Grayscale waves fees on Solana ETF to attract new investors

Grayscale has decided to temporarily remove management fees for its Solana Trust ETF to boost adoption.

- Grayscale has temporarily removed management fees for its Solana Trust ETF

- The promotion will last for three months, or until the fund reaches $1 billion AUM

- The fund will stake up to 100% of its SOL at a 7% rewards rate

The asset management company is betting big on Solana, in hopes of attracting new investors. On Wednesday, November 5, the investment firm has decided to drop all management fees for its Solana Trust ETF (GSOL). The firm will also stake all of its SOL holdings at an average 7% gross staking reward.

Grayscale will drop its management fees on its Solana (SOL) fund for up to three months, or until the fund reaches $1 billion in assets under management, whichever comes first. Moreover, investors don’t receive staking rewards directly. Instead, the returns will be reflected in the appreciation of the trust’s share value.

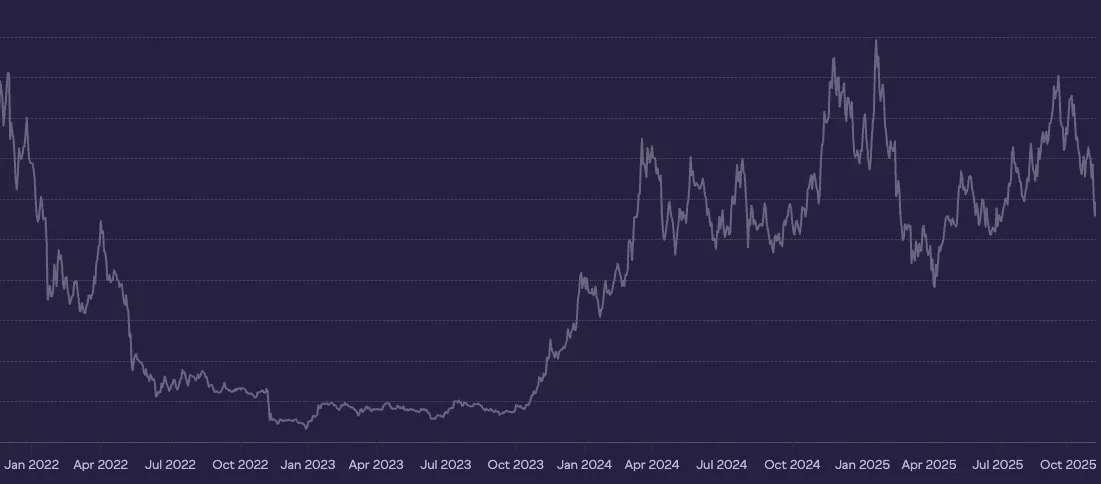

Grayscale’s Solana Trust ETF

According to Grayscale, the move will direct more of the economic rewards to investors, in hopes of attracting more capital. The asset manager is also under increased competition from other ETFs, including VanEck, 21Shares, and Ark.

Grayscale Solana Trust ETF is designed to track the performance of SOL, giving investors exposure to the token through the stock market. The fund currently manages $93.983 million in assets and holds 578,144 SOL. GSOL operates as an exchange-traded product, and not a U.S.-registered ETF.

You May Also Like

Bitcoin Has Taken Gold’s Role In Today’s World, Eric Trump Says

Dogecoin (DOGE) Investors Seek Fresh Ground, But This $0.035 Token Could be The Best Cryptocurrency To Invest In