Crypto Market Crash: Why Bitcoin, Ethereum, and XRP Prices Are Falling Today

The downturn caught traders off guard, following weeks of record highs that had fueled optimism across the industry. Instead, a mix of whale activity, profit-taking, and macroeconomic uncertainty has shaken investor confidence and triggered a sharp correction.

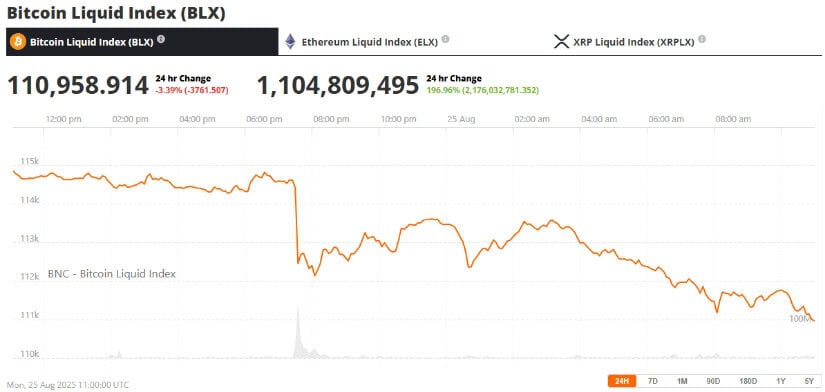

Bitcoin Flash Crash Below $111K

Bitcoin bore the brunt of the weekend sell-off, dropping 3.39% to around $110,958 after a sudden flash crash erased nearly $4,000 in minutes. The decline was driven by the movement of a single whale that offloaded 24,000 BTC worth over $2.7 billion onto exchanges.

Bitcoin (BTC) was trading at around $110,958, down 3.39% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

This triggered forced liquidations exceeding $550 million, mostly in overleveraged long positions. Analysts note such abrupt drops often occur on Sundays, when liquidity is thin and “liquidation hunting” amplifies volatility. Despite recent highs near $125,000, Bitcoin is now testing key support levels as traders reassess risk appetite.

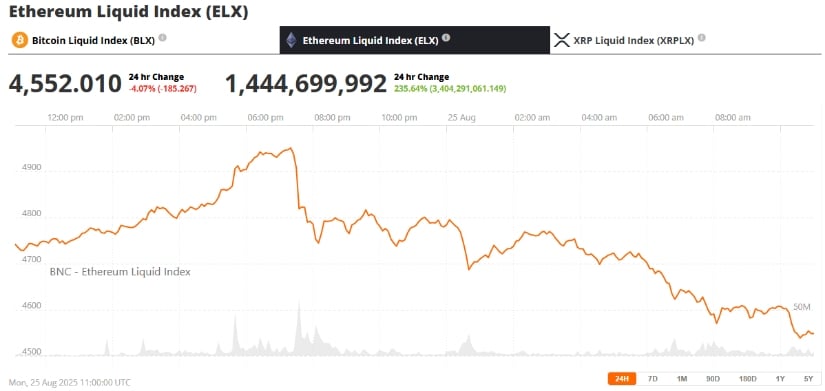

Ethereum Holds Up—but Faces Pullback Pressure

Ethereum showed relative resilience, holding the $4,550 support after climbing nearly 9% over the past week, and briefly touching $4,945. Its market cap is approaching $600 billion, buoyed by rising institutional demand and its strength in smart-contract infrastructure.

Ethereum (ETH) was trading at around $4,552, down 4.07% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

That said, historical patterns warn that Ethereum tends to cool off in September following strong August gains. Since 2016, the altcoin has averaged a 6.4% drop in September after rallying in August. Meanwhile, ETF inflows this month have reached nearly $3 billion, and corporate treasuries now hold over $17 billion in ETH, suggesting some buffer amid seasonal weakness.

XRP Drops Below $3 Amid Market Ripples

Riding the wave of Powell’s rate-cut hints, XRP had surged from around $2.78 on Friday to just over $3.11, gaining nearly 12% over the weekend. But the ripple effect from Bitcoin’s flash crash dragged it below the $3 threshold on Monday.

XRP was trading at around $2.94, down 2.86% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Compounding concerns for XRP are renewed comparisons to past boom-and-bust cycles, such as in 2017 and 2021, which highlight the token’s history of sharp volatility during broader market corrections.

Fed Commentary Sparked Initial Bounce

Much of the recent volatility was preceded by a strong rally after Federal Reserve Chair Jerome Powell’s remarks at the Jackson Hole symposium. Powell hinted that the Fed may be approaching a point where interest rates could be eased, citing progress in managing inflation and a softer outlook for U.S. growth. The comments briefly revived risk appetite across global markets, with Bitcoin climbing back to around $116,500 and Ethereum gaining momentum alongside it.

On August 22, 2025, Federal Reserve Chair Jerome Powell signaled that conditions now support interest rate cuts, marking a shift from his more cautious stance in July. Source: @DeFiTracer via X

Initially, Powell’s remarks ignited a quick bounce in crypto-linked equities. MicroStrategy climbed more than 5% and Coinbase surged nearly 7% as markets cheered rate-cut hopes. However, that optimism faded in subsequent trading—when the broader crypto market turned lower, MicroStrategy slid 4.1% and Coinbase dipped 2.9%.

Final Thoughts

Today’s crypto downturn stems from a convergence of factors: massive whale liquidations igniting a flash crash; speculative profit-taking; ongoing macroeconomic uncertainty; and a shift in sentiment across altcoins. As markets remain highly volatile, close attention to ETF flows, institutional activity, and macroeconomic indicators will be key in the days ahead.

You May Also Like

Solana Price Plummets: SOL Crashes Below $90 in Stunning Market Reversal

New Developments Could Push Price Toward $0.40