Top 3 Most Accumulated Cheap Cryptocurrencies in 2026

The altcoin market of early 2026 is moving through a period of deep transition. For years, the spotlight remained on a small group of high-profile assets. However, a major trend is now taking shape as capital rotates away from aging giants. Many leading altcoins are currently facing structural challenges that hinder their ability to grow. Their massive size and reliance on social hype have become heavy anchors.

In contrast, a new crypto is rising with much stronger growth signals. Investors are moving toward protocols that offer real utility and lower entry costs. This shift highlights a classic problem-solution contrast.

Dogecoin (DOGE)

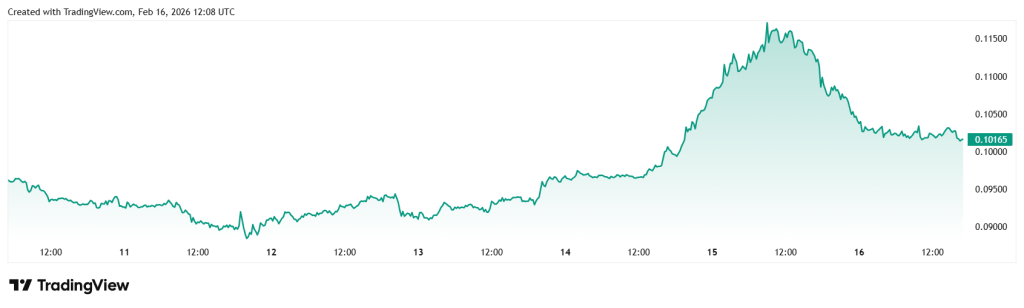

Dogecoin (DOGE) remains a famous name, trading around $0.10 with a market cap of over $14 billion. Early investors loved DOGE because of its simple appeal and the backing of high-profile figures. It was the first “cheap” coin to turn a joke into a billion-dollar asset. This history created a massive community that still holds the coin today.

However, its past success is now its biggest problem. Because DOGE is so large, it requires huge amounts of new money just to move the price a small amount. In 2026, the chart shows slowing movement and stalled breakout attempts.

Every time the price tries to rise, it hits a wall of sell orders from long-term holders. For DOGE to double in value, it would need billions in new liquidity. This makes it a slow-moving asset for those seeking high percentage gains.

Shiba Inu (SHIB)

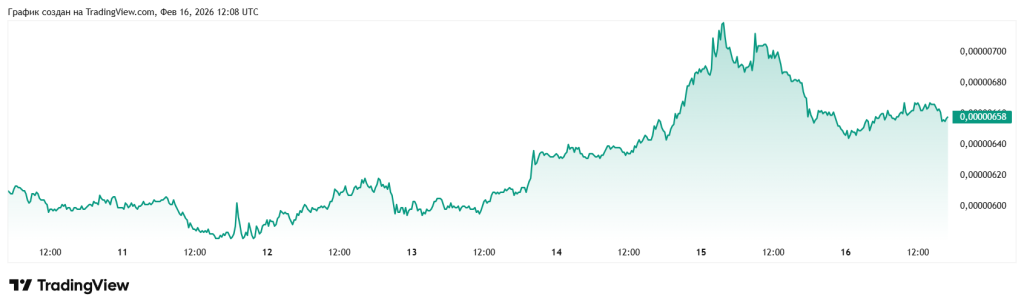

Shiba Inu (SHIB) followed a similar path, rising to fame as the “Dogecoin Killer.” It built a strong adoption curve by expanding into its own ecosystem. However, the narrative that once drove SHIB has begun to weaken. Community demand is falling, and the trend strength on its daily charts is fading. Currently trading at $0.0000064, SHIB is struggling to keep the attention of new buyers.

The core issue for SHIB is a lack of a clear catalyst for recovery. The early hype has been replaced by a quiet period where no new “viral” news can seem to push the price higher. Many analysts now share a bad price outlook for the token, noting that it has lost its speculative edge. Without a new reason for the masses to buy in, SHIB remains stuck in a cycle of slow decline.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is emerging as the answer to the problems facing DOGE and SHIB. It does not rely on massive liquidity to move its price, nor is its growth tied to social media hype. Instead, MUTM is preparing a professional lending protocol that creates value through its structure.

Mutuum Finance’s whitepaper highlights a dual market mechanism: a Peer-to-Contract (P2C) system for instant loans and a Peer-to-Peer (P2P) market for custom deals. This creates a predictable lending environment where rules are set by code.

The presale for MUTM is currently seeing intense accumulation. The token is in Phase 7, priced at $0.04, which is a 300% increase from its starting price of $0.01. The project has raised over $20.5 million and has attracted more than 19,000 holders. With 45.5% of its 4 billion tokens allocated to the presale, the supply is being secured by serious participants before the official launch price of $0.06.

MUTM’s Long-Term Case

MUTM’s strength comes from developing roadmap mechanics that support long-term value. One key tool is mtToken. When users deposit assets, they get mtTokens as receipts. These tokens gain value over time as borrowers pay interest. This links the token’s performance to real use, not just a viral tweet.

The protocol also aims to use a buy-and-distribute model. Part of the revenue is used to buy MUTM tokens from the open market. These are then given to users who help secure the protocol. By using Chainlink oracles and Pyth price scaling, the system stays safe and accurate.

These tools solve the issues that DOGE and SHIB cannot. They give the token a solid reason to rise as the platform grows. Analysts believe these mechanics could lead to a 9X increase in value as long as the protocol scales as planned.

Roadmap Catalysts: Scaling for 2027

The roadmap for Mutuum Finance is built on a clean sequence of technical milestones, beginning with the V1 protocol already live on the Sepolia testnet for public testing. This environment allows users to interact with core assets including ETH, WBTC, LINK, and USDT, providing a realistic simulation of decentralized credit markets. To manage these positions, the system issues debt tokens that represent a user’s specific liabilities, ensuring clear accounting within the smart contracts.

To maintain system integrity, the protocol utilizes a Health Factor calculation, which monitors the ratio between a user’s collateral and their borrowed debt. If this factor drops below a predefined threshold, the position becomes eligible for liquidation to preserve the platform’s stability factor and protect the liquidity pools..

As Phase 7 nears completion, whale inflows are increasing as large investors utilize the 24-hour leaderboard to compete for bonuses and maximize their positions. With the confirmed launch price set at $0.06, the current $0.04 rate represents a 50% discount for early participants. For those seeking a high-utility asset before the 2027 cycle begins, the window to enter Mutuum Finance at these levels is closing rapidly.

For more information about Mutuum Finance (MUTM) visit the links below:

Website:https://www.mutuum.com

Linktree:https://linktr.ee/mutuumfinance

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Top 3 Most Accumulated Cheap Cryptocurrencies in 2026 appeared first on CaptainAltcoin.

You May Also Like

Trump adviser demands Fed economists be 'disciplined' for arguing with presidential tactic

CME Group to launch options on XRP and SOL futures