Bitcoin Tumbles as Markets Reel, in the Wake of Gloomy Inflation Data

The digital asset’s price saw a precipitous drop early Thursday morning after the U.S. Bureau of Labor Statistics published data revealing record inflation metrics.

Inflation Shock Triggers Bitcoin Slump

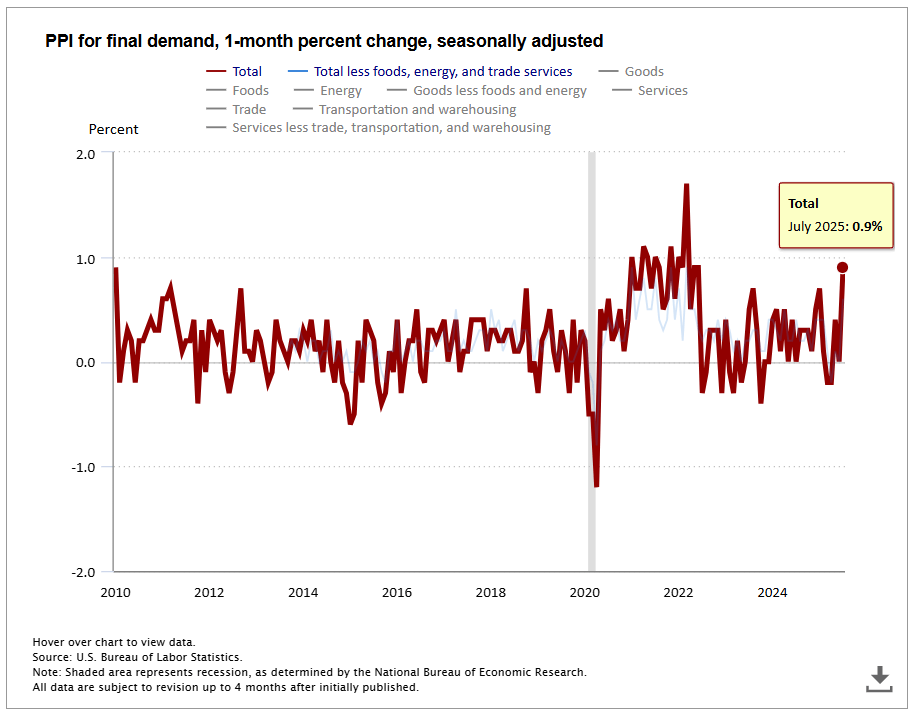

Just seconds after the U.S. Bureau of Labor Statistics (BLS) published its inflation data at 8:30 am on Thursday, bitcoin ( BTC) fell off a cliff. The Producer Price Index (PPI), a measure of inflation at the commercial or wholesale level, soared 0.9%, jumping from 2.4% in June to 3.3% in July, and eclipsing expert estimates of a significantly lower 0.1-0.2% increase.

(Bitcoin fell off a cliff soon after the U.S. Bureau of Labor Statistics published higher-than-expected PPI inflation data / bls.gov)

(Bitcoin fell off a cliff soon after the U.S. Bureau of Labor Statistics published higher-than-expected PPI inflation data / bls.gov)

