Trump Phone Fallout: Are MAGA ‘Scams’ Holding Crypto Back a Decade?

Trump dropshipping his own unbranded golden third-world phone makes me question if I’m in a coma.

First, we had the failed NFT launch, then the rug pull that was , now a phone nobody asked for while two US-backed wars rage on.

Say hello to the Commander in Grift:

This fall, Trump’s business empire will enter the telecom space with a new phone plan—“The 47 Plan”—and a MAGA-branded smartphone retailing for just under $500.

At this point,t we need to ask ourselves: has Trump’s grifting and shilling crypto memes set this space back 10 years? Would we have been better under Kamala Harris?

What is the Trump Phone Offering?

The Trump T1 smartphone isn’t subtle. Decked out in gold trim with the American flag and “Make America Great Again” engraved on its backside, it looks more like a campaign trophy than a budget Android. Specs-wise, it punches above its weight: a 6.8-inch AMOLED screen, 50MP camera, 12GB of RAM, and 256GB of storage running Android 15. At $499.

Then there’s the “47 Plan,” a nod to his highness. For $47.45 a month — you can’t make this stuff up — subscribers get unlimited talk, text, and data; plus unexpected perks like roadside assistance and telehealth services.

(TRUMP)

(TRUMP)

Launching a MAGA phone while global markets twitch over war headlines is surreal, but it spotlights a more profound dissonance: everything Trump touches looks predatory.

Trump Phone Is Just One Of Many ‘Scams’ Cashing in on Political Branding

Crypto now has the perception of a Trump and Dump ops. It’s no longer counter culture to retail investors, but instead another way for the president to grift.

That’s why retail investor interest in crypto is at its lowest, while institutions are leading the next bull run.

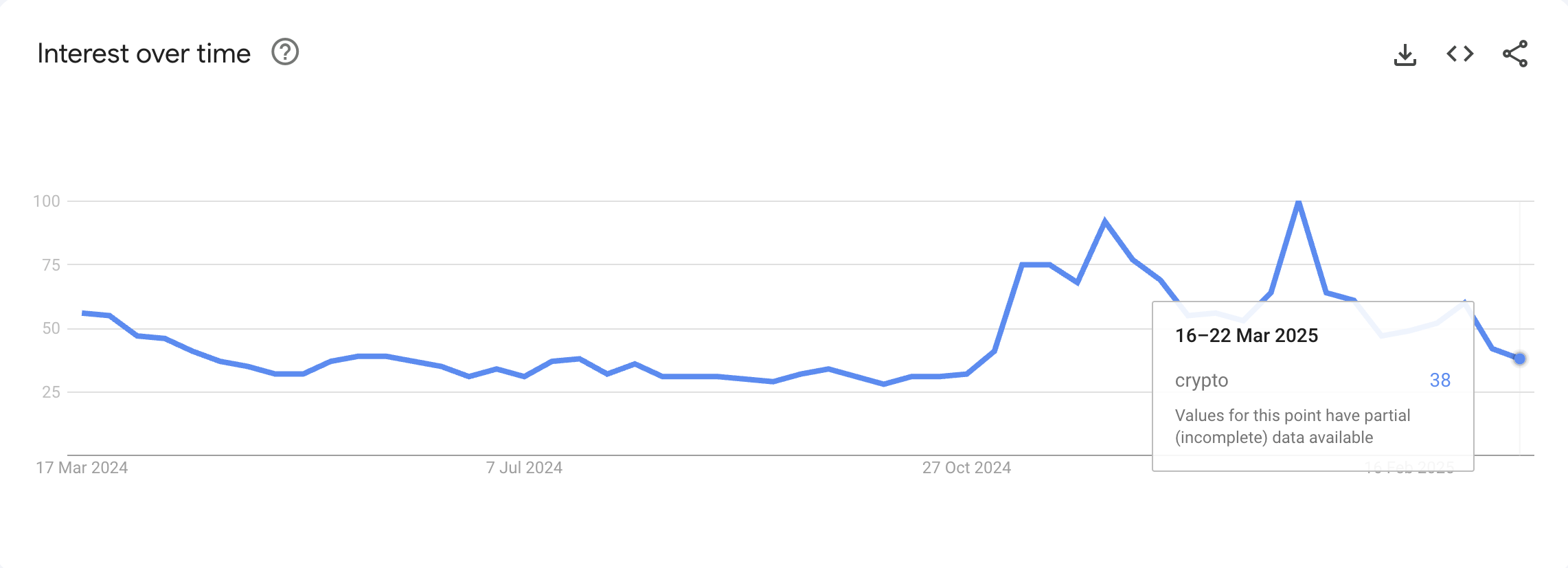

Google Searches for “crypto” has declined almost 62% since the end of January.

Google Searches for “crypto” has declined almost 62% since the end of January.

The meme coin, NFTs, gold shoes, and now the phone beg the same question that has hovered over Trump’s presidency brand: where exactly does the businessman end and the public servant begin?

For his detractors, the answer is that there’s no line at all. For his base, this is just the American dream in action. However, it’s not just the usual Trump critics raising eyebrows anymore. The nonstop grift parade makes even level-headed observers second-guess anything he puts his name on, especially in crypto.

Everything Trump does is to grift his ardent MAGA faithful, wait a few days for them to forget, and do it all over again.

RIP The United States of America

Beneath the flashy branding and gold trim of every Trump product lies a deeper conversation about ethics, governance, and the role of business in the political sphere.

Meanwhile, institutions are creeping deeper into crypto, but with every new Trump-branded hustle, retail seems more likely to stay out of this cycle.

EXPLORE: Tether CEO Paolo Ardoino Hopes For Net Positive From US Elections, Says Bitcoin Strategic Reserve Is A Great Idea: 99Bitcoins Exclusive

The post Trump Phone Fallout: Are MAGA ‘Scams’ Holding Crypto Back a Decade? appeared first on 99Bitcoins.

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

BlackRock boosts AI and US equity exposure in $185 billion models