Data overview of the MEME universe: The "Golden Dog" is one in a million, and the Frog series has the best liquidity

Author: PANews, Frank

MEME coins have become an important business card in the crypto world, full of wealth stories and ups and downs of hot topics. On the other hand, MEME culture has become more and more complicated with the influx of a large amount of funds, and the angle of hype has even shifted from online hot spots to various abstract cultures. For many people who are looking forward to finding the code of wealth in this market, it seems that they have entered an epic level of difficulty in understanding.

Compared with its high popularity, the MEME track still lacks some macro tools to analyze the overall development. People seem to be more obsessed with the stimulation of PVP, but rarely think about what kind of MEME is more likely to break out of the curve, or what are the characteristics behind those top MEMEs?

PANews uses the overall data of MEME to restore the truth about the top MEMEs.

Dog series MEME becomes the final winner

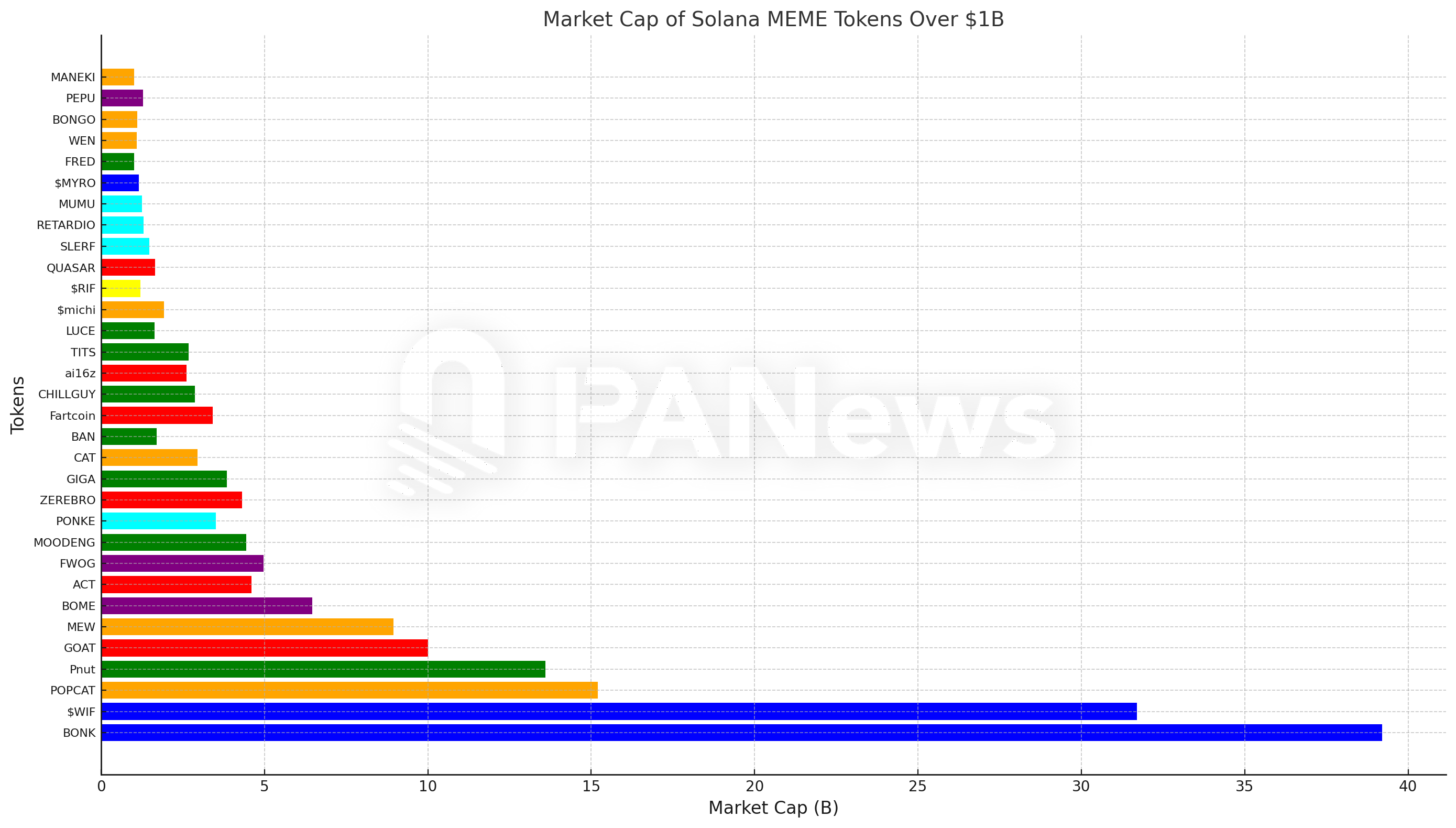

