Bitcoin (BTC) Price: Is the Bottom In After Largest Capitulation Event in History?

TLDR

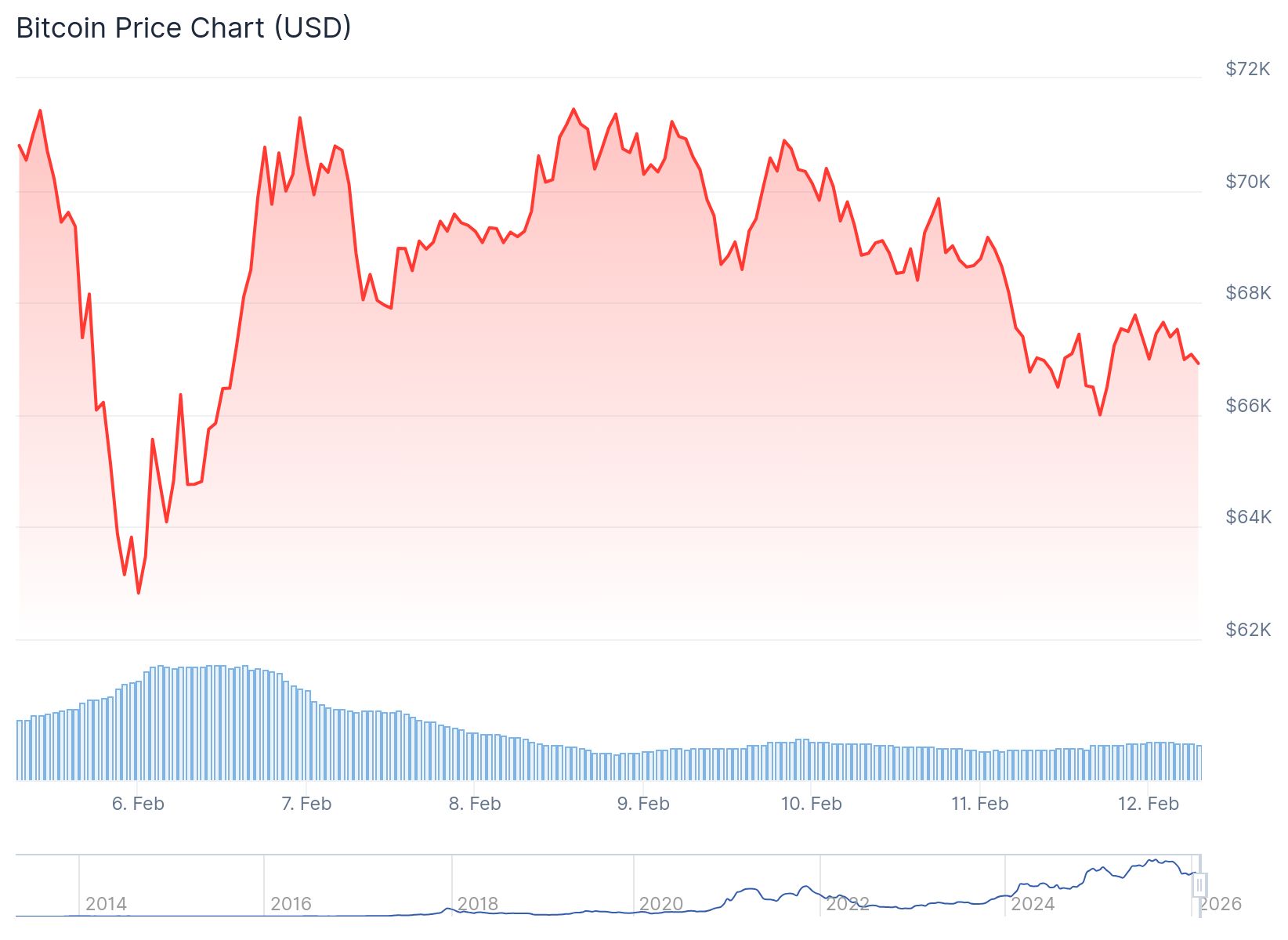

- Bitcoin experienced its largest-ever realized loss of $3.2 billion on February 5, 2026, surpassing the 2022 Terra Luna collapse.

- The cryptocurrency dropped from $70,000 to $60,000 during the February 5 crash, with daily net losses exceeding $1.5 billion.

- Bitcoin is currently trading near $67,000, struggling to break above the $70,000 resistance level after the recent downturn.

- Stronger-than-expected U.S. employment data in January reduced expectations for Federal Reserve interest rate cuts in the near term.

- Investors are awaiting Friday’s U.S. Consumer Price Index report for clearer direction on inflation trends and monetary policy.

Bitcoin is trading near $67,000 in February 2026 after experiencing the largest realized loss in its history. The cryptocurrency recently suffered a sharp decline that resulted in $3.2 billion in losses.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The February 5 crash saw Bitcoin fall from $70,000 to $60,000 in a single day. This drop created the largest loss event ever recorded on the Bitcoin network.

According to Glassnode data, the Entity-Adjusted Realized Loss reached $3.2 billion. This metric tracks the USD value of coins sold below their purchase price.

Source: Glassnode

Source: Glassnode

The recent loss surpassed the previous record set during the 2022 Terra Luna collapse. That event resulted in $2.7 billion in realized losses.

Data platform Checkonchain reported that daily net losses exceeded $1.5 billion during the sell-off. The platform described the event as a “textbook capitulation.”

The sell-off occurred rapidly and on heavy volume. It crystallized losses from investors with the lowest conviction in their positions.

Labor Market Data Pressures Rate Cut Expectations

U.S. nonfarm payrolls increased more than forecast in January 2026. The jobs report showed continued strength in the labor market.

The unemployment rate held near multi-month lows. Wage growth remained firm throughout the month.

Following the employment data release, traders reduced bets on near-term Federal Reserve interest rate cuts. Market pricing now indicates lower odds of easing until June.

Higher-for-longer rate expectations typically weigh on risk-sensitive assets. Cryptocurrencies often face selling pressure in such environments.

Bitcoin last traded 0.4% higher at $67,102. The cryptocurrency remains capped below the key $70,000 level.

Market activity has been subdued with thinning liquidity. Bitcoin had rebounded from its slide toward $60,000 earlier in February but has struggled to regain momentum.

CPI Data in Focus

Investors are now watching for weekly jobless claims data due Thursday. This information will provide additional insight into labor market conditions.

Attention will turn to Friday’s U.S. Consumer Price Index report. The CPI data could offer clearer direction on inflation trends.

The inflation report will help shape expectations for the Federal Reserve’s policy outlook. Rate decisions depend heavily on inflation data.

Bitcoin’s inability to break above $70,000 reflects cautious risk appetite. The cryptocurrency remains range-bound after its recent volatility.

As of press time, Bitcoin is trading around $67,600. The cryptocurrency continues to consolidate after the historic loss event.

The post Bitcoin (BTC) Price: Is the Bottom In After Largest Capitulation Event in History? appeared first on CoinCentral.

You May Also Like

Satoshi-Era Mt. Gox’s 1,000 Bitcoin Wallet Suddenly Reactivated

Bitcoin Holds $115K Support as Fed Cuts Rates by 25 Basis Points