Bitcoin Holds $115K Support as Fed Cuts Rates by 25 Basis Points

Bitcoin BTC $116 419 24h volatility: 0.3% Market cap: $2.32 T Vol. 24h: $54.97 B price found support above $115,000 on Wednesday, September 17, as markets absorbed the US Federal Reserve’s latest move. The Fed opted to cut rates by 25 basis points from 4.50% to 4.25%, a smaller reduction than the 50 basis points widely expected.

The decision followed overheated consumer inflation data last week, leaving speculative traders uncertain about US monetary policy direction for the coming quarters.

US Federal Funds Rate Trends, 2025 | Source: TradingEconomics, September 17, 2025

However, the Federal Open Market Committee (FOMC) called for caution in its accompanying statement, hinting at downside risks from slower job gains and a slight uptick in unemployment rates.

Despite this, the committee maintained expectations for additional rate cuts totaling 50 basis points later in 2025, though timing remains unclear.

Fed Decision Sparks Limited Market Liquidations Despite Gold Rally Concerns

Earlier in the week, gold’s rally to all-time highs above $3,700 had sparked fears of massive crypto liquidations in the event of a disappointing Fed rate decision. However, derivatives market movement suggests limited downside impact.

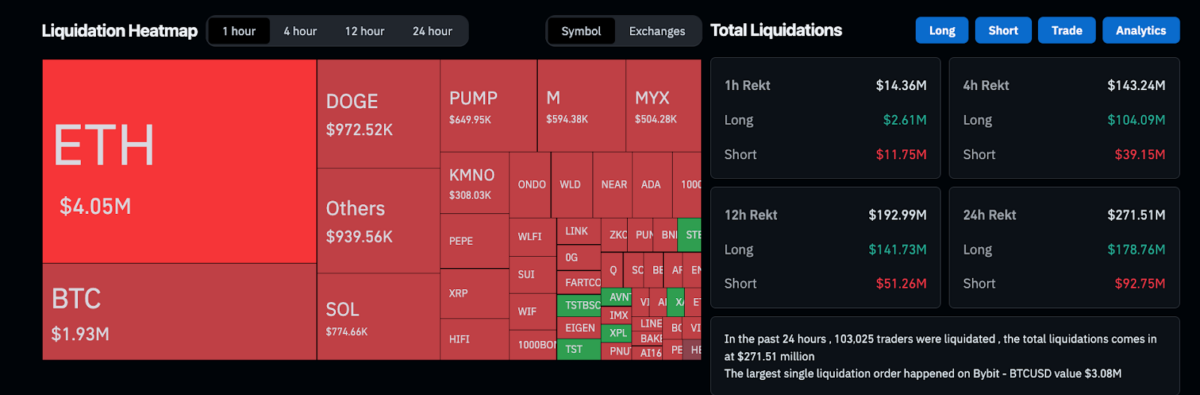

Crypto market liquidations, September 17, 2025 | Source: Coinglass

According to Coinglass figures, 24-hour total crypto market liquidations reached $267.44 million, with $178.64 million in longs and $88.81 million in shorts. Notably, only $36.19 million of those liquidations occurred within the hour following the Fed’s announcement, suggesting the market absorbed the decision without panic selling.

Bitcoin Bulls Hold Key Support While Short Squeeze Potential Builds at $118K

Liquidation maps provide further insights into Bitcoin’s near-term trajectory. These maps track futures positions deployed at specific price levels, helping traders anticipate potential price reversal zones. At first glance, bears appear to have the upper hand, with $3.3 billion in active shorts outpacing $2.3 billion in longs.

A closer look shows over 35% of the active long positions are concentrated around $114,458, where $814 million could be liquidated. With the intraday total liquidations of $267 million well below that threshold, these positions are likely to remain intact. This suggests Bitcoin remains positioned for an early rebound if bulls hold the line above $114,500.

Bitcoin Liquidation Maps as of September 17, 2025 | Source: Coinglass

On the upside, short positions cluster heavily around $118,000, where more than $1.8 billion could face liquidation. Lacking stronger resistance zones, a breakout above this level could ignite a short squeeze, propelling Bitcoin price toward the $124,500 peak recorded in August.

