Crypto ETFs Extend Losing Streak With Nearly $1 Billion in Redemptions

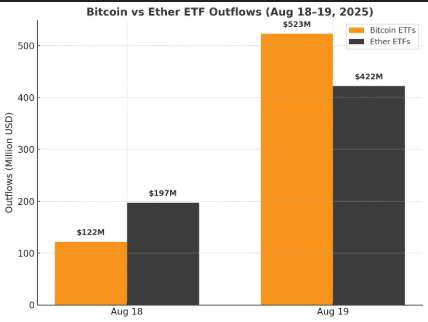

Crypto exchange-traded funds (ETFs) saw nearly $1 billion in redemptions on Tuesday as bitcoin funds lost $523 million and ether ETFs shed $430 million. Fidelity’s funds led the exits, with no ETF managing an inflow.

Market Shakeout Sees $523 Million Leave Bitcoin ETFs and $430 Million Pulled From Ether ETFs

The crypto ETF market is feeling the weight of investor caution. After Monday’s retreat, redemptions deepened on Tuesday, Aug. 19, with nearly $1 billion exiting bitcoin and ether ETFs combined. Trading activity remained elevated, but the tide of capital flowing out is hard to ignore.

Bitcoin ETFs suffered a punishing $523.31 million outflow. Fidelity’s FBTC alone shed $246.89 million, the heaviest loss of the day. Grayscale’s GBTC followed with $115.53 million in exits, while Bitwise’s BITB bled $86.76 million.

Ark 21shares’ ARKB lost $63.35 million, with smaller outflows hitting Grayscale’s Bitcoin Mini Trust (-$7.51 million) and Franklin’s EZBC (-$3.27 million). Not a single bitcoin ETF registered inflows. Despite strong trading volumes of $4.75 billion, net assets slid to $146.20 billion.

Ether ETFs were not spared, logging $429.73 million in outflows. Fidelity’s FETH led with $156.32 million in redemptions, while Grayscale’s ETHE saw $122.05 million leave.

Grayscale’s Ether Mini Trust was hit with $88.53 million in exits, and Bitwise’s ETHW shed $39.80 million. Invesco’s QETH (-$7.44 million), Franklin’s EZET (-$6.29 million), Vaneck’s ETHV (-$3.03 million), and even Blackrock’s ETHA (-$6.27 million) closed the day red. No funds registered inflows. Trading volumes held steady at $2.76 billion, but net assets dropped to $25.94 billion.

Back-to-back outflows suggest investors may be locking in gains after last week’s historic surge. Whether this represents a brief cooldown or the start of a more prolonged correction will be closely watched in the days ahead.

You May Also Like

“Vibes Should Match Substance”: Vitalik on Fake Ethereum Connections

Why Bitcoin Crashed Below $69,000 — Causes & Outlook