What is Helping Hyperliquid (HYPE) Hold Firm Amid Extreme Market Fear?

Hyperliquid (HYPE) has moved against the broader market since the start of the year, supported by several internal and distinctive drivers. Analysts observe that liquidation losses have actually helped push HYPE’s price higher.

How long can HYPE continue to outperform the market? Several on-chain and market data points offer a more nuanced view.

Drivers Behind Hyperliquid’s Market Outperformance

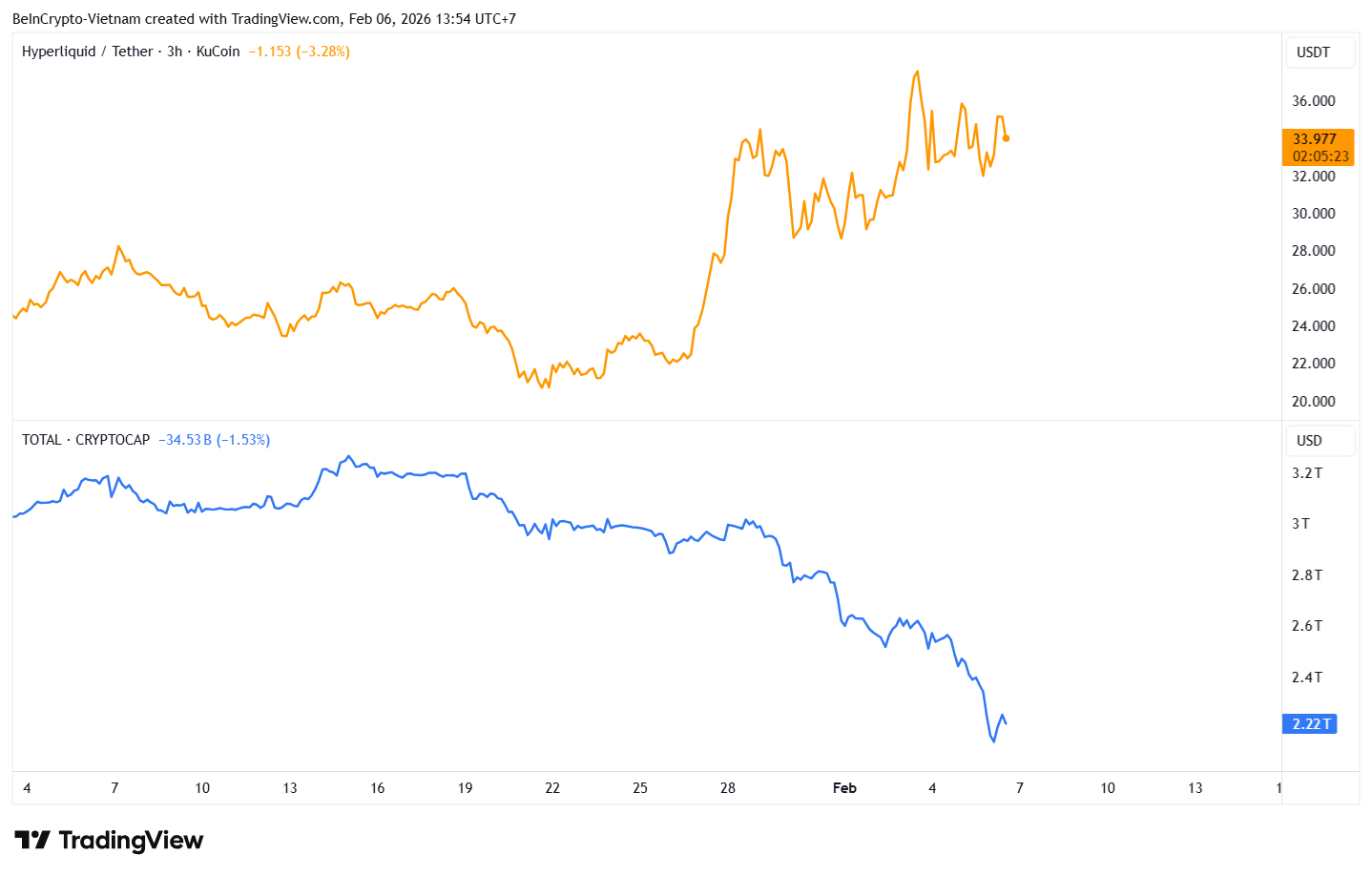

While capital continues to flow out of the broader crypto market, Hyperliquid (HYPE) has attracted inflows. TradingView data shows that since mid-last month, the total crypto market capitalization has fallen from $3.2 trillion to $2.2 trillion. Over the same period, HYPE rose 60%, from $20.6 to $33.6.