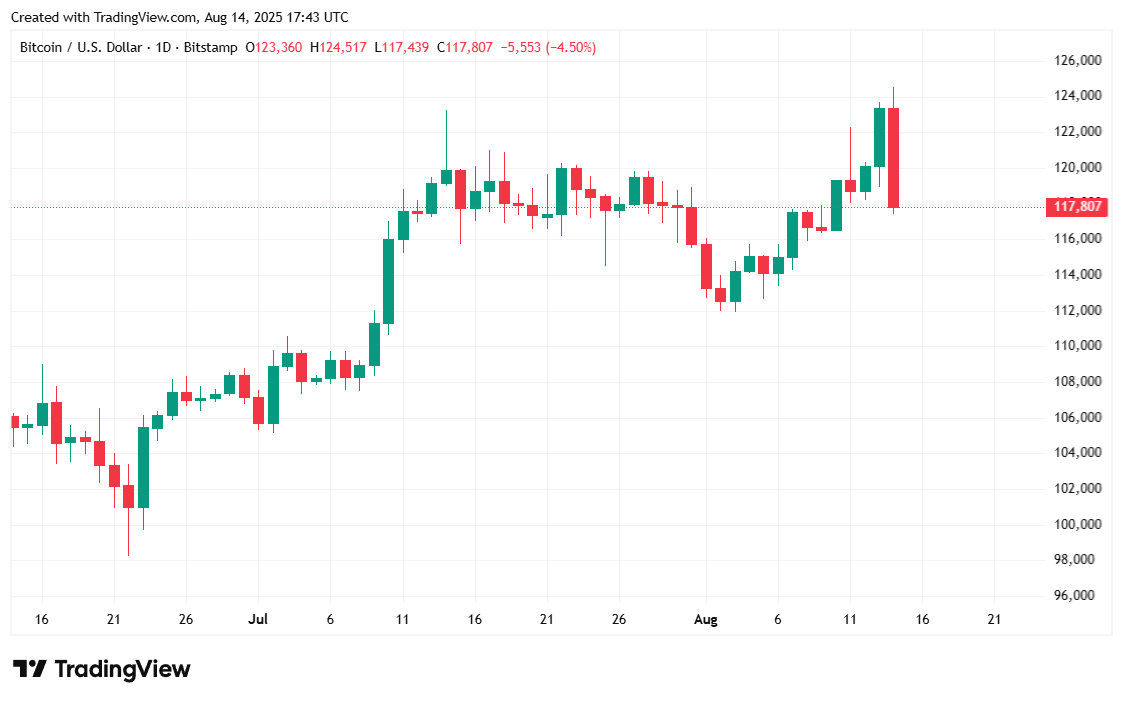

The data was so jarring that its impact was felt across both stock and crypto markets. Bitcoin sank to $117K after topping $122K on Wednesday, and ether ( ETH) shed roughly 3.50% and dropped to $4.5K after almost touching $4.8K yesterday. The S&P 500, Nasdaq, and Dow all fell 0.19%, 0.12%, and 0.43% respectively. In short, it was a market-wide bloodbath.

Because the PPI focuses on wholesale prices, it acts as a leading inflation indicator to its counterpart, the Consumer Price Index (CPI), which calculates inflation for consumer prices. Tuesday’s CPI showed flat overall inflation, but “core” inflation, which strips out volatile food and energy prices, climbed to a two-year high. And now, with the PPI also jumping to a three-year record, most economists are predicting runaway inflation on the horizon, and that sentiment was captured across all markets this morning.

Overview of Market Metrics

Bitcoin was priced at $117,919.94 at the time of reporting, down 3.03% over 24 hours but still up 1.31% for the week according to Coinmarketcap. The cryptocurrency has been hovering between $117,457.51 and $124,457.12 since Wednesday.

( BTC price / Trading View)

( BTC price / Trading View)

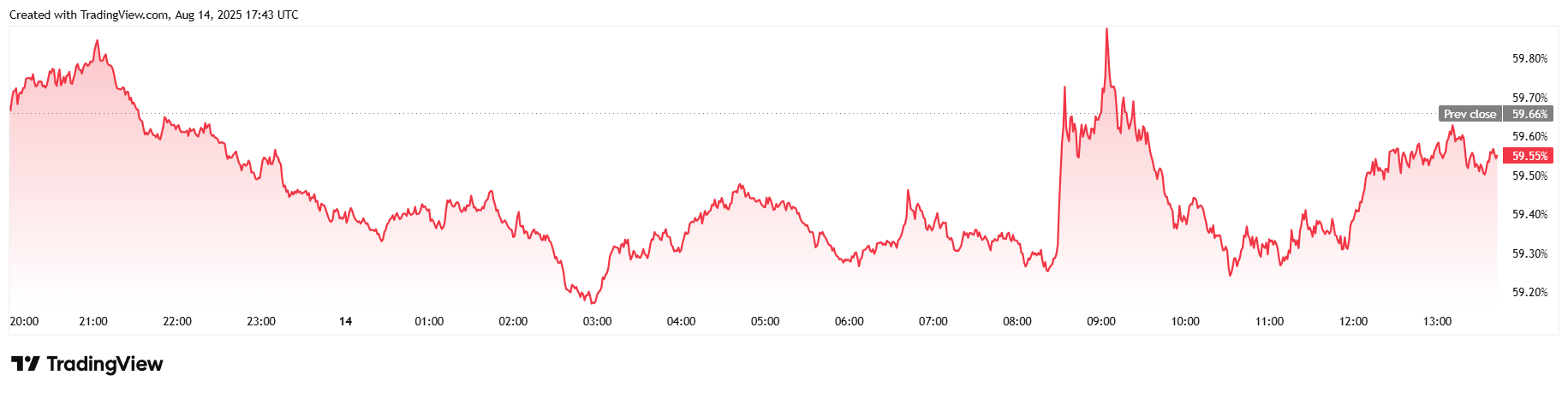

Trading volume over the past 24 hours jumped by more than 30% and stood at roughly $108.16 billion at the time of writing. However, market capitalization fell 3.09% to arrive at $2.34 trillion, and bitcoin dominance remained below 60%, even dropping further by 0.19% to 59.55% since yesterday.

( BTC dominance / Trading View)

( BTC dominance / Trading View)

Total bitcoin futures open interest on Coinglass rose 1.08% to $83.13 billion, and BTC liquidations skyrocketed to $225.75 million overall. Bulls caught off guard by the unexpected inflation data were eviscerated to the tune of $159.25 million, and the remaining $66.50 million portion consisted of short position liquidations.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

XRPL Validator Reveals Why He Just Vetoed New Amendment