Bitcoin Price Reacts Instantly to August US CPI Data

The last US CPI data ahead of the highly anticipated FOMC meeting next week just came out, and the numbers are mostly in line with what experts predicted.

The regular Consumer Price Index matched precisely the forecast of 2.9% on a yearly basis. However, the monthly projection of a 0.3% increase was outpaced by the actual rise of 0.4%.

The Core CPI, which excludes more volatile sectors like food and energy, was also spot on with the expectations at 3.1% YoY and 0.3% MoM.

These CPI numbers have particular importance for the overall financial markets as the US Fed is set to have its next FOMC meeting in less than a week. After the most recent Jackson Hole speech, market experts believe Fed Chair Jerome Powell will finally follow Trump’s advice and lower the key interest rates after failing to do so in 2025.

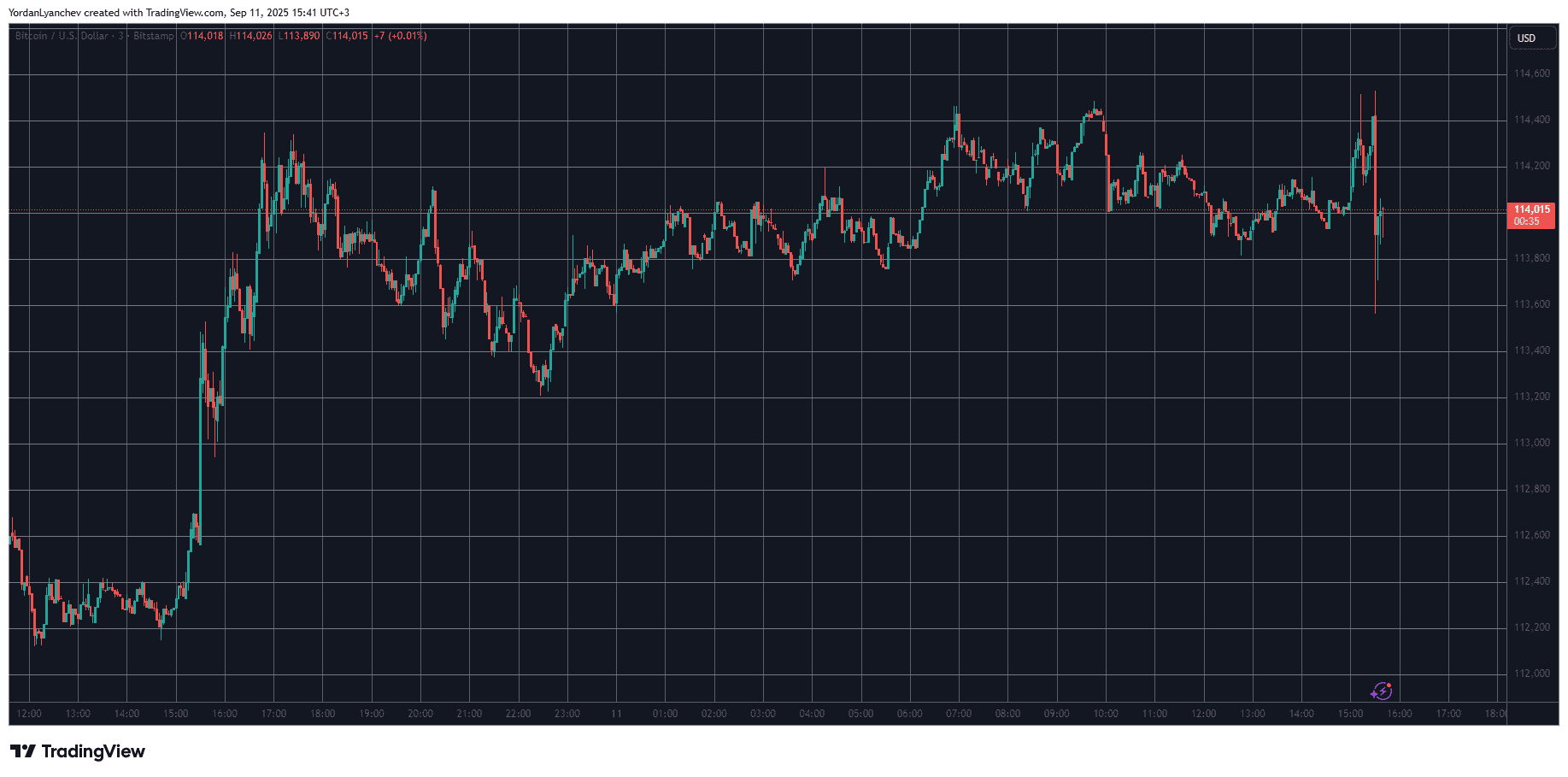

Bitcoin’s price reacted immediately to the CPI announcement today. The asset had climbed to $114,000, and it jumped to a new multi-week peak of $114,500 before it suddenly dropped by a grand. As of press time, it’s back to $114,000.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

The post Bitcoin Price Reacts Instantly to August US CPI Data appeared first on CryptoPotato.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

XRP Buyers Defend Most Major 200-Week Price Average: Can It Be Bottom of 2026?