Germany’s AfD Party To Establish National Bitcoin Reserve

The post Germany’s AfD Party To Establish National Bitcoin Reserve appeared first on Coinpedia Fintech News

Germany’s right-wing Alternative for Germany (AfD) party, the second-largest opposition faction in the Bundestag, has introduced a motion to create a national Bitcoin reserve.

If approved, this proposal could transform Germany from a Bitcoin seller into one of Europe’s top holders and potentially kickstart a new wave of crypto-driven financial strategy across the EU.

Key Details of the Motion

The AfD’s proposal comes at a time when traditional currencies are under growing pressure from inflation and central bank interventions. The party, known for its eurosceptic stance, argues that Bitcoin could serve as a financial safety net for Germany, similar to how gold once did.

The AfD’s proposal calls for the federal government to acquire and hold a significant portion of Bitcoin, estimated at around 2% of the total supply, mirroring recent initiatives in France, where lawmaker Éric Ciotti has voiced similar intentions.

The motion aims to use Bitcoin to strengthen Germany’s reserves amid inflation and global uncertainty. The finance ministry will now review how to store it securely and align it with EU financial rules.

Germany’s Shift from Selling to Storing

Ironically, this proposal follows Germany’s massive sale of nearly 50,000 seized BTC last year, coins originally seized from criminal investigations. However, it could have been worth more than $6.5 billion, at current prices near $113,000.

Critics within the crypto community viewed that sale as a costly mistake, claiming it showed short-term thinking at the government level.

Now, AfD’s move appears to flip that narrative, suggesting Germany should have held onto its Bitcoin instead of liquidating it.

Other Countries are in FOMO

If the motion is approved, Germany could become one of the first major economies to include Bitcoin in its national reserves. Interestingly, if Germany and France both proceed, it could spark a European race to accumulate Bitcoin as a sovereign asset.

Experts say many countries, especially in Europe and Asia, are watching Germany’s move closely. Governments now see Bitcoin not just as an investment, but as a tool to strengthen their economies.

You May Also Like

Privacy is ‘Constant Battle’ Between Blockchain Stakeholders and State

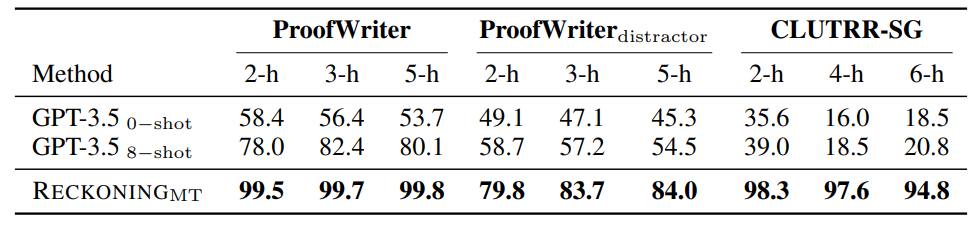

Technical Setup for RECKONING: Inner Loop Gradient Steps, Learning Rates, and Hardware Specification