Unless trading volume increases significantly, Bitcoin is likely to consolidate between $114,000 and $118,000 in the near term, as market participants may remain cautious given the US Fed’s concerns about unemployment risks.

nextThe post Bitcoin Holds $115K Support as Fed Cuts Rates by 25 Basis Points appeared first on Coinspeaker.

You May Also Like

Crypto News of the Week (05–12 November 2025)

Analyst Predicts Dogecoin Price “Historic Mega Run” – Here’s The Target

Singapore to Pilot Tokenized Bills Amid Stablecoin Regulation Push

Highlights: Singapore will pilot tokenized bills settled with central bank digital currency. Stablecoin regulations will focus on reserve backing and reliable redemption. Singapore supports tokenized bank liabilities through the BLOOM initiative. The Monetary Authority of Singapore (MAS) will initiate a pilot of the issuance of tokenized bills to primary dealers, which will be settled in the central bank digital currency (CBDC). This program aims to reinforce the digital finance ecosystem of Singapore and explore the real-world use of asset-backed tokens. Chia Der Jiun, the MAS Managing Director, said at the Singapore FinTech Festival that the trial will take place next year with additional details forthcoming. Chia pointed out that the concept of tokenization has ceased to be an experimental idea. “Are asset-backed tokens really out of the lab? Without a doubt,” he stated. He further pointed out that tokenization has not become large-scale yet, or rather, the “escape velocity,” pointing to the necessity to tackle structural challenges in the sector. The pilot aims to enhance the efficiency of settlement by allowing 24/7 processing and eliminating the need to use intermediaries. Banks involved in the pilot tests are DBS, OCBC, and UOB, which engaged in interbank overnight lending using the Singapore dollar wholesale CBDC. This experiment aligns with the objective of Singapore to scale tokenized finance with safe settlement assets. Singapore to Pilot Tokenized Bills, Introduce New Stablecoin Legislation Singapore’s central bank will move forward with building a scalable and secure tokenized financial ecosystem, with plans to pilot tokenized MAS bills next year and introduce legislation to regulate… pic.twitter.com/4EKa0d8XOt — ME (@MetaEraHK) November 13, 2025 Stablecoin Regulation and Industry Trials MAS is developing a legal framework for stablecoins alongside the pilot of tokenized bills. Singapore considers stablecoins as digital payment tokens, which fall under the Payment Services Act. The forthcoming law will focus on robust reserve support and effective redemption mechanisms. Chia also cautioned that unregulated stablecoins usually do not keep their pegs. He compared the risks to the 2008 money market fund crisis, which experienced funds “breaking the buck.” The MAS introduced the BLOOM initiative in October to facilitate the testing of tokenized bank liabilities and regulated stablecoins. MAS today announced a new initiative – BLOOM (Borderless, Liquid, Open, Online, Multi-currency), to extend settlement capabilities offered by financial institutions. For more: https://t.co/M8D7o04wXS — MAS (@MAS_sg) October 16, 2025 Recently, crypto exchange Coinbase launched Coinbase Business in Singapore, which offers businesses high-speed and programmable digital financial solutions. This partnership is based on the MAS’s BLOOM program, centered on borderless payments and innovative financial services. The pilot programs will test the regulated stablecoins for secure and efficient settlements. The Singapore government also intends to provide regulatory clarity to single-currency stablecoins. These tokens may be pegged with the Singapore dollar or major foreign currencies such as the U.S. dollar and the euro. The emphasis is on securing financial stability and making innovation possible. Global Collaboration and Fintech Innovation Singapore is enhancing international collaboration in order to develop tokenized finance. In July, Singapore and the UK agreed to explore joint ventures in AI-supported financial services and asset tokenization. Project Guardian will focus on cross-border tokenized asset trading and its impact on retail investors. The UK-Singapore Financial Dialogue united top MAS and FCA officials to plot regulatory and innovation plans. This partnership furthermore aligns with the broader vision of Singapore in providing a secure and scalable tokenized financial ecosystem. Through the integration of domestic pilots and international partnerships, Singapore aims to become the center of tokenized finance and digital payments. Next year, MAS will issue comprehensive guidelines on the pilot issuance of tokenized bills. eToro Platform Best Crypto Exchange Over 90 top cryptos to trade Regulated by top-tier entities User-friendly trading app 30+ million users 9.9 Visit eToro eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.