WorldCoin Price Soars 61% On Eightco Plan To Build WLD Treasury With Funding Involving Peter Thiel-Backed BitMine

The WorldCoin price surged 53% after fintech firm Eightco Holdings announced plans for a WLD treasury via a fundraising involving Peter Thiel-backed BitMine.

Eightco shares soared 3,800% on the news while WLD extended its weekly gain to 134%.

Thiel-backed BitMine said it will make a $20 million investment in Eightco in what it called a ”moonshot” investment.

WorldCoin Price Flashes Overbought as Bulls Extend Run

Technical analysis of the WLDUSDT chart shows just how wild the recent rally has been. On the daily timeframe, WorldCoin price leapt from an open of $1.57 to hit highs around $2.05 before settling near $1.91.

WLDUSDT Analysis Source: Tradingview

This means the coin price booked over 21% gains in just one session, and more than 60% from last week’s levels. Volume was huge, with nearly 200 million WLD tokens traded, proving just how wide interest became.

The coin price now sits far above both the 50-day simple moving average ($1.03) and the longer-term 200-day SMA ($0.99). Historically, when price surges like this happen, a pullback or cooling-off period often follows.

Momentum indicators agree. The Relative Strength Index (RSI) is at 84, very overbought territory, which tells us the coin price could face a healthy correction soon.

The MACD, however, remains strongly positive, showing that the trend’s momentum is still with the bulls for now. The ADX is at 27.87, confirming a robust uptrend, but it’s not at levels usually seen in explosive bull markets, implying that things could balance out soon.

For support, the recent breakout zone around $1.60–$1.70 will be important. If the coin price dips, these levels may bring in new buyers. If WLD pushes above $2.05 and holds, the next major chart resistance comes in around $2.50, but traders should be careful.

When the price moves this far above the moving averages and the RSI gets so high, some profit-taking is likely.

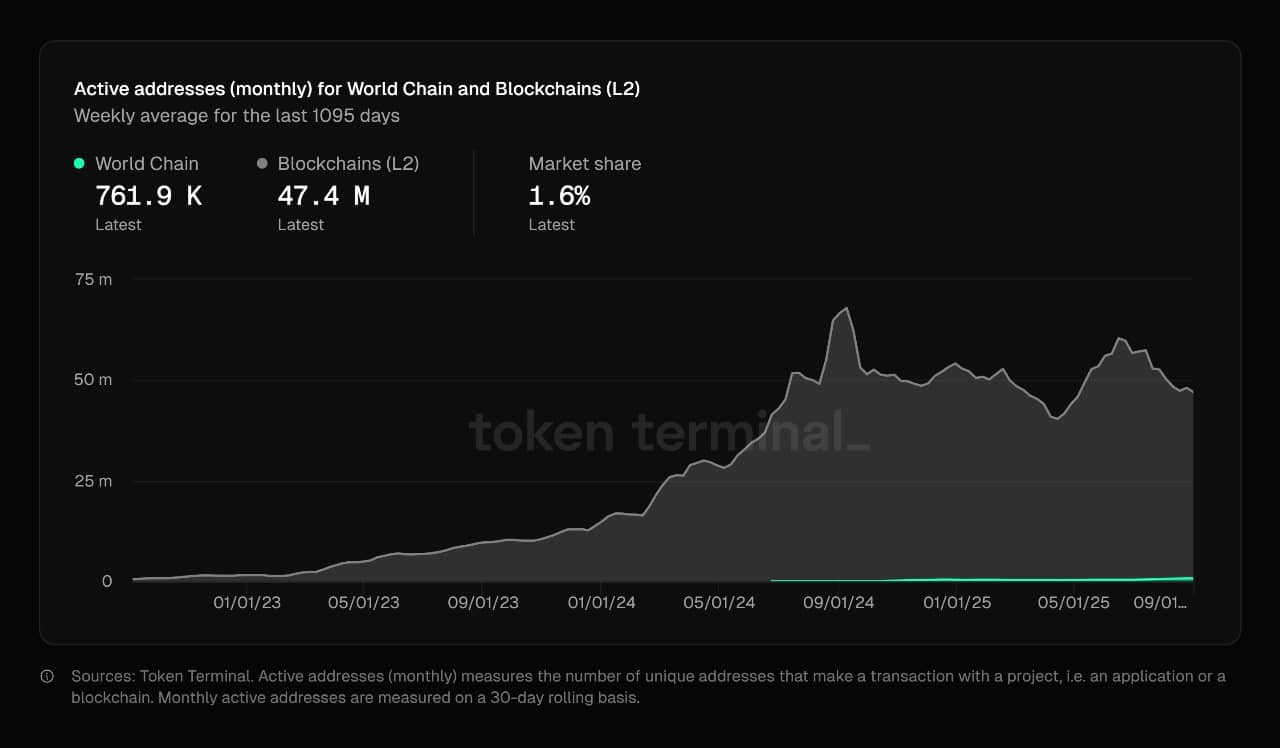

WorldCoin Price: Onchain Data Shows Frenzy

Looking at on-chain statistics, the WorldCoin price jump is supported by key metrics. Data from block explorers reveal that wallet activity and new address creation have soared.

WorldCoin Active Addresses Source: Token terminal

The number of transactions related to WLD doubled overnight as news drove both small buyers and larger whales to add to their positions.

Exchange inflows for WorldCoin increased sharply as traders deposited tokens to take part in the volume surge.

Many traders seemed to be selling into strength, booking profits amid the sharp price rise, but a healthy number of buyers also seemed to be withdrawing WLD for long-term holding, pointing toward strong conviction behind the rally.

Longer term, the presence of new, well-funded backers for the WorldCoin treasury could mean a more stable support base and fewer wild sell-offs in the future.

Whenever a coin price sees strong on-chain activity matched by market-moving news, analysts often look for short pauses, then potential new breakouts.

Related Articles:

You May Also Like

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC