Chainlink Eyes $100 as US Commerce Data Integration Boosts Outlook

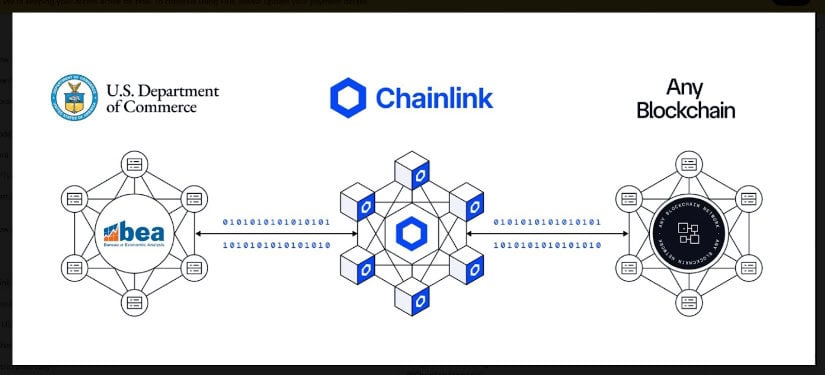

The integration will make key U.S. Bureau of Economic Analysis (BEA) data, including GDP, inflation, and consumption, directly accessible on-chain.

This initiative ensures greater transparency, accuracy, and accessibility of official economic statistics within decentralized finance (DeFi) and financial institutions. By bridging public data with blockchain, Chainlink strengthens its role as a core infrastructure for reliable financial innovation.

Analysts highlight that this development could accelerate institutional adoption while fueling market optimism for its native token, LINK. With prices hovering near $24, projections suggest a potential rally toward the $100 mark. The move underscores its expanding role as a trusted data layer powering next-generation financial applications.

On-chain Macroeconomic Data Through Chainlink

The asset has partnered with the U.S. Department of Commerce to place official macroeconomic data on blockchain networks. Therefore the collaboration will allow data such as GDP, inflation (PCE), and consumption to be fed directly into decentralized systems.

According to analyst Quinten | 048.eth, this development introduces a structural change in how blockchain integrates with traditional finance. Data from the U.S. Bureau of Economic Analysis (BEA) will now be accessible on-chain. This ensures that economic indicators are delivered in a transparent and verifiable manner, opening new possibilities for decentralized finance applications.

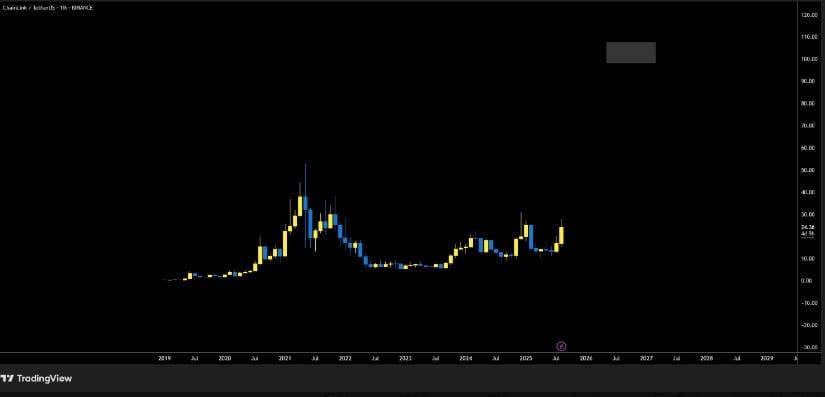

LINKUSD Chart | Source:x

Enhancing Reliability and Financial Infrastructure

By providing direct on-chain access to official government statistics, the reliability of critical data is expected to improve substantially. Smart contracts, DeFi platforms, and institutions will be able to build more accurate models and conduct real-time risk assessments.

This integration moves the coin beyond its established role as an oracle service. Hence, the project is positioning itself as a foundational infrastructure connecting public-sector data with blockchain-based financial products. Quinten noted that this is more than a technical update; it is a step toward redefined transparency and reduced reliance on intermediaries in global markets.

Price Outlook and Technical Momentum

Analyst Crypto Bullet  suggested that the asset could target $100, a price not seen since its previous cycle peak. At present, the altcoin trades near $24, showing strong momentum on the monthly chart after a prolonged consolidation.

suggested that the asset could target $100, a price not seen since its previous cycle peak. At present, the altcoin trades near $24, showing strong momentum on the monthly chart after a prolonged consolidation.

LINKUSD Chart | Source:x

The chart structure resembles earlier accumulation phases that historically preceded large breakouts. Analysts point out that sustaining momentum above resistance levels could pave the way for higher valuations. If broader market conditions remain supportive, the possibility of Chainlink revisiting triple-digit territory is being considered by market participants.

Short-Term Market Movements

In the past 24 hours, its price displayed short-term volatility. The token opened trading near $24.00. Mid-session activity saw stabilization, followed by a sharp surge that took the altcoin close to $25.50.

LINKUSD 24-Hr Chart | Source: BraveNewCoin

However, the breakout was met with strong resistance, and profit-taking quickly erased much of the gains. By the session close, LINK settled at $24.33, marking a daily gain of 2.23%. Trading volume surpassed $1.5 billion, reflecting active participation.

Analysts observed that support remains firm at $24.55, while resistance at $25.50 continues to limit upward movement. If buyers manage to consolidate above the current support, another breakout attempt remains possible.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

TRM Labs Becomes Unicorn with 70M$: BTC Fraud Risk