Dogecoin Rally Stalls as Sell Signal Emerges

After climbing to $0.2367 with an 8% gain in market capitalization over the past week, the meme-inspired cryptocurrency may be due for a pullback.

Overbought Signals Raise Caution

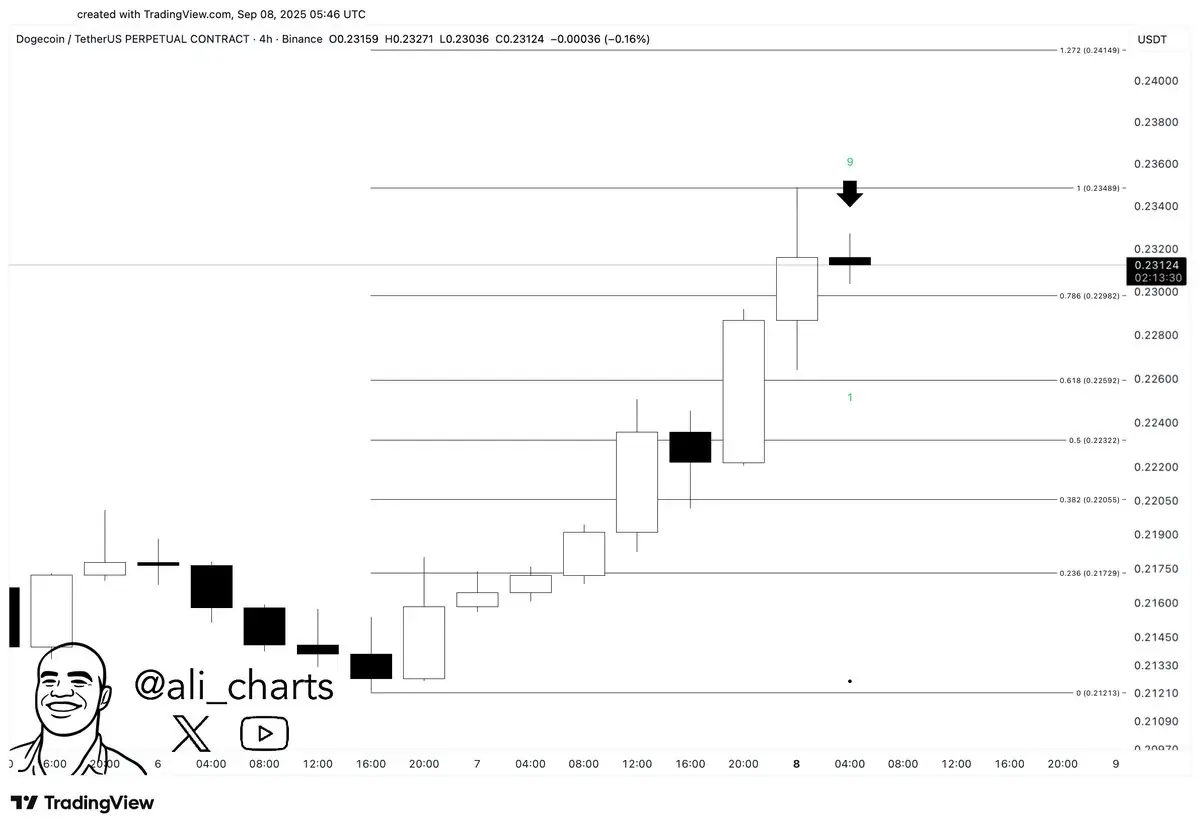

A recent analysis highlighted the TD Sequential indicator flashing a sell signal on the 4-hour chart, suggesting that DOGE could face near-term resistance after its latest rally. Historically, this signal has marked local tops, often preceding short-term corrections.

On the hourly chart, momentum appears stretched. The Relative Strength Index (RSI) has surged to 78, placing DOGE firmly in overbought territory. This increases the probability of profit-taking as traders reassess positions. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator is still in positive territory, hinting at strong momentum, though crossovers could develop if selling pressure intensifies.

Key Levels to Watch

Market participants are closely watching support levels around $0.2300 and $0.2250. A breakdown below these zones could push DOGE toward $0.2200, while holding above them may allow the asset to consolidate before any further upside.

Despite the looming risk of a short-term retracement, Dogecoin’s market cap of $35.7 billion underscores continued investor interest. With DOGE ranked eighth among cryptocurrencies, it remains a closely watched asset as traders speculate whether its current rally is just a pause before another leg higher or the beginning of a broader correction.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Dogecoin Rally Stalls as Sell Signal Emerges appeared first on Coindoo.

You May Also Like

What crashed Bitcoin? Three theories behind BTC's trip below $60K

Fed Decides On Interest Rates Today—Here’s What To Watch For