Palantir revenues soar above estimates toppling $1b – will crypto AIs follow suit?

Data analytics firm Palantir saw a 48% increase in sales revenue in the second half of 2025 as it rides the high waves of an AI momentum. Is the crypto AI sector next on the surge list?

- Palantir has risen by 48%, going beyond $1 billion in revenue.

- The AI and crypto sector has shown growth amidst the boom of AI momentum.

According to data from CNBC’s latest report, the artificial intelligence software provider recently saw its revenue surpass the $1 billion mark in quarterly revenue for the first time in history. Previously, analysts predicted that its revenue would reach somewhere within the $940 million, but the financial books have gone beyond that.

The 48% surge was attributed to high demand for its artificial intelligence services. Just last week, the U.S. Army said it might purchase services of up to $10 billion from the company over a decade. If it comes to fruition, this could further spike its revenue overtime.

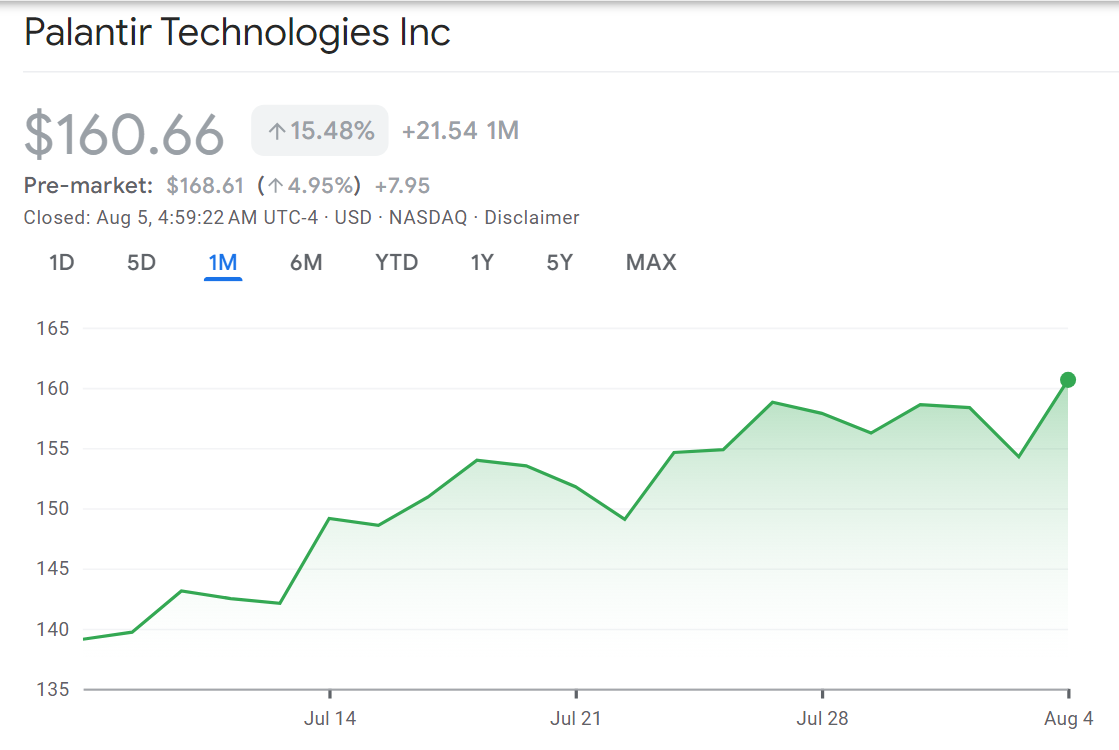

On August 5, the stock price for Palantir Technologies went up by 4.14%. Its pre-market price even soared to higher levels exceeding $168 from its previous close at $160.66. In the past month, the stock has seen a 15.48% surge following news of the rumored investment in its AI technology from the U.S. Army.

In fact, after the results of its quarterly earnings came out, the AI technologies firm reportedly raised its annual revenue forecast for the second time this year. This time around, Palantir Technologies raised its revenue prediction to somewhere between $4.14 billion and $4.15 billion this year, up from its earlier forecast of between $3.89 billion and $3.90 billion.

According to Reuters, the company is expecting a bigger boom in demand regarding AI-linked services, specifically from businesses and governments.

AI is booming, will the AI and crypto sector reap rewards?

Following news of the Palantir revenue surpassing $1 billion, the overall market cap for AI and crypto saw a slight boost. In the past 24 hours, it reached $27.8 billion after rising by 1%. The largest portion comes from the AI agents sector, which saw a 1.91% rise.

