Bitcoin Price Explodes as Fed Chair Powell Opens the Door for Rate Cuts in September

During today’s highly anticipated speech from Jackson Hole, the current Fed Chair warned that Trump’s tariff policy has already started to harm prices, as inflation is getting to concerning levels.

In what is most likely his last speech from Jackson Hole, Jerome Powell hinted at potential rate cuts by the end of the year, without providing more specific details.

The Fed Chair, who is expected to step down as his term nears its end, said there’s an evident slowdown in the US economy, which is “much larger than assessed just a month ago.”

In terms of unemployment rates, he noted that although the percentage has increased to 4.2% in July, it’s still at historical lows and has been relatively stable over the past year.

What was most anticipated, especially from financial markets, was his views on whether the Fed should lower the interest rates during its next FOMC meeting in September. His comments were somewhat positive, as he opened the door to a rate cut as soon as next month.

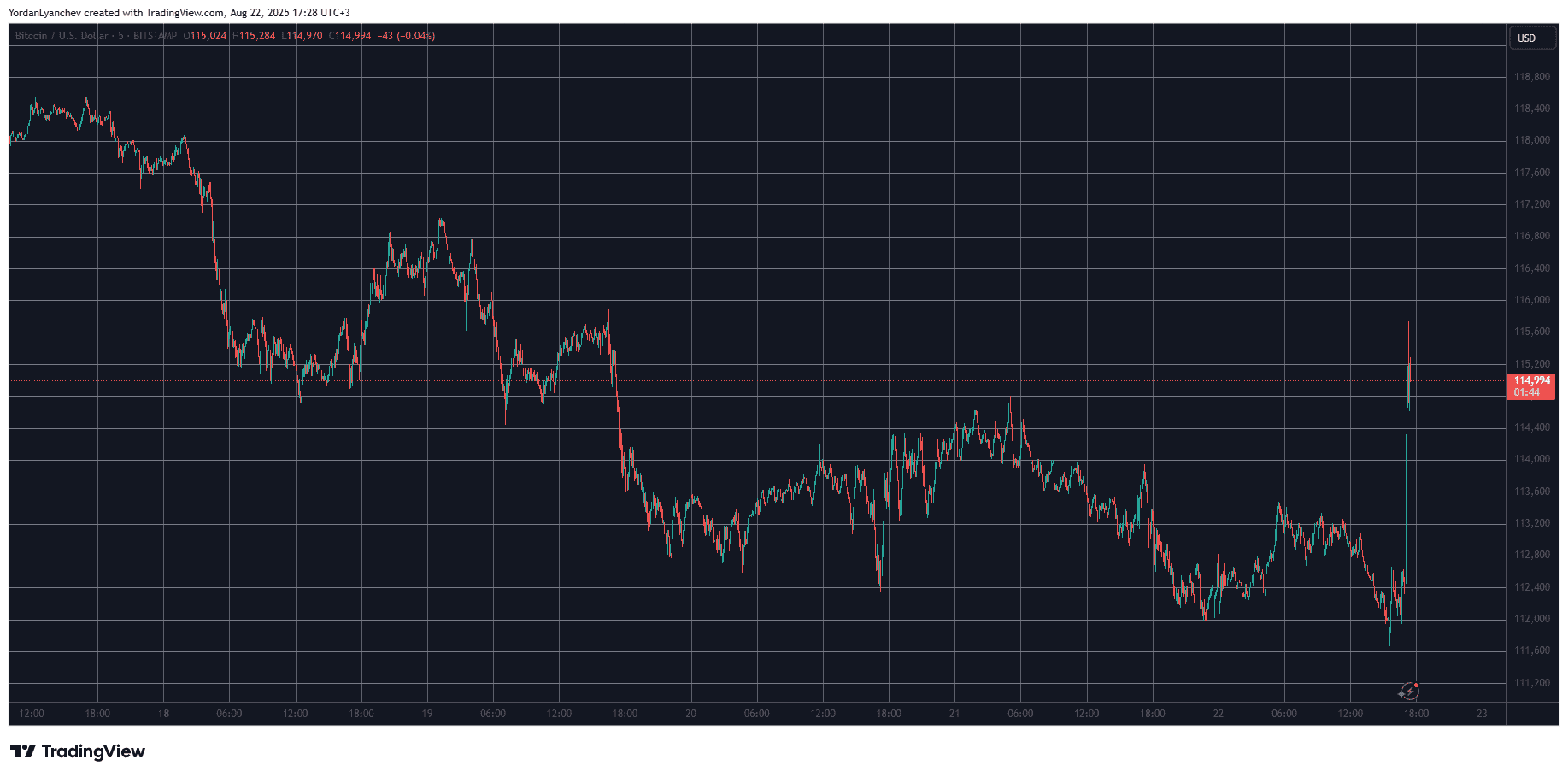

Bitcoin’s price reacted immediately to Powell’s speech. The asset had retraced in the days leading to the event today, dropping from $118,000 over the weekend to under $112,000 earlier today. However, it shot up immediately after Powell took the stage and exploded to almost $116,000 before it retraced slightly.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Due to this massive surge for BTC and many altcoins, including ETH’s pump above $4,500, the liquidations have rocketed to over $230 million in the past hour alone.

The post Bitcoin Price Explodes as Fed Chair Powell Opens the Door for Rate Cuts in September appeared first on CryptoPotato.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

TRM Labs Becomes Unicorn with 70M$: BTC Fraud Risk