Solana (SOL) Price Breaks Key Support—Is $50 the Next Level to Watch?

The post Solana (SOL) Price Breaks Key Support—Is $50 the Next Level to Watch? appeared first on Coinpedia Fintech News

Solana price saw a sharp pullback at the start of the month, with the price sliding to a low near $67.48. Since then, the recovery has looked fragile. After losing an important support zone, SOL has moved into a weaker position, allowing sellers to regain control. Buyers tried to steady the price during the consolidation phase, but the lack of strong follow-through has kept downside risks alive, shifting focus toward the $50 area as the next key support.

The move has closely followed Bitcoin’s recent breakdown below a major psychological level. While Ethereum and XRP managed to defend their supports, Solana struggled to build momentum after its bounce, raising concerns that the current setup could still open the door to a deeper pullback.

Big Players Step Back From Solana

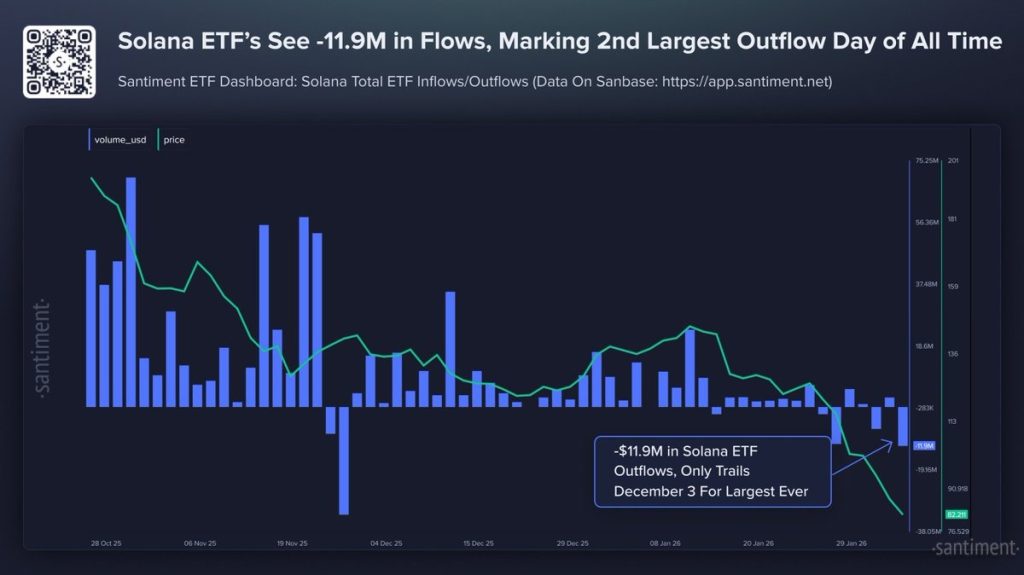

Since their launch, Solana ETFs have largely recorded consistent net inflows, with outflows remaining limited and short-lived. However, the chart above highlights a clear shift in that trend. There have been a few instances where outflows briefly overtook inflows, signalling cooling institutional interest, and the latest data points to one of the most notable moves so far.

According to Santiment, Solana ETFs recently saw nearly $11.9 million in net outflows, marking the second-largest outflow day on record, trailing only December 2025. This comes at a time when SOL has already shed over 62% of its market capitalization in the past four months, reinforcing the view that institutional sentiment has weakened alongside price.

Historically, sharp ETF outflows during extended downtrends have often coincided with late-stage selling or capitulation, rather than the start of fresh declines. While this does not confirm a bottom, the scale of the outflow suggests traders are becoming increasingly cautious, a dynamic that has, in past cycles, preceded periods of stabilization once selling pressure begins to exhaust.

Is Solana (SOL) Price Heading to $50?

Selling pressure has picked up again on Solana’s weekly chart, even after a brief rebound attempt. As the chart shows, buyers failed to deliver sustained follow-through, keeping SOL capped below key resistance zones. Last week’s sharp spike in trading volume triggered heightened volatility, but with volume now cooling and price stuck in a tight range, momentum has clearly weakened.

More importantly, the weekly Gaussian Channel has flipped bearish, signaling that SOL may have entered a broader downtrend phase rather than a short-lived correction. This shift aligns with the confirmed breakdown of a head-and-shoulders pattern on the weekly timeframe, a structure that often precedes extended downside if price fails to reclaim lost levels.

On a slightly constructive note, the weekly RSI appears to have bottomed and is attempting a rebound, suggesting selling pressure may be slowing. However, until momentum improves and price reclaims key resistance levels, the broader setup continues to favor caution, keeping the risk of further downside open as the month progresses.

The Bottom Line

Solana remains in a fragile position as long as the price stays below the $105–$110 resistance zone. Failure to reclaim this range could keep downside pressure intact, opening the door for a move toward $77–$75, where short-term demand may attempt to slow the decline. A deeper breakdown would bring the $50–$55 region into focus, aligning with historical support.

On the upside, bulls need a strong weekly close back above $115 to invalidate the bearish setup and shift momentum toward $135–$150. Until then, risk remains skewed to the downside.

You May Also Like

Hadron Labs Launches Bitcoin Summer on Neutron, Offering 5–10% BTC Yield

South Korea Launches First Won-Backed Stablecoin KRW1 on Avalanche