Within the same time period as the Palantir surge, the current market cap for AI tokens has surged roughly by 24% in the past month reaching beyond $30 billion a few times within the week, according to data from CoinGecko.

While the AI token sector is still small compared to total crypto market cap, which stands at $3.9 trillion, its recent growth outpaces broader crypto sectors. CoinGecko notes that AI tokens now account for around 0.8% to 0.9% of the overall market.

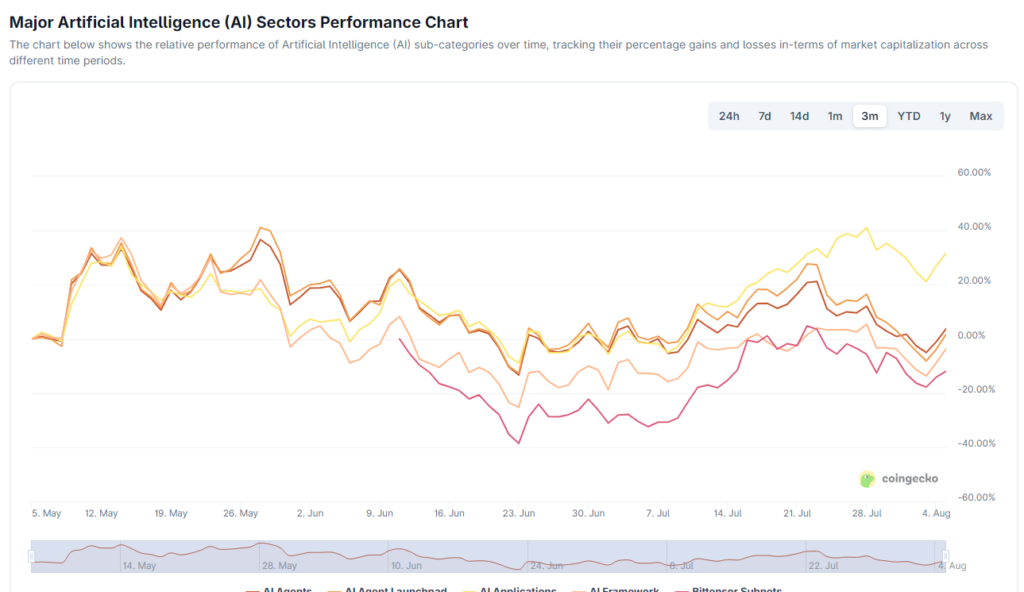

Data shows that from July 5 to August 5, the same day as Palantir, the largest growth was shown on the AI Applications sector which demonstrated a significant increase 33.32%, rising from $1.04 billion to as much as $1.39 billion. Following behind is Bittensor Subnets which has risen by 26.68%.

Performance for the AI Agent sector rose by 3.82% to $6.12 billion. Meanwhile, AI Agent launchpads increased by 1.75% to $3.53 billion. Even with the small boost that was signified by Palantir’s revenue surge, it is possible that the sector will continue to see gains as the artificial intelligence industry continues to gain momentum.

Here are some tokens that are poised for a boom in the near-future in the aftermath of Palantir’s revenue spike.

Rising tokens amidst AI boom

Mamo

Mamo is currently trading at $0.16, with notable volume of daily trading volume $11.8 million and a market cap estimated around $53 million. The token recently hit an all-time high near $0.18 in mid‑July 2025, and is now trading approximately 15% below that peak.

Performance over the last month has been strong, with 30‑day gains exceeding 170%, showing an increase in investor interest in its DeFi automation narrative.

NEAR Protocol

NEAR (NEAR) has shown strong momentum, with its price up approximately 18.6% over the past month. By mid‑July, NEAR surged 12% to reach a peak of around $3.04, driven by increasing AI integration activity on its chain. At press time, NEAR has seen a slight boost of 1.6%, reaching $2.50.

In the past month, the token has surged by 18.2%. If NEAR can break through the $3.00 level, it may consolidate and test overhead resistance.

Bittensor

Bittensor (TAO) has been trading in a wide range between $330 and $440 in recent weeks, with notable price swings and high volatility. At press time, TAO is trading at a price of $351, having dropped slightly by 1.4%.

Despite the dip, TAO remains one of the largest crypto AI tokens by market cap, and its unique use case as a decentralized machine learning protocol continues to drive interest. If it can shoot above $400, it may be able to climb up to the $480–$500 range.

You May Also Like

Federal Reserve’s Rate Cuts May Affect Cryptocurrency Market

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds