BIO Protocol founder publishes an article to explain DeSci and will launch three projects on Launchpad

Original author: Paul Kohlhaas , founder of BIO Protocol

Compiled by: Zen, PANews

As the first decentralized digital currency system, Bitcoin has achieved permissionless value exchange; Ethereum has introduced smart contracts that allow anyone to deploy their own programs, thus achieving permissionless code execution.

Many people invest in cryptocurrencies to assert their autonomy and to prevent the freedoms that are slowly and quietly being taken away. Similar movements are forming in science and medicine, as the freedom to innovate, experiment with oneself, and disseminate science is eroded by a broken biomedical R&D system.

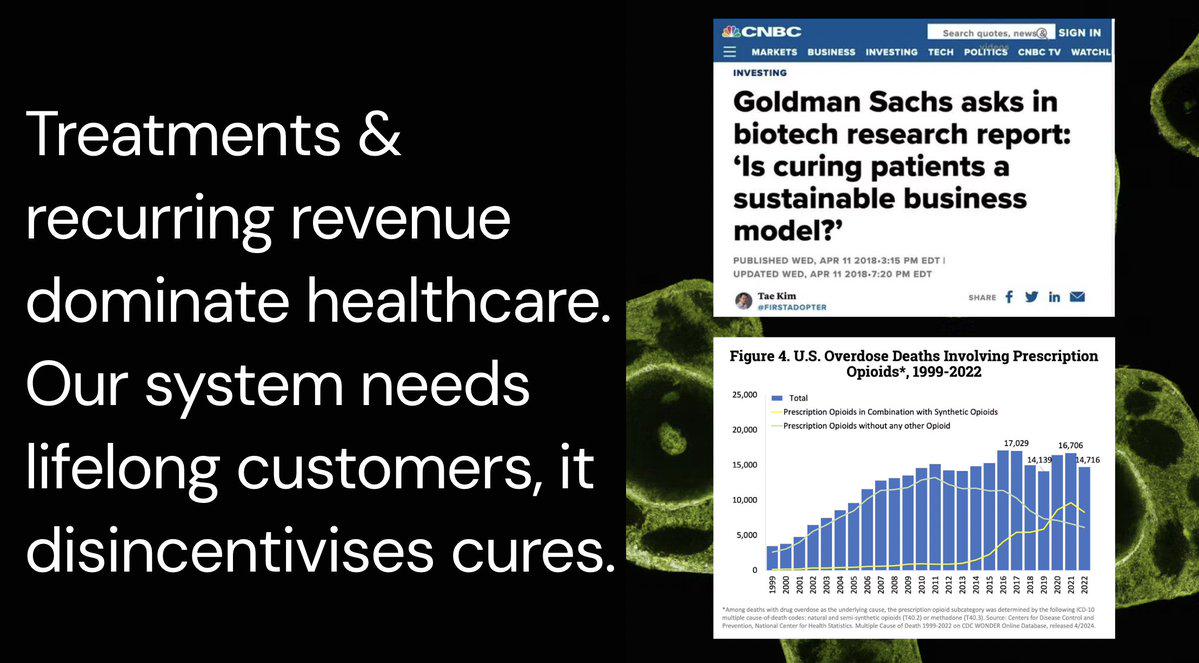

The current system is not conducive to curing diseases

In 2018, Goldman Sachs released a report titled "The Genomic Revolution," which questioned whether curing patients is a sustainable business model. Goldman Sachs cited Gilead Sciences as an example, which generated $12.5 billion in revenue in 2015 due to the development of a highly effective hepatitis C treatment, but as more and more patients were cured, sales fell sharply to $4 billion in the following years.

For example, the use of opioids for chronic disease treatment, such as pain management, can ensure regular income, but often makes patients dependent on drugs rather than curing the problem. Its addictive nature also leads to widespread drug abuse and dependence. Deaths related to opioids, especially those caused by prescription opioids, have become a major public health problem in the United States.

Scientists focus on fundraising rather than research

Imagine if software developers spent most of their time fundraising instead of writing code?

Most scientific talent is underutilized

Without the basic foundation of upgraded science and technology, we cannot achieve solarpunk - an idealistic vision of a society in which humans and nature are in high harmony, full of sustainability, abundant resources and innovation.

These difficulties have led to various obstacles and problems in the process of scientific development, rather than the "science fiction" world we yearn for.

What if we could build a decentralized and self-organizing scientific world? A self-sovereign scientific system driven by open data and liquid markets, with curing disease as its core goal?

Molecule DAO and BIO Protocol

Molecule is a protocol that brings scientific intellectual property (IP) to the blockchain; BIO is an engine that provides startups and acceleration for on-chain scientific communities (BioDAOs), which are composed of scientists, patients, and investors. BioDAO focuses on a specific scientific field or disease and develops on-chain intellectual property such as research, drugs, and products. For example: VitaDAO has funded multiple projects on longevity science and research, including the VITA-FAST project, which was developed by the Vikorolchuk Lab at Newcastle University.

The BIO Protocol team built the first batch of BioDAOs across multiple scientific fields. According to Dune data, when Paul Kohlhaas gave a speech last week, the total market value of BioDAO was less than $100 million, but on November 18, it exceeded $230 million.

BIO aims to assist scientists, patients and biotech founders in the process of establishing a scientific community on the chain, such as token economic design, community building, funding and liquidity support, etc. BIO token holders can vote to include DAOs in the network, similar to a community-owned accelerator, allowing the best teams to stand out and launch their communities on the chain. The projects that are currently being launched on BIO Launchpad include:

- Curetopia : It targets the rare disease market worth one trillion U.S. dollars. Its team includes Eric Perlstein, a Y Combinator alumnus, Harvard PhD, and rare disease entrepreneur. He used only $5 million to push a drug into Phase III clinical trials, which usually costs more than $100 million.

- Long COVID Labs : Accelerating cures for the more than 100 million long COVID patients worldwide, led by former Stanford neuroscientist Rohan Dixit.

- Quantum Biology DAO : is building quantum microscopes to observe quantum biological phenomena, led by Clarice D. Aiello, PhD from MIT and one of the world’s leading quantum biology scientists.

To promote the development of the protocol, BIO recently held a Genesis event, inviting users to deposit supported DeSci tokens in exchange for BIO tokens. Genesis raised $33 million for the BIO treasury, and as the price of DeSci tokens rises, the treasury funds now exceed $53 million. In addition, BIO has also received investment from Binance Labs.

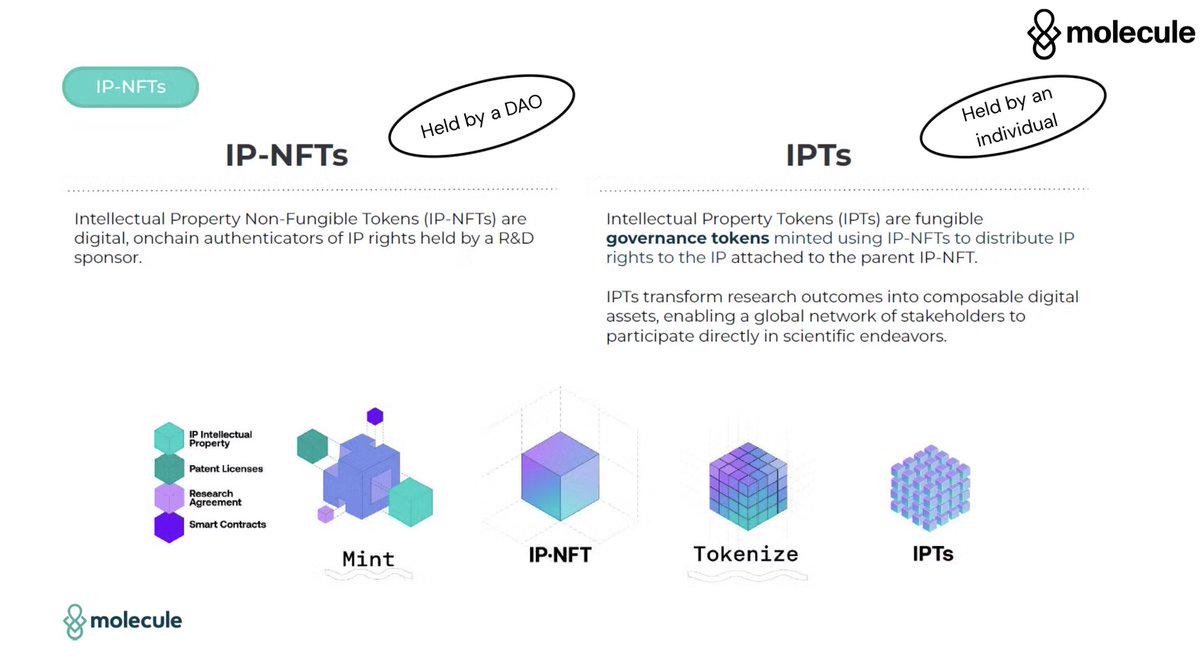

The role of IP-NFT

The BIO protocol plays a central role in the BioDAO network, where each BioDAO is developing drugs and therapies related to a specific disease or treatment, and these research results exist in the form of tokenized scientific intellectual property (IP). Typically, each stage of drug development has historically been kept secret from the public, and BioDAO aims to use blockchain technology to make the process more open and transparent.

IP-NFT is the foundation for supporting this new model, which allows anyone to put intellectual property on the chain, making it programmable, tradable, liquid, and rich in data. In essence, IP-NFT is a container for intellectual property. When the IP is fully verified, it can be divided into IPT (IP token) and used as a governance token, enabling individuals to participate in the scientific process as active stakeholders.

For example, Vita-RNA, which is backed by VitaDAO and focuses on developing novel mRNA gene therapies, is led by biotech experts Michael Torres and Anthony Schwartz. The Vita-RNA project received $300,000 in initial funding, but the market value of its VITARNA token has grown to more than $27 million. When one of Vita-RNA's lead drug candidates showed activity in vitro (in the lab), its price began to rise on Uniswap.

BIO Future Outlook

BIO Protocol is inspired by the bio/acc movement , which aims to accelerate the development of biology and overturn many traditional understandings of existing health care. Biotechnology is the new substrate of life itself. We must fundamentally reshape outdated scientific institutions and processes, accelerate all biological research, and build a global, accessible scientific network.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Here’s How Consumers May Benefit From Lower Interest Rates