Opportunities and strategies in the DeFi boom: tapping into new potential

Written by: 0xresearcher

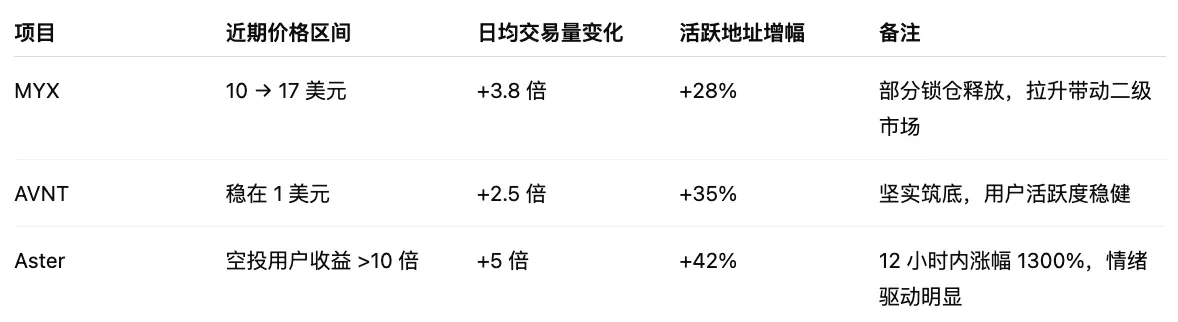

The DeFi space has recently become incredibly vibrant. From the short-term surge in MYX, to the tenfold increase in AVNT, to the over tenfold early returns from the Aster airdrop, this wave of activity has practically plunged the entire market into a state of fear of extinction (FOMO). As an observer, I believe this isn't just a short-term frenzy driven by market sentiment; it also reflects investors' sensitivity to innovative DeFi protocols and their ability to identify promising projects. While short-term price fluctuations may attract attention, from a long-term investment perspective, projects with robust technology, a well-structured ecosystem, and experienced teams are truly worthy of attention.

On-chain data is very clear: MYX has risen from $10 to $17, with its average daily trading volume nearly quadrupling; AVNT has stabilized at $1, with active addresses increasing by 35% over the past week; and Aster's early airdrop users have seen returns exceeding tenfold, with the price increasing by over 1,300% in 12 hours. This market trend has not only driven prices but also significantly boosted on-chain activity and user engagement, creating a dual resonance between market sentiment and ecosystem vitality in the short term.

Judging from market dynamics, the driving effect of price manipulation on the sector is highly evident. Aster's surge in price directly drove a surge in early-stage projects like MYX and AVNT. Meanwhile, platforms like Lighter.xyz, EdgeX_exchange, and TradeParadex have the potential to become the next hot topic. The continued expansion of the Base ecosystem provides investors with a clear path forward. The combination of ecosystem dividends and technological advantages means that amid the sector's frenzy, opportunities always remain for discerning investors. This also explains Professor Suo's lament in the Morning Post, "Everything available to the secondary market, I can't get." The fear of missing out (FOMO) atmosphere drives not only prices but also market attention.

A closer look at the entire DeFi space reveals a subtle shift in investment logic. In the past, the market was almost entirely driven by sentiment: airdrops and short-term price manipulation dominated the market, while new coins were often abandoned after a surge. But now, experienced investors are realizing that discovering the next promising project amidst the hype requires several key characteristics:

- Strong technical capabilities: Sufficient trading depth, efficient matching mechanism, and excellent slippage control enable it to accommodate large amounts of funds and institutional investors, while also forming a natural moat in derivatives and liquidity management.

- Ecological stability: Early user and community participation is the foundation, and there must also be a clear incentive mechanism and ecological layout to maintain continued activity during capital inflow and market expansion.

- Reasonable valuation: Popular coins in a track are easily pushed up by short-term pull-ups. If new projects want to become long-term winners, they need to demonstrate stability in FDV and lock-up ratio, while leaving room for growth for long-term investment.

Take BSX, for example. Early in the DEX space, it received multiple rounds of investment from Base, led by Blockchain Capital, a veteran crypto investment firm. This demonstrates industry recognition of its technology and team. BSX's order book trading and matching capabilities are comparable to those of HyperliquidX, offering significant advantages in high-frequency trading and liquidity management. While it lacks the short-term profits of Aster, its robust technology and ecosystem offer discerning investors a low-risk investment opportunity. The expansion of Base's ecosystem could also bring additional value. This demonstrates that projects with strong technological moats and ecosystem advantages often maintain steady growth after market euphoria subsides.

By this standard, Orderly's performance deserves special attention.

- Technology and Trading Model: Order book trading and high-frequency matching capabilities give the platform a natural advantage in derivatives and liquidity management. At the same time, its excellent trading depth and slippage control can support large capital inflows and institutional participation.

- Ecosystem Development: Orderly is promoting collaboration and community incentives, and its platform activity and transaction depth are expected to steadily grow alongside the expansion of ecosystems like Base and EdgeX. Its multi-dimensional ecosystem strategy focuses not only on transaction volume but also on community governance and long-term incentives to retain value for both capital and users.

- Valuation and Potential: Compared to popular tokens in the space, Orderly's fully circulating market capitalization remains low, suggesting significant potential growth. Judging by its FDV and lock-up ratio, Orderly is relatively robust, providing a margin of safety for long-term investors.

- Financing Background: It is worth noting that Orderly has raised a total of US$25 million in funding since its founding. Early investors include top global institutions such as Pantera, Dragonfly, Jump, and Sequoia China. The investment from these leading capitals also indirectly confirms its long-term potential and industry status.

Everyone's been hyping $AVNT lately, calling it "Hyperliquid on Base," but data suggests $ORDER is a severely undervalued perpetual contract opportunity. Orderly's model is more like the underlying engine of DeFi, or the AWS of Web3: a unified order book + full-chain liquidity, with a processing scale approaching that of centralized exchanges. Currently supporting 58 builders and liquidating billions of dollars, $ORDER's price remains at a low valuation typical of its early stages.

Data comparison shows:

- In terms of core indicators such as trading volume, TVL, and open interest (OI), Orderly is 2–6 times higher than AVNT.

- But $ORDER’s market capitalization is only 1/7–1/8 of AVNT’s

This isn't just an undervaluation; it's more like a market mispricing. Simple valuation models suggest $ORDER's fair value should be above $2.5, yet its current trading price has barely surpassed $0.15. Once the market realizes its true value, the price is likely to correct quickly, rather than slowly returning to its fair value, creating a strong upward momentum.

It's worth emphasizing that Orderly isn't just competing with other perp DEXs; it's building a full-chain, ecosystem-wide infrastructure, aiming for a CME-level clearing system. In other words, its value lies not only in short-term market performance but also in its foundation and long-term potential within the entire DeFi ecosystem.

Based on recent market dynamics, DeFi investment strategies can be categorized as short-term arbitrage and long-term investment. Short-term arbitrage opportunities are obvious: capitalize on price increases and airdrops to quickly profit, as seen with MYX, AVNT, and Aster. However, long-term investment requires more insight, as truly robust opportunities often lie within projects with deep technical expertise, robust ecosystems, and experienced teams. Orderly is a prime example of this: while it may not be immediately fully recognized by the market, as the DeFi space matures, undervalued technology-focused projects like these often experience a revaluation.

From an investor's perspective, the DeFi craze isn't just about chasing short-term profits; it's also a process of re-evaluating the sector's potential, technological innovation, and ecosystem landscape. In this process, Orderly meets the three key criteria of technology, ecosystem, and valuation, allowing it to avoid short-term noise while capturing long-term growth opportunities.

In short, the DeFi craze brings more than just price fluctuations; it also provides a window into observing, understanding, and exploring promising projects. Rational investors should remain calm amidst the hype and focus on trends and the core value of each project. Orderly, as a technology-driven coin with potential, undoubtedly deserves continued attention. In the coming months, as market capital flows return and ecosystem dividends are unleashed, Orderly's performance will provide a crucial window into DeFi's maturity and potential investment logic.

You May Also Like

CME Group to offer 24/7 crypto futures and options in 2026

Ross Ulbricht sets the record straight as Kamala Harris’s critique misses the mark