Who Will Take SHIB’s Place in the Meme Market?: Predicting Whether Pepe or XYZVerse Has the Highest ROI Potential in 2025

After SHIB’s climb, some meme tokens are fighting for the spotlight. Fresh contenders like Pepe and XYZVerse attract traders looking for the next big surge. Both tokens show rapid growth and buzzing communities. This article examines their potential for high returns in the coming year, uncovering which one might become the next top pick for investors.

Pepe (PEPE)

Source: TradingView

Source: TradingView

PEPE keeps traders guessing. The token slid almost 4% over the past 7 days and more than 10% in a month, yet it still boasts a 38% jump since late winter. Prices now hover between $0.00000907 and $0.00001064, just below both the short and long term averages, signaling a cooling phase after the spring rally.

Momentum data underline the pause. A relative strength score near 37 and a stochastic reading of 3 place the coin in oversold territory, while the MACD line stays slightly negative. The nearest floor sits at $0.000008493; if that level cracks, traders eye $0.000006919. On the upside, $0.00001164 blocks progress, with $0.00001321 the next ceiling.

Short term, bears hold the wheel, but the deep oversold readings hint at a bounce. Holding the current floor could spark a climb of about 30% toward the second resistance. Failure to do so risks a slide of roughly 23% to the lower support. Given the six-month uptrend, odds favor a recovery once selling pressure eases.

Undervalued $XYZ Meme Coin Gears Up for Listing on a Major CEX

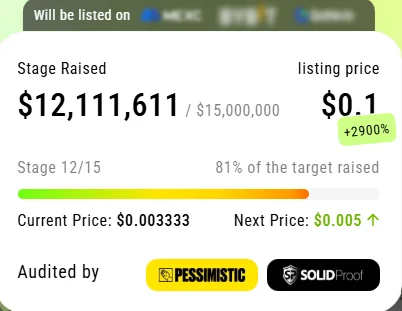

XYZVerse ($XYZ) is the meme coin that has grabbed headlines with its ambitious claim of rising from $0.0001 to $0.1 during a presale phase.

So far, it has gone halfway, raising over $15 million, and the price of the $XYZ token currently stands at $0.005.

At the next 14th stage of the presale, the $XYZ token value will further rise to $0.01, meaning that early investors have the chance to secure a bigger discount.

Following the presale, $XYZ will be listed on major centralized and decentralized exchanges. The team has not disclosed the details yet, but they have put a teaser for a big launch.

Born for Fighters, Built for Champions

XYZVerse is building a community for those hungry for big profits in crypto — the relentless, the ambitious, the ones aiming for dominance. This is a coin for true fighters — a mindset that resonates with athletes and sports fans alike. $XYZ is the token for thrill-seekers chasing the next big meme coin.

Central to the XYZVerse story is XYZepe — a fighter in the meme coin arena, battling to climb the charts and make it to the top on CoinMarketCap. Will it become the next DOGE or SHIB? Time will tell.

Community-First Vibes

In XYZVerse, the community runs the show. Active participants earn hefty rewards, and the team has allocated a massive 10% of the total token supply — around 10 billion $XYZ — for airdrops, making it one of the largest airdrops on record.

Backed by solid tokenomics, strategic CEX and DEX listings, and regular token burns, $XYZ is built for a championship run. Every move is designed to boost momentum, drive price growth, and rally a loyal community that knows this could be the start of something legendary.

Airdrops, Rewards, and More — Join XYZVerse to Unlock All the Benefits

Shiba Inu (SHIB)

Source: TradingView

Source: TradingView

SHIB keeps sliding. The token now trades between $0.000011636 and $0.000012936, leaving it below both its 10-day and 100-day averages. A 1.92% dip in the past week adds to the 2.16% drop over the past month and the 6.63% slide seen in 6 months. Volume is thin and sellers still dominate.

Yet the mood is not hopeless. The RSI sits at 32.51 and the stochastic reading is 3.70, both pointing to an oversold market. If buyers show up, even modest demand could push SHIB back toward the nearest ceiling at $0.000013683, roughly 11% above the midpoint of the current band. A stronger move could test $0.000014983, about 22% higher.

Bears still have a say. If momentum stays weak, the coin may retest the closest floor at $0.000011083, a 10% slip from today’s average level. A failure there opens the door to $0.000009783, implying a fall of roughly 20%. For now, the chart shows SHIB resting on a knife-edge: oversold signals hint at a short bounce, but the broader trend remains tilted down until a clear break above $0.000013683.

Conclusion

PEPE and SHIB remain solid, but XYZVerse (XYZ) blends sports and memes, targets 20,000% upside, drives community-driven GameFi and media ties, positioning it as 2025 ROI leader.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse