Crashed Below $69,000 — Causes & Outlook