Solana Staking Protocol, Jito (JTO) Gets $50M Investment from $46B AUM Andreessen Horowitz

Venture capital firm Andreessen Horowitz (A16Z) acquired $50 million worth of JTO, the native token of Solana staking protocol Jito, marking a significant institutional investment in one of Solana’s leading liquid staking platforms.

According to a Fortune report, the transaction marks the largest single commitment by an investor in Jito’s history.

Brian Smith, executive director at the Jito Foundation, confirmed that the private deal is structured for long-term cooperation between both firms, hinting at discount incentives.

The purchase represents a private token acquisition rather than an equity stake, a structure increasingly common among institutional investors seeking liquid exposure to blockchain protocols.

Over the past year, A16Z has executed several large token-based deals, including $55 million in LayerZero and $70 million in EigenLayer.

Solana Staking Rewards Hit $5B Annually as Institutions Accumulate

According to StakingRewards data, Solana’s staking ecosystem generates roughly $5 billion in annual rewards, making it one of the most lucrative proof-of-stake networks globally. A16Z’s $50 million allocation places it on a growing list of corporate entities such as Forward Industries and DeFi Corporation, both of which hold and stake substantial SOL reserves in their treasuries.

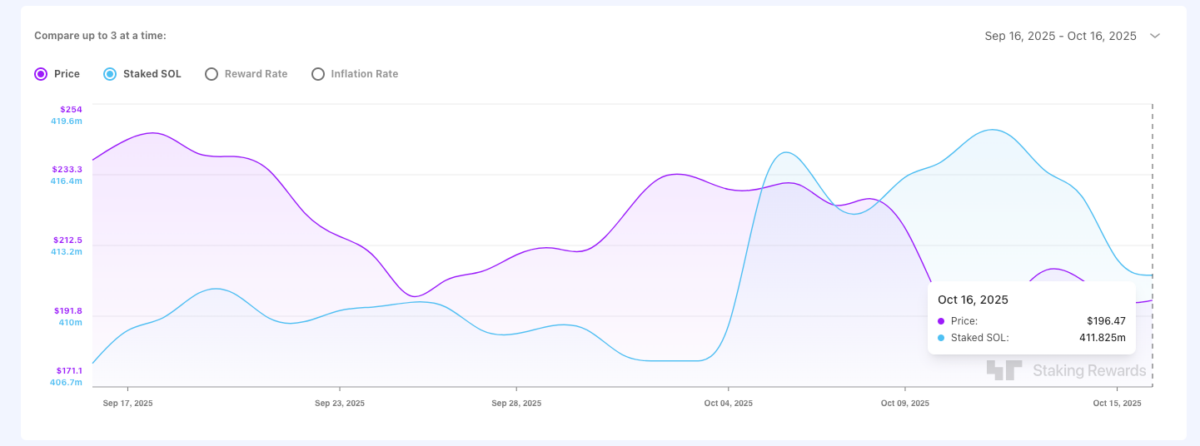

However, recent on-chain metrics indicate that Solana aggregate staking flows remain negative since the record-breaking market crash last week. As seen below, Total SOL stake has declined from 418.6 million on October 11 to 411.5 million SOL at press time, a withdrawal of 7.1 million SOL worth over $1.4 billion.

Total Solana (SOL) Staked declined 7.1 million SOL (~$1.4 billion) since Oct 11 market crash | Source: StakingRewards

Increased circulating supply from the recent $1.4 billion staking withdrawals adds to bearish pressure pinning Solana price below $200 this week.

However, fresh corporate inflows from A16z reinforces long-term confidence in Solana’s tokenomics among institutional firms, anticipating an imminent recovery from the ongoing market consolidation phase.

SUBBD Presale Crosses $1.2M as Solana Ecosystem Growth Lifts Web3 Investor Confidence

Solana’s recent whale inflows have reignited interest in emerging projects like SUBBD ($SUBBD).

SUBBD integrates AI-driven personalization with creator monetization, enabling influencers and brands to build fan communities.

SUBBD Presale

The SUBBD presale has now surpassed $1.2 million of its $1.4 million fundraising target, with tokens currently priced at $0.056 each. With less than 24 hours before the next price tier, interested participants can visit the official SUBBD presale website to unlock early-entrant rewards.

nextThe post Solana Staking Protocol, Jito (JTO) Gets $50M Investment from $46B AUM Andreessen Horowitz appeared first on Coinspeaker.

You May Also Like

SOL Faces Pressure, DOT Climbs 2.3%, While BullZilla Presale Rockets Past $460K as the Top New Crypto to Join Now

Ethereum Price Prediction: Can ETH Hit $6K While MoonBull Ignites as the Best Crypto Presale in 2025?