Ethereum Price Forecast: ETF inflows blow past $4 billion as whales accumulate 1.44 million ETH in August

Ethereum price today: $4,500

- Ethereum ETFs cross $4 billion in net inflows for August, while Bitcoin ETFs lag with $800 million outflows.

- Whales scooped up 340K ETH over the past three days, bringing their total acquisition in August to 1.44 million ETH.

- ETH faces pressure at the $4,500 support and 14-day EMA, spurred by nearly $1 billion in profit-taking.

Ethereum (ETH) remained muted near $4,500 on Thursday despite sustained accumulation from institutional investors and whales over the past few days.

ETH ETFs attract $4 billion, whales accumulate 1.44 million ETH

Ethereum ETFs have pulled in $4 billion in net inflows since the beginning of August, according to SoSoValue data.

The milestone comes after the products posted a fifth consecutive day of net inflows, worth $309 million on Wednesday. In contrast, their BTC ETF counterparts have seen net outflows of $800 million in August, indicating a potential institutional rotation toward ETH.

"There is a relentless bid for ETH [at the moment]," wrote Bitwise CIO Matt Hougan in an X post on Thursday.

A recent chart by Bloomberg analyst James Seyffart shows top institutional holders of ETH ETFs as of the end of the second quarter include Goldman Sachs, Jane Street, Millennium Management and DE Shaw.

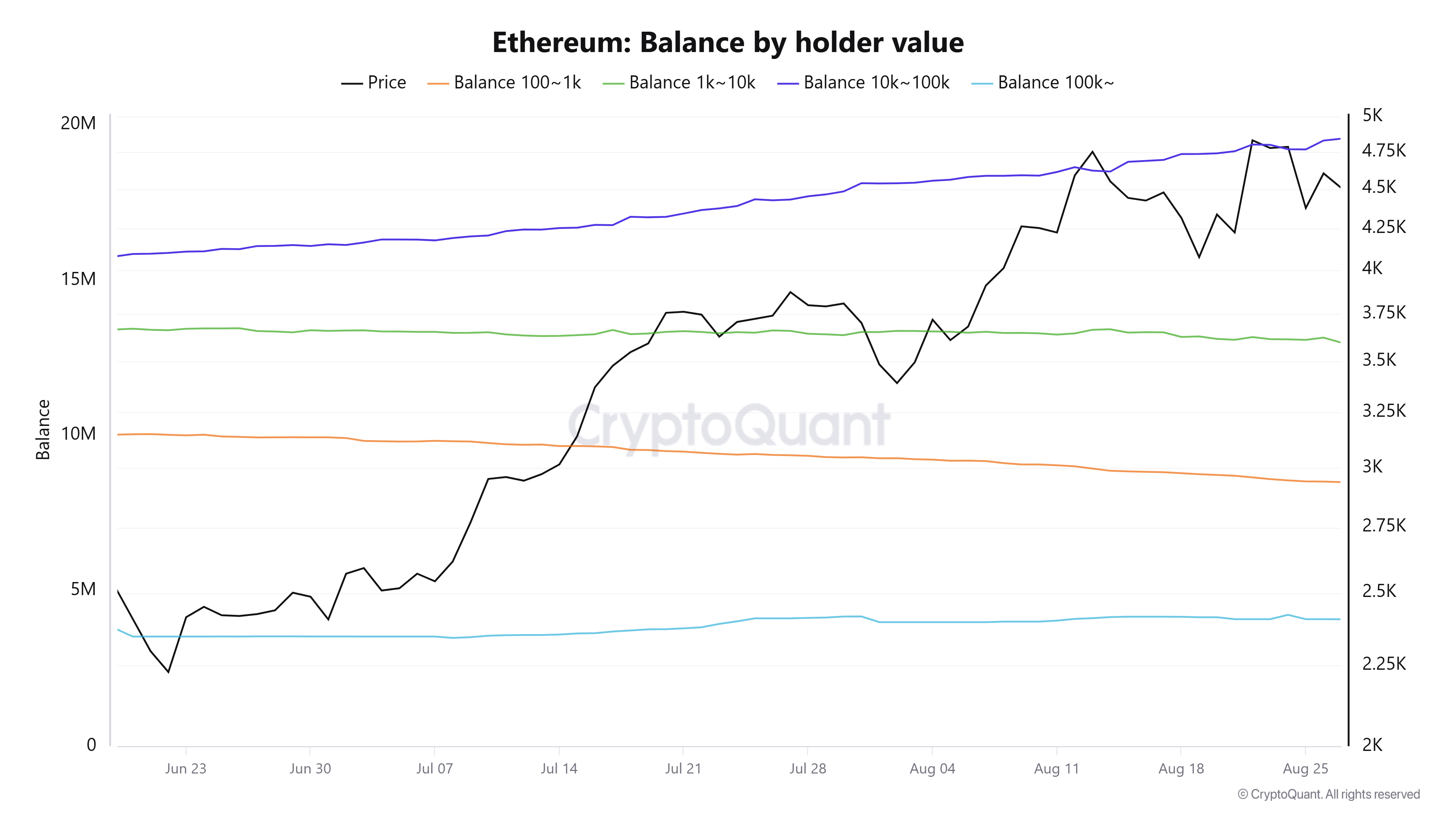

The demand from institutional investors mirrors that of large-scale Ethereum investors, also known as whales, who hold between 10,000 and 100,000 ETH. This cohort has bought over 340,000 ETH in the past three days, pushing their total acquisition in the month to 1.44 million ETH.

ETH Balance by Holder Value. Source: CryptoQuant

Ethereum treasuries, led by BitMine Immersion (BMNR) and SharpLink Gaming (SBET), have also continued to accumulate the top altcoin, expanding their collective balance to 3.3 million ETH, worth about $15 billion, within just three months of gaining popularity.

The increased attention surrounding ETH follows comments from Jan Van Eck, CEO of asset manager VanEck, who referred to ETH as the "Wall Street token" due to its dominance in the stablecoin market.

"Companies have to employ technology to enable stablecoin usage over the next 12 months. [...] If I want to send you stablecoins, your bank has to figure it out, or you will find some other institution to do that," said Van Eck in a CNBC interview on Wednesday.

"So the winner is, who's going to be building on these blockchains? It's going to be Ethereum or something that uses Ethereum kind of methodology, which is called EVM," he added.

Despite the strong performance of ETH, investors have continued to book profits, with realized profits reaching nearly $1 billion over the past five days.

ETH Network Realized Profit/Loss. Source: Santiment

Ethereum Price Forecast: ETH tests $4,500 support again

Ethereum experienced $88 million in futures liquidations over the past 24 hours, comprising $63 million and $25 million in long and short liquidations, according to Coinglass data.

Following a rejection just above $4,600, ETH is testing the support near $4,500, which is strengthened by the 14-day Exponential Moving Average (EMA). If ETH declines firmly below this EMA and fails to hold the support near $4,000, it could bounce off the 50-day Simple Moving Average (SMA).

ETH/USDT daily chart

A move below the 50-day SMA could send ETH toward $3,470.

On the upside, ETH must firmly overcome its all-time high resistance and hold it as support to initiate another leg up.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are moving range-bound, slightly above their neutral levels, indicating indecision among traders.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

You May Also Like

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus