Solana (SOL) Price: Citigroup Expands Tokenized Products to Network

TLDR

- Citigroup, a $2.6 trillion banking giant, has expanded its tokenized products to the Solana network by tokenizing a bill of exchange and completing settlement.

- Solana’s real-world asset value has grown to over $1.64 billion, increasing nearly 40% in 30 days, with RWA transfer volume jumping 30% to $2.21 billion.

- The network’s stablecoin market cap rose nearly 20% to over $16 billion, while active addresses increased 95% to 118 million users.

- US-listed Solana spot ETFs recorded $11.60 million in inflows through Thursday, ending two consecutive weeks of withdrawals.

- Solana price trades around $79 after dropping over 9% this week, with technical analysis suggesting potential decline to $60 or lower.

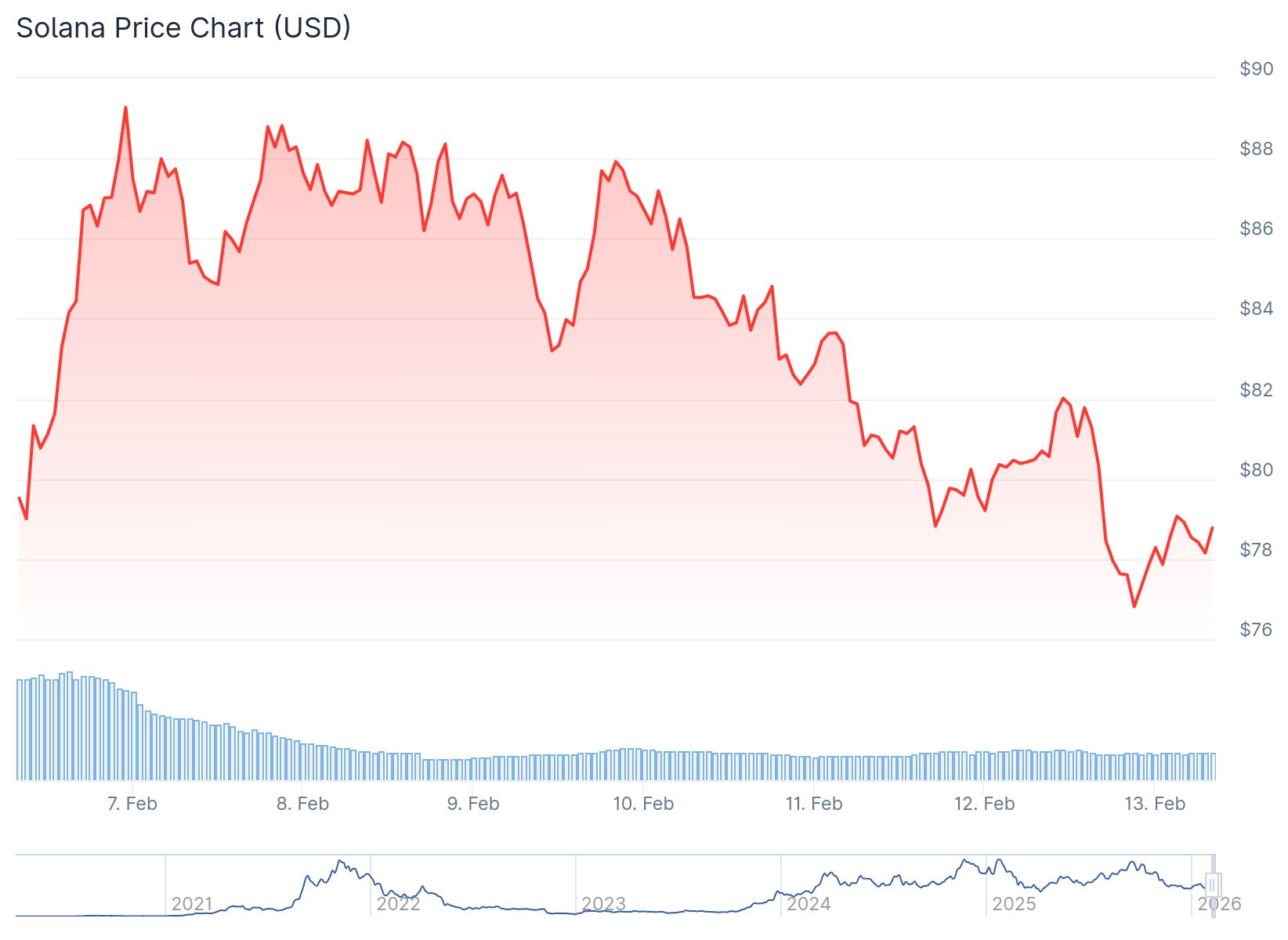

Solana price has fallen to around $79 after dropping more than 9% this week. The decline continues a downward trend that began in September when the cryptocurrency traded at $250.

Solana (SOL) Price

Solana (SOL) Price

Citigroup announced this week that it expanded its tokenized products to the Solana network. The bank tokenized a bill of exchange and completed the issuance to settlement on Solana.

Citigroup operates with over $2.6 trillion in assets and serves millions of customers across more than 100 countries. The bank launched its CIDAP tokenization platform in 2024 and plans to move substantial assets on-chain through this system.

The financial institution also plans to launch crypto custody solutions this year. The platform will combine custody, tokenization, and global banking distribution services.

Growing Network Activity

Solana has seen strong growth in its real-world asset sector. Data shows the network’s distributed asset value reached over $1.64 billion, representing a nearly 40% increase in the past 30 days.

RWA transfer volume on Solana jumped 30% to exceed $2.21 billion. Major companies using the network for tokenization include BlackRock, Galaxy Digital, WisdomTree, and Apollo Global.

The stablecoin market on Solana has also expanded. Market capitalization grew nearly 20% to over $16 billion. Stablecoin transfer volume increased by more than 274% to surpass $1.1 trillion.

Network metrics show Solana has 118 million active addresses, up 95% from previous periods. Active transactions rose 55% to 2.7 billion. Network fees reached $27 million during this growth period.

ETF Inflows Return

US-listed Solana spot ETFs recorded inflows of $11.60 million through Thursday. This marks a shift after two consecutive weeks of withdrawals from these investment products.

Source: SoSoValue

Source: SoSoValue

CryptoQuant data indicates some positive signals in the market. The spot and futures markets show large whale orders and buy dominance among traders.

Bearish Technical Signals

Derivatives data paints a cautious picture for Solana. Funding rates turned negative on Friday, reading -0.0014%. This means short position holders are paying long position holders.

Open interest in Solana fell to $4.96 billion on Friday. This level represents a steady decline since mid-January and matches lows not seen since mid-April 2025.

The Relative Strength Index sits at 26 on the daily chart. This indicates an extreme oversold condition with strong bearish momentum present.

Technical analysis shows Solana formed a head-and-shoulders pattern on the weekly chart. The cryptocurrency moved below the 61.8% Fibonacci Retracement level at $117.

The Moving Average Convergence Divergence showed a bearish crossover on January 19. Red histogram bars below the neutral level continue to support the negative outlook.

Analysts suggest the price could decline further toward the February 6 low of $67.50. A close below that level could push the price toward the $60 psychological level or lower at $50.

Recovery would require Solana to move above the $80 level. A stronger reversal would need the price to climb above the 50% Fibonacci Retracement level at $150.

Citigroup joins other major financial institutions embracing blockchain technology for traditional financial products. The bank’s entry into Solana represents continued institutional adoption of the network despite current price weakness.

The post Solana (SOL) Price: Citigroup Expands Tokenized Products to Network appeared first on CoinCentral.

You May Also Like

Spot ETH ETFs Losses Outpace Bitcoin As Monthly Netflows Remain Negative

The Hithium Disclosure Risk Highlights Regulatory Enforcement Challenges of the Stationary Battery Industry