HYPE Price And Total Crypto Market Capitalization. Source: TradingView

HYPE Price And Total Crypto Market Capitalization. Source: TradingView

This divergence suggests that HYPE’s internal catalysts have outweighed the market’s heavy selling pressure.

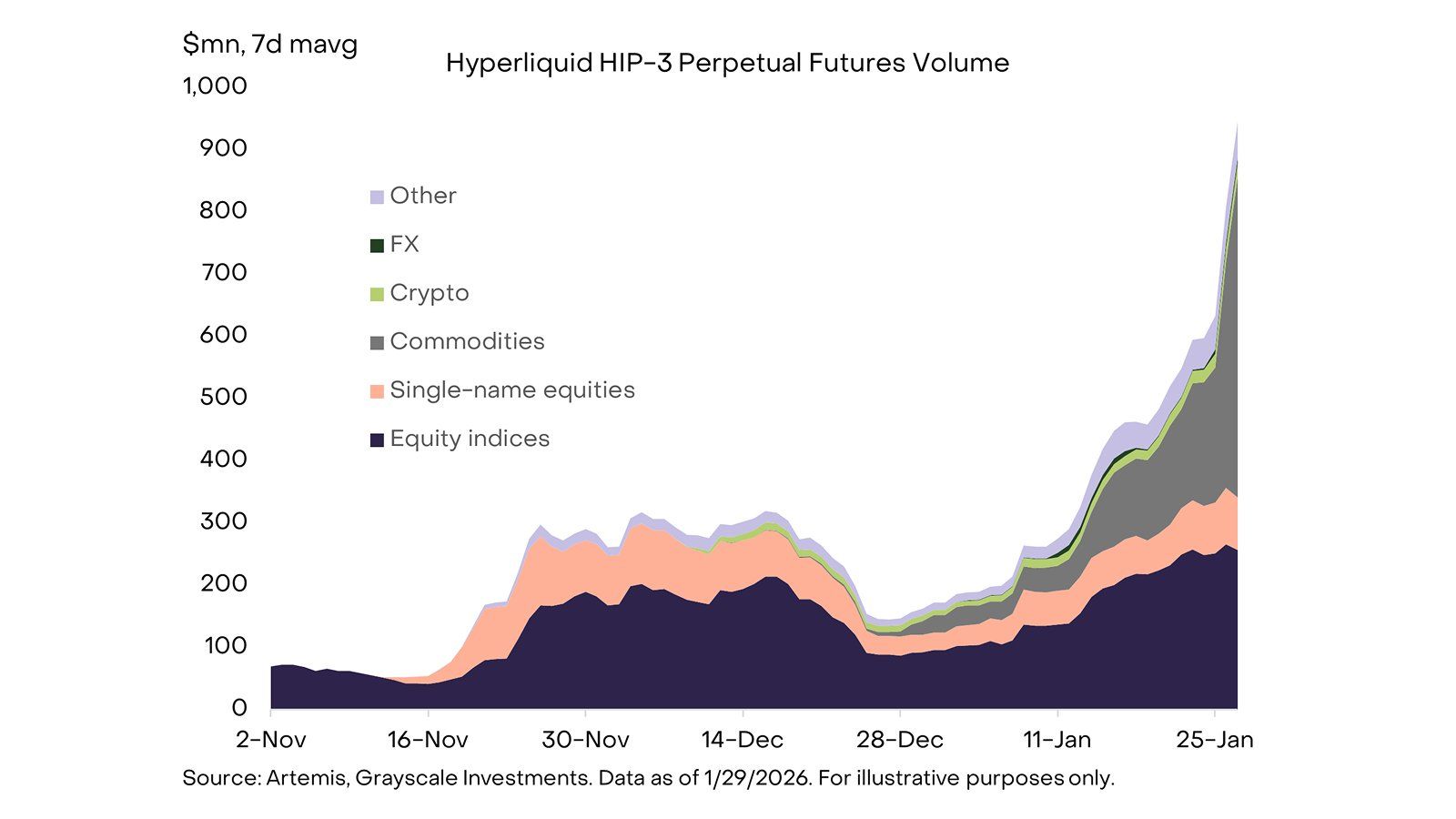

Recent reports from BeInCrypto attribute part of this momentum to a sharp surge in trading volume for HIP-3 futures contracts on Hyperliquid.

Grayscale Research highlights a boom in perpetual futures trading for non-crypto assets on Hyperliquid earlier this year. The platform recorded a seven-day average trading volume exceeding $900 million.