As of November 21, there are 32 MEME coins on the Solana chain with a market value of more than 100 million. Among them, the MEME coin with the highest market value is BONK, a dog-like token issued in 2023.

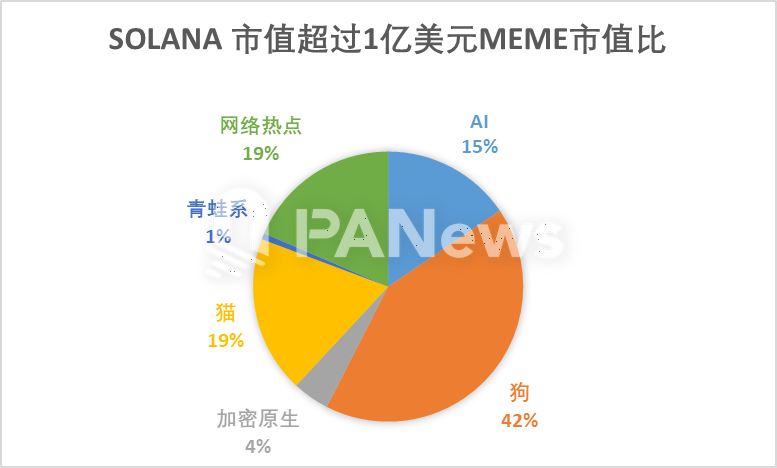

PANews divides these tokens into the following categories: crypto-native (encrypted original content), frog-based (similar to PEPE), cats, dogs, internet hotspots (from TIKTOK or other Internet social hotspots), AI, and DeSci.

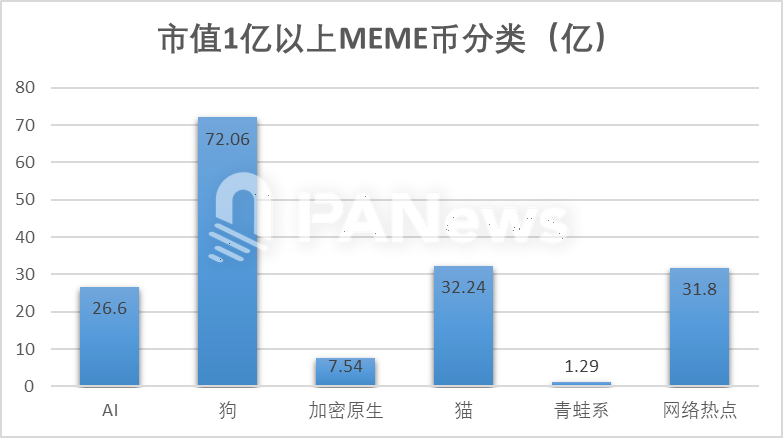

According to this classification, we can see that among the MEME coins with a market value of $100 million, the number of network hot spots and cat series tokens is the largest, 8 and 7 respectively. The number of AI themes is 6. But in terms of total market value, the dog series MEME has the highest total market value, reaching $7.206 billion, accounting for 42% of the total market value.

The market value of the cat series’ tokens is approximately US$3.224 billion. From this perspective, the dog series is currently leading in the cat-dog war.

AI triggers MEME "October Revolution"

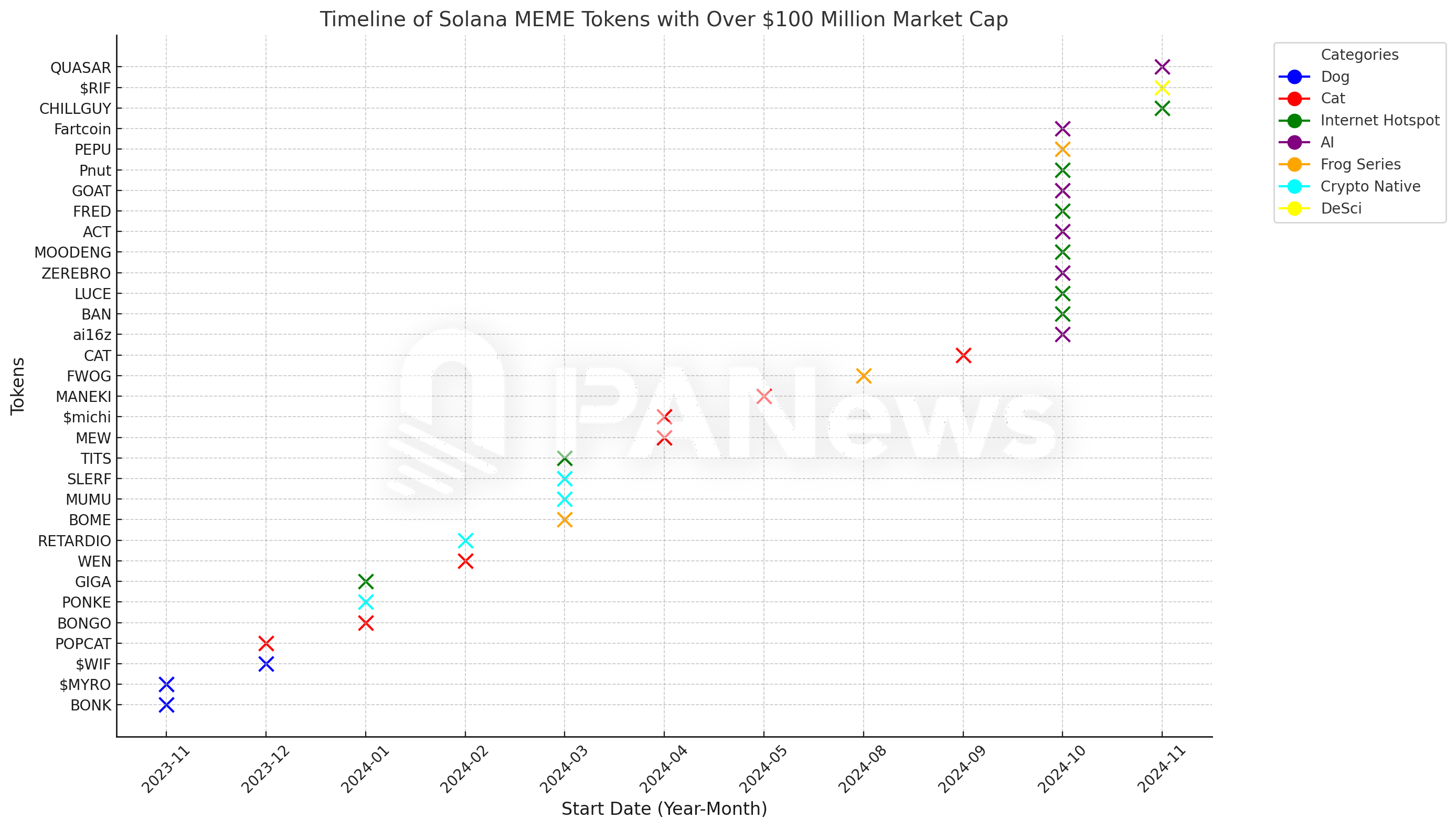

In addition to the market value comparison, the overall market heat can be seen from the time. The figure below is a comparison of the issuance time of MEME tokens with a market value of more than 100 million US dollars. From this comparison, it can be clearly seen that the MEME market has a significant theme preference in each time period.

The dog series of tokens is the earliest series to become famous on the Solana chain, and the issuance time is almost concentrated in 2023. From November 2023 to today, almost a year has passed, and there are still 3 dog series MEMEs with a market value of more than 100 million US dollars. Among them, BONK ranks first in the MEME on the Solana chain with a market value of nearly 4 billion US dollars. $WIF ranks second on Solana. From this point of view, the dog series is still the most popular material in the MEME world.

The cat series appeared later than the dog series, but the popularity seemed to have lasted until September, during which cat series tokens continued to become new MEME upstarts. Overall, Solana can be said to be a cat market from April to May. However, from the overall average market value, the average market value of the cat series reached 1.295 billion US dollars, only lower than the dog series in second place. This also indirectly shows that the cat-dog war is still the biggest winner on Solana.

The cat series appeared later than the dog series, but the popularity seemed to have lasted until September, during which cat series tokens continued to become new MEME upstarts. Overall, Solana can be said to be a cat market from April to May. However, from the overall average market value, the average market value of the cat series reached 1.295 billion US dollars, only lower than the dog series in second place. This also indirectly shows that the cat-dog war is still the biggest winner on Solana.

October was the month when Solana entered the hottest MEME. In this month, the most MEME coins with a market value of more than 100 million were born. A total of 11 MEME coins with a market value of more than 100 million US dollars were born in October, of which the largest proportion was AI series and network hot spots. The tokens represented in this month are MOODENG (network hot spot) and GOAT (AI).

In November, when the crypto market was hot, although the MEME angle changed every day, it seems that there is no strong momentum so far. Three tokens born in November reached a market value of 100 million, still dominated by AI and network hotspots. However, from the DeSci angle that has been very popular in recent days, only one token $RIF reached a market value of more than 100 million. In November, the most eye-catching one was undoubtedly Pnut, which became the youngest token with a market value of 1 billion US dollars with the help of Musk and Binance.

From the overall perspective of the time span, the MEME with the highest market value on the Solana chain is still the token that was issued earlier. Among the top ten tokens, only Pnut was issued less than 1 month ago. Perhaps, from this perspective, most of the top tokens need to go through the precipitation of time to build consensus.

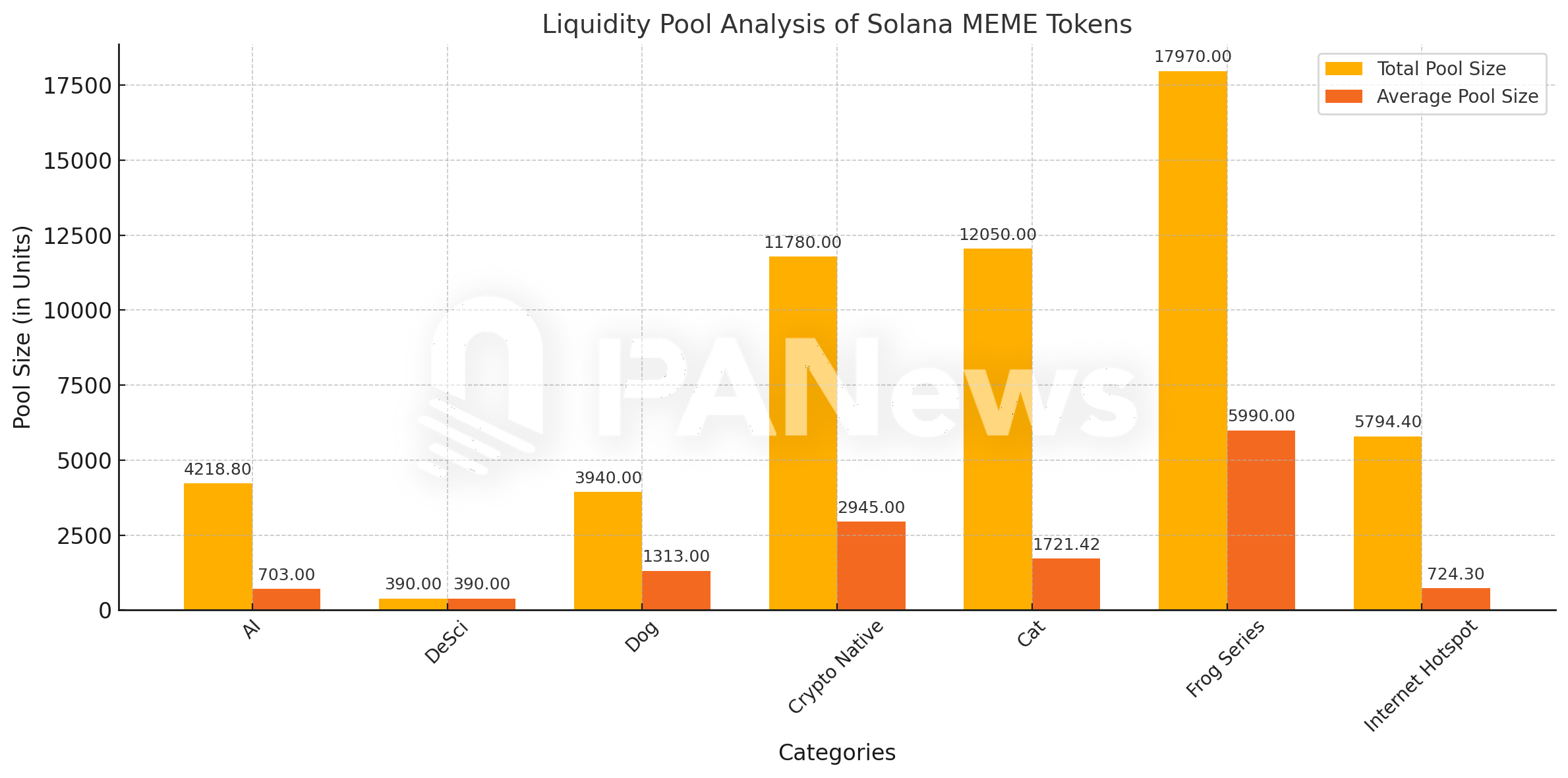

A thick pool of funds allows Frog to gain a foothold

When looking for the reasons why these tokens can maintain a market value of more than 100 million US dollars, PANews found some unique phenomena that may explain the problem. In terms of overall market value and social media popularity, the Frog series tokens do not seem to be popular, but there are still 3 Frog series tokens with a market value of more than 100 million US dollars.

By observing the liquidity pool amounts of all these tokens, it can be found that the Frog series tokens have the largest liquidity pool. The liquidity pools of the three tokens exceed all other series, reaching 179 million. The average liquidity pool of each Frog reaches 59.9 million US dollars, and the average liquidity pool/market value ratio is 11.53%. Adequate liquidity may be a proof of the persistence of big funds. From the average value, the liquidity pool of the AI series seems to be the thinnest (except DeSci), only 7.03 million US dollars, and the liquidity pool/market value ratio is only 1.49%. Such liquidity may be difficult to maintain for a longer period of time. However, from the current point of view, the AI series seems to be still in the stage of competition among the heroes. In the case of the outcome, big funds have not yet invested in the liquidity pool.

6 in 10,000 chances of catching a 100 million gold dog

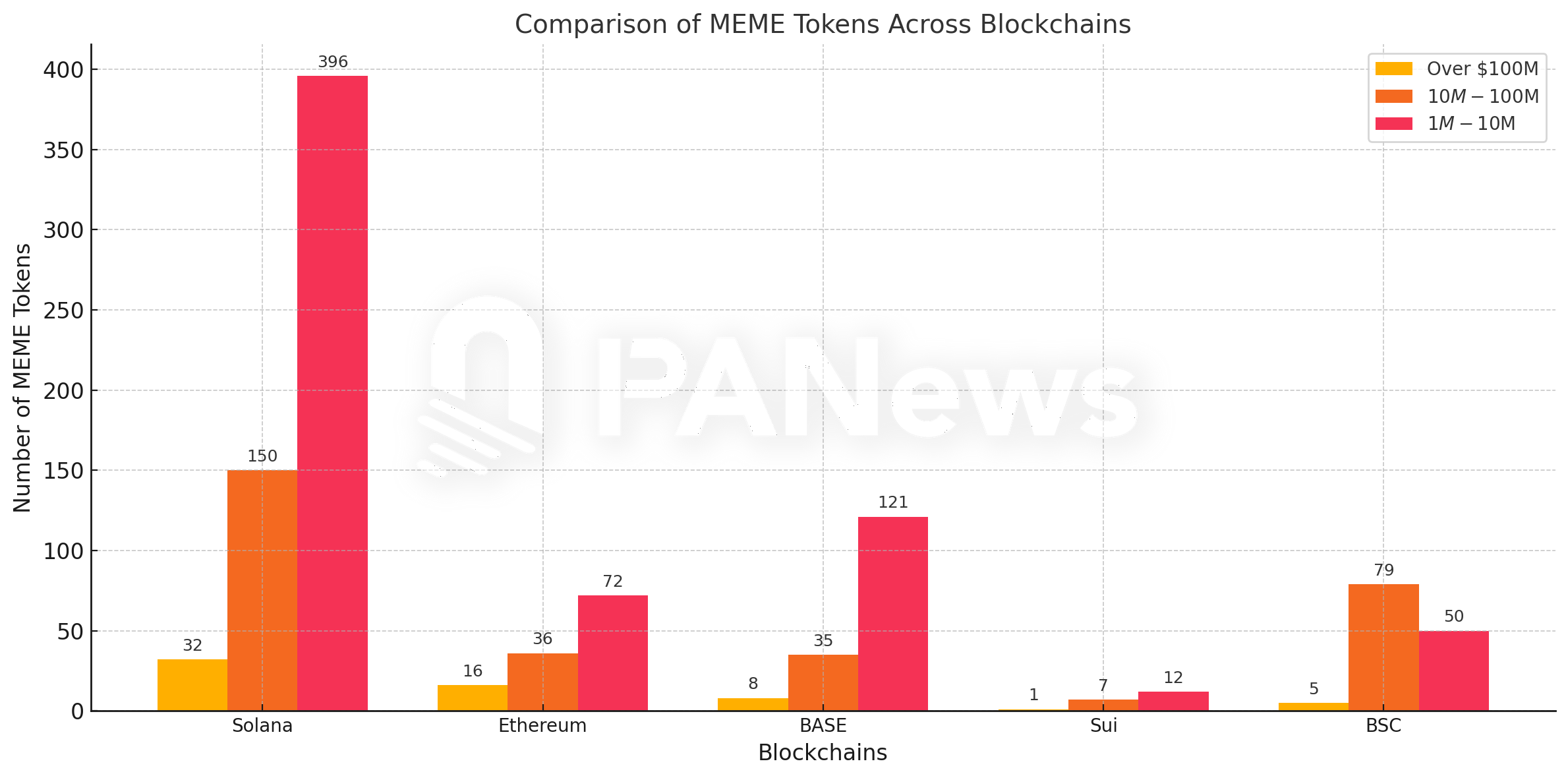

So, how many tokens can become real MEME gold mines? As of November 21, Pump.fun has issued a total of 3.59 million tokens, which is far more than the total number of tokens issued in the crypto world in the past 10 years. Among them, the number of graduated tokens (full curve and listed on Raydium) is 50,389, accounting for about 1.4%. The number of tokens with a market value of over 100 million US dollars is 32.

There are 154 MEMEs with a market value of $10 million to $100 million. The probability is about 0.00089%, less than one in 100,000. The proportion of graduated tokens is about 0.6 in 10,000. The number of tokens with a market value of $1 million to $10 million is 396, accounting for 0.79% of graduated tokens, and the number of tokens with a market value of $10 million to $100 million is 150, accounting for 0.29% of graduated tokens.

Judging from this data percentage, the probability of getting a wealth code and making a profit is no less than that of buying a lottery ticket. However, it seems to be higher than the probability of winning the first prize of buying a lottery ticket (about 1 in 17.72 million). It is no wonder that the crypto community calls MEME investment lottery-style investment.

In addition to Solana, what other public chains are also hot spots for MEME?

In our impression, Ethereum and BSC chain were once the paradise of MEME. Judging from the current data, in addition to Solana, the prosperity of Base chain seems to be happening quietly.

In our impression, Ethereum and BSC chain were once the paradise of MEME. Judging from the current data, in addition to Solana, the prosperity of Base chain seems to be happening quietly.

In terms of quantity, Base has 121 MEMEs between 1 million and 10 million, second only to Solana, while BSC is more concentrated between 10 million and 100 million, becoming the gathering place of MEME intermediate forces. Ethereum is still the place with the most top MEMEs besides Solana, with a total of 16 MEMEs above 100 million. Among them, PEPE has the highest market value, reaching 8.74 billion US dollars, which is the MEME with the highest market value among the analyzed chains (DOGE and SHIB are not included here). Overall, on coingecko, 11 of the top 100 tokens by market value are MEMEs.

In order to have a more in-depth discussion on the development and methodology of MEME coin, PANews will launch a series of in-depth content to analyze the chip data of the top MEME coin projects in different categories.

Are there a lot of insider trading in these MEMEs that have become gold mines? How long can early chips be held? At what point did the big players build positions, etc., and try to use data to restore the truth about the funds of these MEMEs. Welcome to continue to pay attention!

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

Ethereum Fusaka Upgrade Set for December 3 Mainnet Launch, Blob Capacity to Double