Best Meme Coins to Buy That Can Turn $1,000 into $1 Million

The meme coin market is where traders go when they want to turn modest investments into life-changing wealth. Countless examples demonstrate this is possible, so millions of hopeful investors try their luck in the meme coin casino every day.

One trader, known as Blockgraze, turned $1,000 into well over $1 million on Dogwifhat in 2023 and 2024. Meanwhile, the well-known “Bonk Guy” achieved a similar feat with Bonk and has also made huge profits on other meme coins, including Fartcoin and Useless Coin.

SPX6900 investor Murad, in another example, turning a few thousand dollars into what is now worth $38 million. All of this shows that it’s possible to become absurdly wealthy with meme coins – but what if there are secrets to spotting projects with the highest potential that most investors are unaware of?

What if Dogwifhat, Bonk, Useless Coin, and SPX6900 all follow a pattern – and Blockgraze, Bonk Guy, and Murad know what it is? Let’s break down five of the best meme coins to buy now that might follow a similar pattern and potentially be the next millionaire-makers.

Wall Street Pepe

Wall Street Pepe launched in February as a Wolf of Wall Street-themed Pepe alternative with real utility – a trading insights ecosystem and market-beating alpha. After an initial surge, the hype cooled, and $WEPE entered an accumulation phase.

However, the team didn’t leave – they have continued to make significant moves. Most recently, they announced a migration from the Ethereum blockchain to Solana and also launched an NFT collection.

This has sparked excitement among the $WEPE community, attracted market attention, and ultimately caused the price to triple since May.

The fact that $WEPE is now breaking out after a lengthy consolidation period is exactly what meme coin millionaire Murad looks for in projects. He argues that this ensures the community is sufficiently “cult-like” to endure crashes and recover.

With Wall Street Pepe now surging and new ecosystem developments underway, $WEPE appears well-positioned for explosive gains in the weeks ahead. Visit Wall Street Pepe.

Maxi Doge

Maxi Doge is a Dogecoin-themed meme coin on the Ethereum blockchain. It’s marketed as Dogecoin for degens – he’s Dogecoin’s 1,000x leverage trading younger cousin, whose bench press is bigger than his ability to hedge risk.

Since the launch of Pump.fun, there has been a clear shift in the meme coin market dynamics, moving from lighthearted internet jokes to full-blown, high-stakes gambling. Maxi Doge understands this cultural change and embraces it.

Evident from the performance of Dogwifhat and Bonk earlier this cycle, there is strong potential for dog-themed meme coins to make millionaires. It’s also worth noting that $MAXI offers advantages such as staking, futures trading integrations, and community giveaways, which help separate it from other dog coins.

Furthermore, $MAXI is currently in a presale, during which it has raised $1.6 million so far.

Although the presale shows strong signs of demand, it is still in its early stages, which means investors can buy in early and maximize their potential gains. Visit Maxi Doge.

Keyboard Cat (Base)

Keyboard Cat is a cat-themed meme coin on Coinbase’s Ethereum layer 2 blockchain Base. Historical patterns show that cat coins often perform well alongside dog coins, as many traders cycle capital between narratives to maximize returns.

The project’s presence on Base offers an advantage, thanks to the network’s low fees and its relatively thin competition compared to more established meme coin ecosystems.

$KEYCAT is booming this week after BitMine founder Tom Lee engaged with the project’s X account and even posted a Keyboard Cat meme. BitMine is the largest Ethereum treasury company, now managing over $7 billion in $ETH.

The fact that Lee is interested in this meme coin – which currently has only a $57 million market cap – signals asymmetric potential. A small portion of BitMine’s capital moving into $KEYCAT could result in parabolic gains.

Unstable Coin

Useless Coin was a Fartcoin beta, and it made Bonk Guy huge sums of money. And now Unstable Coin has emerged as a new version of a Useless Coin, but it also taps into the stablecoin trend, giving it extra market appeal and resonance.

Furthermore, the project’s ticker symbol is USDUC, a satirical reference to USDC. This playful connection holds real potential; it’s a similar approach to what SPX6900 used when mocking the US stock market index, which is represented by the ticker $SPX.

The project is also experiencing significant growth this week, with an 89% gain, making it one of the best-performing meme coins on the market. Analysts have noted that Unstable Coin has broken out from an accumulation phase, possibly signaling that a sharp price increase is imminent.

It currently has a $44 million market cap, leaving plenty of room for gains.

Snorter

Bonk grew from $1 billion to $3 billion this summer thanks to the development and expansion of Letsbonk, a meme coin launchpad that gave $BONK genuine utility.

This reflects the massive potential for meme coin infrastructure tools, which is why Snorter could also generate big gains. Unlike Bonk, it isn’t starting at $1 billion – Snorter is in a presale where it has raised $3.5 million. This demonstrates market appeal, but also leaves plenty of room to pump.

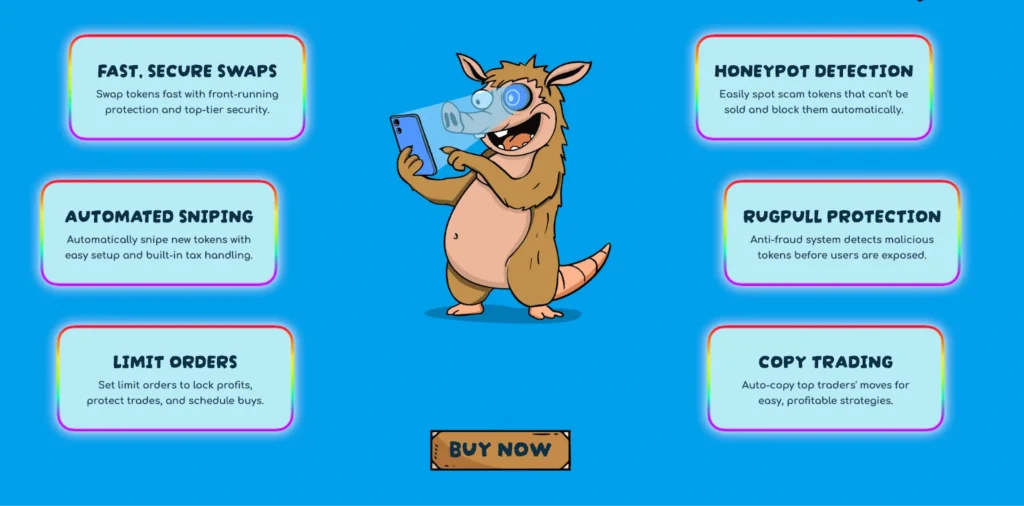

Snorter is creating a meme coin trading bot on the Solana blockchain, designed to identify high-potential runners early. It features automated token sniping, copy trading, rug pull detection, alongside several other powerful features.

The bot also charges the lowest fees on the market at 0.85%, positioning it to attract a large user base and potentially cause the $SNORT price to explode.

With its utility-focused approach and early-stage development, Snorter could prove to be one of the best meme coins to buy now. Visit Snorter.

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Top NYC Book Publishing Companies

Sensorion Announces its Participation in the Association for Research in Otolaryngology ARO 49th Annual Midwinter Meeting