HIP-3 Futures Contracts Volume on Hyperliquid. Source: Grayscale

HIP-3 Futures Contracts Volume on Hyperliquid. Source: Grayscale

In addition, Ripple Prime has opened institutional access to Hyperliquid’s on-chain derivatives tools. This move supports liquidity and broader adoption.

Another development strengthened HYPE on February 5, a day marked by the most fearful market sentiment in a year. Coinbase officially enabled HYPE trading, leaving the token largely unaffected by the broader sell-off.

A listing on a major exchange like Coinbase boosted liquidity and demand. It attracted both institutional and retail investors. This allowed HYPE to absorb selling pressure and even extend gains while the market declined.

Some analysts add that HYPE’s absence from Binance may be an advantage. It may help the token avoid widespread sell-offs. Investor MartyParty notes that HYPE is the only Layer-1 asset not listed on Binance. As a result, it has avoided being pulled into this “liquidity hunt.”

Why Do Larger Liquidations Push HYPE Higher?

Other analysts argue that HYPE’s price story runs deeper.

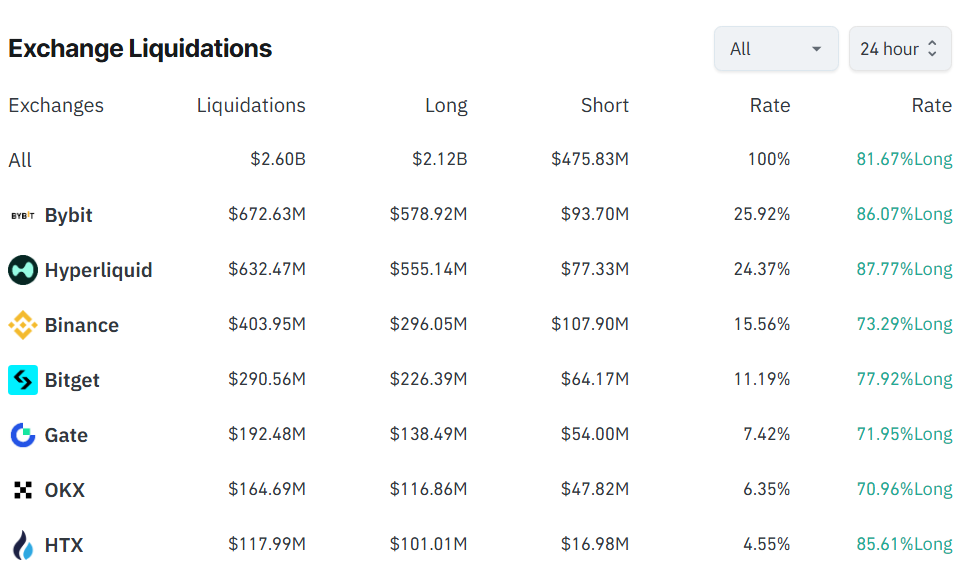

Coinglass data shows that out of more than $2.6 billion liquidated in 24 hours, Hyperliquid accounted for over $630 million. This figure was slightly lower than Bybit’s, but higher than Binance’s.

Exchange Liquidations. Source: Coinglass

Exchange Liquidations. Source: Coinglass

Analysts explain that heavier liquidations tend to support HYPE’s price because of a fee-revenue-based buyback mechanism. High liquidation volume means higher trading volume, which drives higher fee revenue.

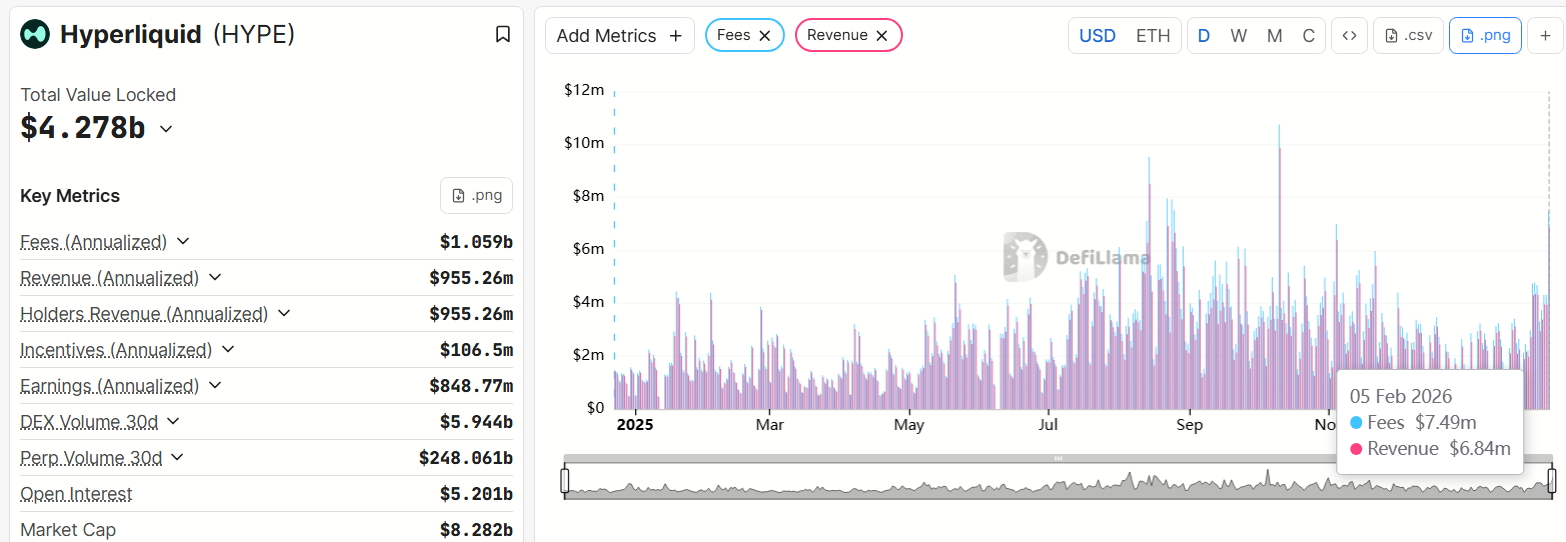

DefiLlama data shows that on February 5, Hyperliquid generated $7.49 million in fees and $6.84 million in revenue. This marked the highest level since the market crash on October 10 last year.

Hyperliquid’s Fee & Revenue. Source: DefiLlama

Hyperliquid’s Fee & Revenue. Source: DefiLlama

For most projects, market crashes reduce revenue. Hyperliquid, as an exchange, benefits from liquidation activity instead. This dynamic directly impacts the price of HYPE.

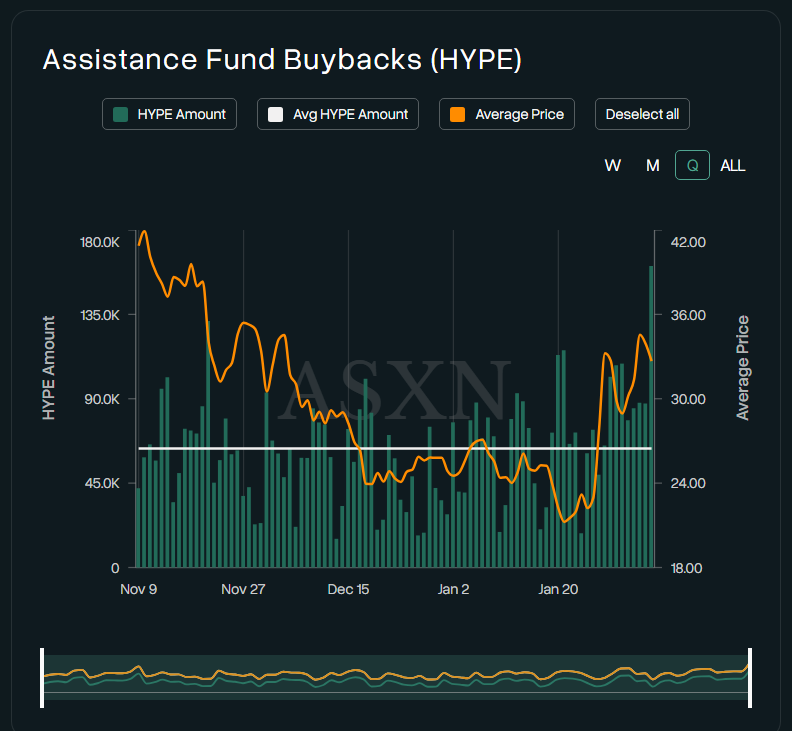

Data from Hyperscreener shows that more than 160,000 HYPE tokens were bought back on February 5. This was the highest level since the October 10 market dump.

HYPE Amount Buybacks Per Day. Source: Hyperscreener

HYPE Amount Buybacks Per Day. Source: Hyperscreener

This structure gives HYPE a unique mechanism to counter negative market pressure.

However, focusing too heavily on positive narratives may cause investors to overlook risks. On February 6, 9.92 million HYPE tokens are scheduled to unlock. In addition, negative market sentiment may persist and could outweigh HYPE’s positive catalysts.

The latest analysis from BeInCrypto emphasizes the importance of the $30 level. Price action above or below this threshold will form the basis for predicting HYPE’s next move this month.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SHIB Price Analysis for February 8