US Dollar (USD) continued to ease slightly from recent highs. DXY last at 98.82, OCBC’s FX analysts Frances Cheung and Christopher Wong note.

2-way trades likely to dominate

“Softer CPI print alongside news of US large corporates cutting jobs continued to reinforce Fed’s easing cycle. Also, prospects of trade diplomacy between US and China is also another factor supportive of risk sentiment, RMB and a softer USD.”

“Near term, FOMC is in focus (2am SGT). A 25bp cut is fairly priced and we continue to look for another back-to-back cut in Dec and another cut in 2026. The meeting between Xi and Trump in Korea on Thu is also on the radar.”

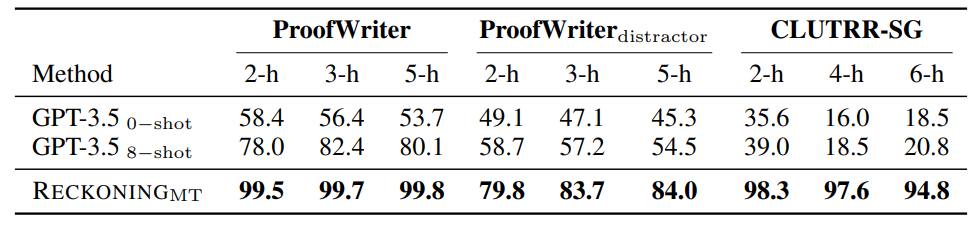

“Daily momentum is flat while RSI rose. 2-way trades likely to dominate. Support at 98.40 (38.2% fibo) and 98 levels (50, 100 DMAs) and 97.60 (23.6% fibo). Resistance at 99.10 levels (50% fibo retracement of May high to Sep low), 99.80 (61.8% fibo), 100.80 levels (200 DMA).”

Source: https://www.fxstreet.com/news/dxy-fomc-tonight-ocbc-202510291042