XRP Price Analysis Shows Rangebound Action As Rollblock Is Predicted To Rally Over 25x

Ripple may be a titan in the crypto world, but its size now limits explosive upside. At $2.95, XRP’s growth is slowing, and on-chain data shows whales are shifting focus to Rollblock.

Over 50,000 investors are already in, chasing a 25x+ rally as RBLK gains momentum. While Ripple hovers near $3, Rollblock is taking the spotlight and possibly Ripple’s future gains.

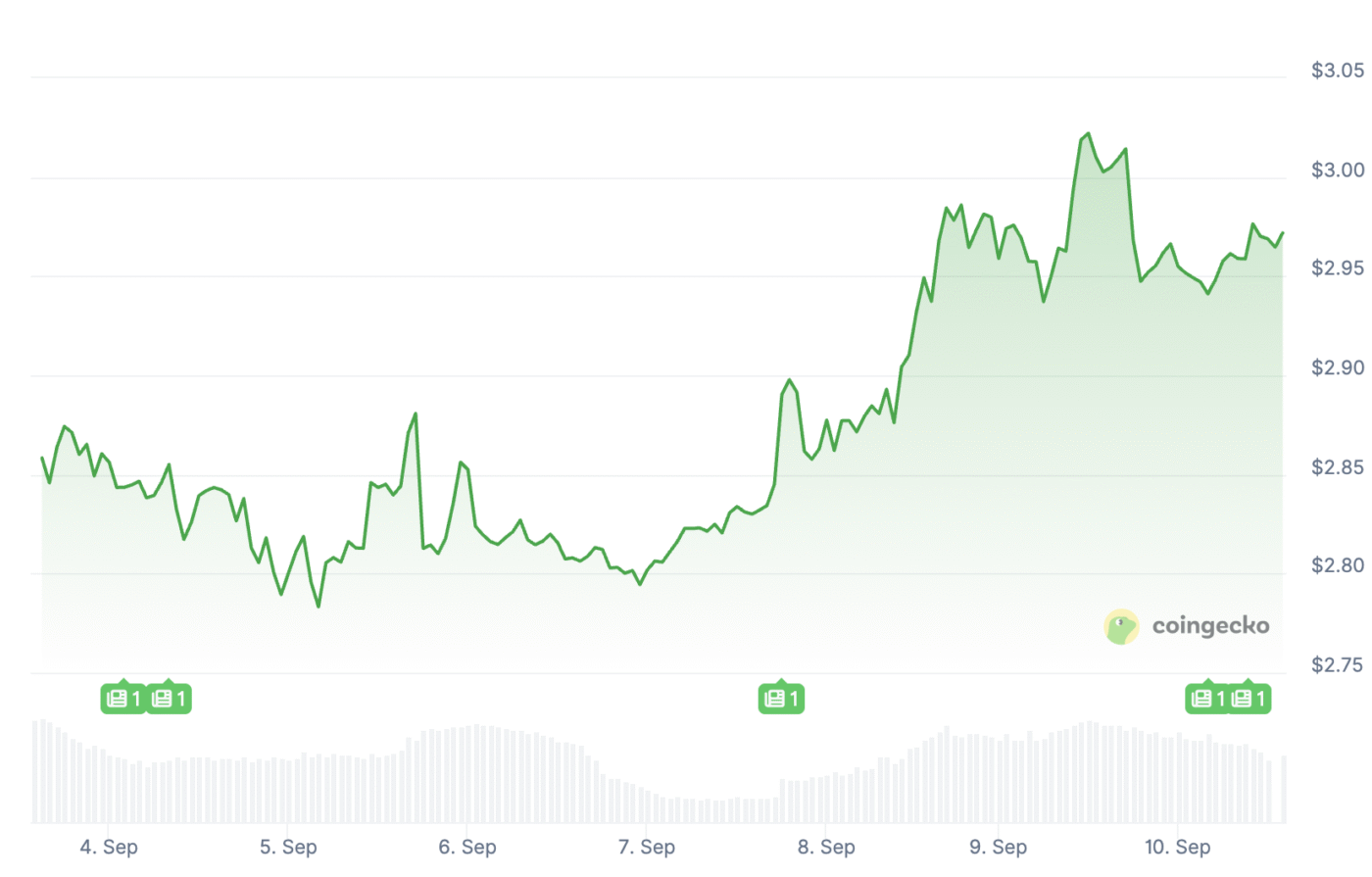

XRP Price Prediction: Can XRP Push Past $3?

The XRP price holds at $2.95, just under the $3 mark, boosted by rising institutional interest. In early September, it pulled $14.7 million in inflows – second only to Solana – showing that big players see it as a regulated, high-liquidity asset.

But pressure is building. GlassNode data shows over 235 million Ripple tokens, worth $693 million, were moved to crypto exchanges, suggesting potential sell-offs as traders take profits near the top.

Now the battle is clear: institutions are buying, but retail may sell. If demand holds, the XRP price could flip $2.95 into support and aim for $3.07 – signaling a breakout.

If sell pressure takes over, a dip to $2.85 could come first. All eyes are on whether institutions keep the rally alive or if exchange supply cuts Ripple’s rally short.

Rollblock Surges 580% Despite Market Consolidation

While the rest of the crypto market consolidates, Rollblock’s presale keeps gaining. RBLK now trades at $0.068 after rising 580% in ten rounds. Over 50,000 early investors have joined, with $11.6 million raised – showing strong demand for this high-potential crypto.

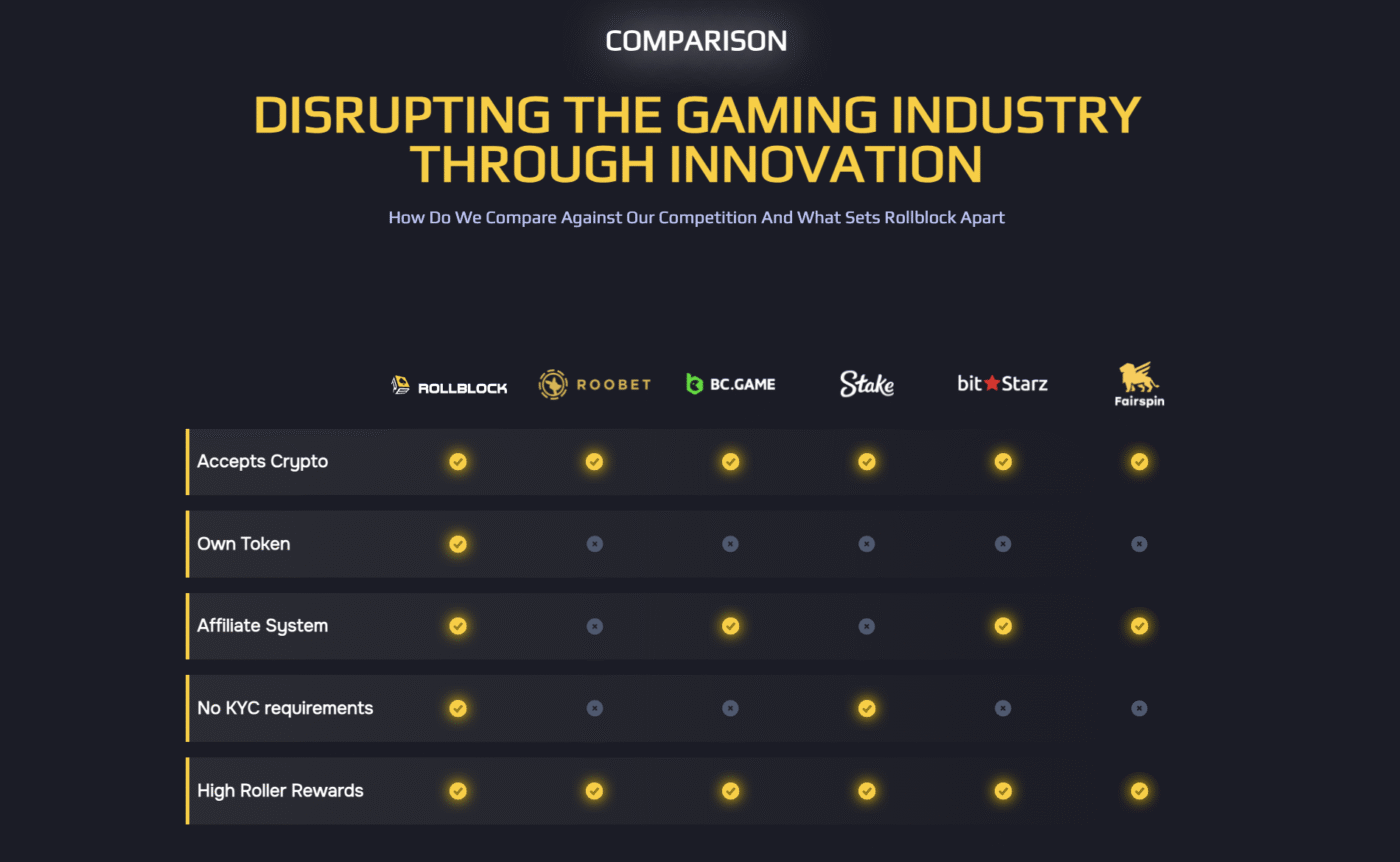

This growth isn’t just buzz. Rollblock is setting a new standard in blockchain gaming with 12,000+ AI-powered games, live dealers, and sports betting – all powered by smart contracts. Every outcome is recorded on the Ethereum blockchain, cutting out fraud and boosting trust.

At the core is RBLK, a deflationary token with a 1 billion supply cap. Up to 30% of platform revenue buys back tokens. 60% of that is burned, while 40% goes to staking crypto rewards.

This cuts supply, increases price pressure, and rewards holders – key traits in top crypto projects. Here are more features that make RBLK the best crypto to buy now:

- Offers sports betting, including events like the Champions League

- Processed over $15 million in bets in a few months

- Serves thousands of active users daily

- Fully operating and successful for over 12 months

Can Rollblock Outperform Ripple in 2025?

Rollblock is gaining ground fast. RBLK has surged 580% in presale, now priced at $0.068. As it nears public launch, demand is rising. Some analysts expect a 100x move, with $1 in sight – placing it among the next 100x crypto plays.

Fueling this is a 30% presale bonus, attracting fresh buyers hoping to catch the next 50x leg up. Momentum is building fast across the GameFi and DeFi space.

If this trend holds, Rollblock could outpace Ripple in 2025. Here’s why:

| Feature | Rollblock (RBLK) | Ripple (XRP) |

| Price | $0.068 | $2.95 |

| Utility | GameFi ecosystem: 12,000+ AI-powered games, live sports betting, staking rewards | Cross-border crypto payment solutions, liquidity for banks and financial institutions |

| Blockchain | Built on Ethereum; uses smart contracts for every game result | RippleNet is centralized with XRP Ledger for fast, low-cost global transfers |

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post XRP Price Analysis Shows Rangebound Action As Rollblock Is Predicted To Rally Over 25x appeared first on Blockonomi.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy