Robinhood Markets (HOOD) Stock: Rallies 10% on S&P 500 Inclusion

TLDR

- Robinhood (HOOD) surged nearly 10% after being selected to join the S&P 500 index, replacing Caesars Entertainment

- The inclusion takes effect before market open on September 22, 2025

- HOOD shares have more than doubled in 2025, reaching a market cap of roughly $91.5 billion

- Index funds will be required to buy HOOD shares, creating automatic demand for the stock

- AppLovin and Emcor will also join the S&P 500, replacing MarketAxess and Enphase Energy respectively

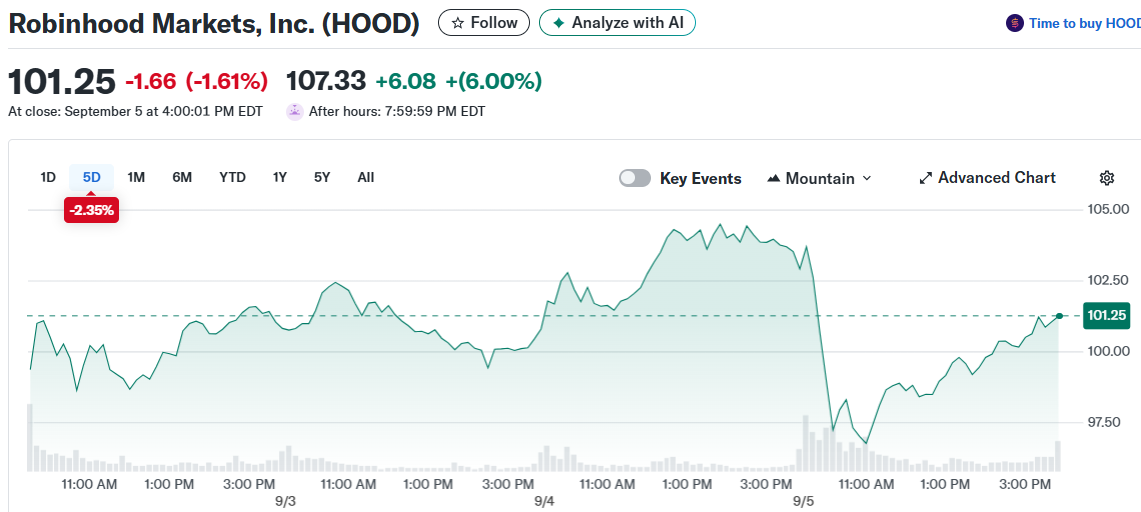

Robinhood Markets saw its stock price surge nearly 10% in extended trading after S&P Dow Jones Indices announced the trading platform would join the benchmark S&P 500. The inclusion marks a major milestone for the fintech company.

Robinhood Markets, Inc. (HOOD)

Robinhood Markets, Inc. (HOOD)

The changes become effective before market open on September 22, 2025. Robinhood will replace casino operator Caesars Entertainment in the prestigious index.

S&P 500 inclusion typically creates automatic buying pressure as passive funds must purchase shares to track the index. This forced demand often drives stock prices higher in the short term.

The announcement validates Robinhood’s transformation from a pandemic-era startup to an established financial services company. The platform revolutionized retail trading by eliminating commissions and creating a mobile-first trading experience.

Robinhood attracted millions of new investors during the 2020-2021 market boom. The company went public in July 2021 but faced early challenges as trading volumes normalized.

Stock Performance Reflects Turnaround

HOOD shares have more than doubled in 2025, giving the company a market capitalization of roughly $91.5 billion. This represents a remarkable recovery from earlier struggles.

The stock traded around $20 before the announcement and jumped over $22 in after-hours trading. Trading volume exceeded normal levels by more than 50% as investors reacted to the news.

Technical indicators suggest the stock broke through key resistance levels at $21.50. Support levels remain around $19.80 for any potential pullbacks.

Institutional investors have shown increased interest in the stock throughout 2025. The S&P 500 addition will likely accelerate this trend as more funds gain exposure.

Index inclusion brings additional credibility and visibility for the platform. Many institutional investors only consider stocks that trade in major indices.

Broader Fintech Recognition

Two other companies will also join the S&P 500 alongside Robinhood. Marketing platform AppLovin and construction services firm Emcor earned spots in the index.

AppLovin climbed 7% in extended trading while Emcor gained 2.2%. The companies will replace MarketAxess and Enphase Energy respectively.

The additions reflect the growing importance of technology companies in the broader market. Fintech firms have gained particular traction as digital financial services expand.

Coinbase became the first crypto exchange to join the S&P 500 in May 2025. This paved the way for other fintech companies to gain similar recognition.

The moves signal increasing acceptance of digital-first financial platforms. Traditional barriers between fintech startups and established financial institutions continue to blur.

Robinhood’s user base spans millions of retail investors across multiple asset classes. The platform offers stocks, options, ETFs, and cryptocurrency trading in a single app.

The company has expanded its product offerings beyond basic trading services. Features now include retirement accounts, cash management, and margin lending.

Revenue growth has stabilized after volatile swings during the meme stock era. The platform benefits from both trading commissions and payment for order flow arrangements.

Market makers pay Robinhood for routing customer orders to their systems. This revenue model has faced regulatory scrutiny but remains legal and profitable.

The S&P 500 announcement comes as Robinhood reports steady user growth and engagement metrics. Monthly active users have increased throughout 2025 despite market volatility.

The post Robinhood Markets (HOOD) Stock: Rallies 10% on S&P 500 Inclusion appeared first on CoinCentral.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise