VanEck CEO Calls Ethereum ‘The Wall Street Token’ As Institutional Adoption Rises

Investment management firm VanEck’s CEO, Jan van Eck, said on Fox Business yesterday that Ethereum (ETH) is very much “the Wall Street token.” His comments come as ETH hovers near a potential new all-time high (ATH), drawing renewed attention from both retail and institutional investors.

Ethereum Essential For Stablecoin Transfers

In a recent interview with Fox Business, VanEck CEO shared thoughts on ETH’s current momentum – both in terms of price and adoption. The executive said that banks must adopt the smart contract network to facilitate stablecoin transactions.

For the uninitiated, stablecoins are cryptocurrencies designed to maintain a stable value by being pegged to a reserve asset like the US dollar. They combine the speed of crypto with the stability of traditional currencies, making them widely used for payments, trading, and remittances.

Until recently, banks were cautious about stablecoins due to regulatory uncertainty and their association with the broader, volatile crypto market. However, following the passage of the GENIUS Act, attitudes have begun to shift.

Regulators are now offering a clearer framework for digital asset operations, and commercial institutions are increasingly open to adopting stablecoins as part of their financial infrastructure.

Speaking on Fox Business, Jan van Eck said it is essential for banks and commercial institutions to adopt a blockchain to enable stablecoin movements. Among the several potential candidates, the VanEck CEO thinks Ethereum holds a competitive advantage. He added:

This is not the first time VanEck has highlighted Ethereum’s role in the evolving digital economy. In a recent report, the firm suggested that Ethereum could one day surpass Bitcoin (BTC) as the preferred store of value, citing ETH’s declining issuance rate and expanding network utility as key drivers.

Stablecoin adoption has accelerated since Donald Trump’s victory in the November 2024 US presidential election. The state of Wyoming recently launched its own stablecoin, FRNT, marking the first such initiative by a US state government.

Meanwhile, Treasury Secretary Scott Bessent projected that the stablecoin market could grow to as much as $3.7 trillion by 2030. Investment banks are also weighing in as Citigroup recently estimated the market could expand sevenfold within five years.

ETH Adoption Outshines Bitcoin

Ethereum’s broad utility continues to give it an edge over Bitcoin. While BTC remains primarily a store of value and an inflation hedge, ETH powers decentralized finance (DeFi), non-fungible tokens (NFTs), and functions as a global settlement layer for digital payments.

Against that backdrop, an increasing number of firms are actively adding ETH to their balance sheets. For example, SharpLink Gaming recently purchased another 56,533 ETH, increasing its total holdings close to 800,000 tokens.

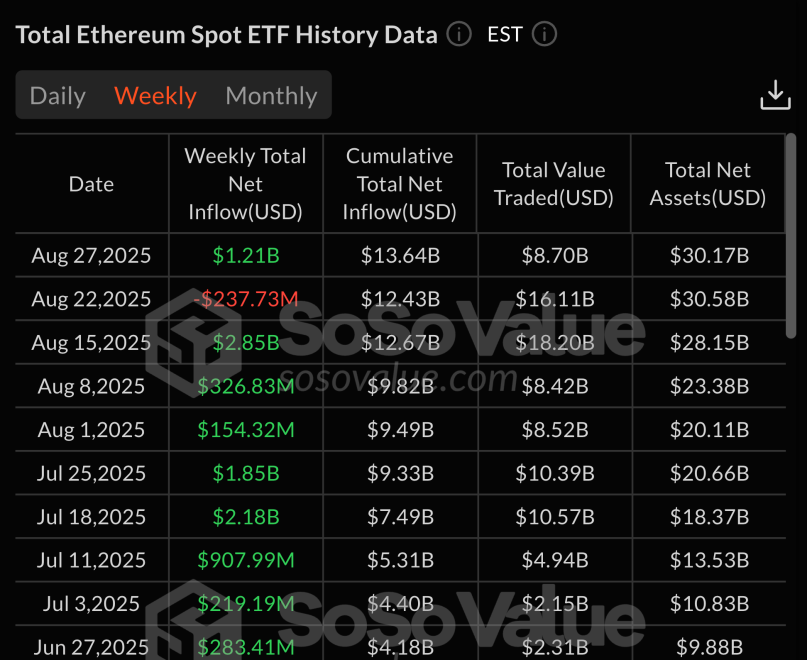

Recent exchange-traded funds (ETF) data also shows ETH ETFs outperforming their Bitcoin counterparts for seven consecutive days. At press time, ETH trades at $4,473, down 3.2% in the past 24 hours.

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Kalshi debuts ecosystem hub with Solana and Base