| COINOTAG recommends • Exchange signup |

| 💹 Trade with pro tools |

| Fast execution, robust charts, clean risk controls. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🚀 Smooth orders, clear control |

| Advanced order types and market depth in one view. |

| 👉 Create account → |

| COINOTAG recommends • Exchange signup |

| 📈 Clarity in volatile markets |

| Plan entries & exits, manage positions with discipline. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| ⚡ Speed, depth, reliability |

| Execute confidently when timing matters. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🧭 A focused workflow for traders |

| Alerts, watchlists, and a repeatable process. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| ✅ Data‑driven decisions |

| Focus on process—not noise. |

| 👉 Sign up → |

MicroStrategy, known here as Strategy, has a 70% chance of joining the S&P 500 by year-end 2025, despite slowing Bitcoin purchases and fading investor sentiment, according to 10x Research. A strong Q3 earnings report on October 30 could trigger this inclusion, boosting its profile as the largest corporate Bitcoin holder.

-

70% probability of S&P 500 inclusion by December 19, 2025, post-Q3 earnings.

-

Strategy’s Bitcoin holdings could yield $3.8 billion in gains via fair-value accounting.

-

Investor sentiment is low, but the upcoming earnings serve as a key catalyst amid market corrections.

Discover Strategy’s 70% shot at S&P 500 inclusion in 2025 despite Bitcoin slowdowns. Explore earnings impact, market NAV challenges, and liquidity trends. Stay ahead in crypto investments—read now for expert insights.

What Are the Chances of Strategy Joining the S&P 500 in 2025?

Strategy S&P 500 inclusion appears highly likely with a 70% probability by December 19, 2025, even as its stock price dips and Bitcoin acquisitions slow, per analysis from crypto intelligence firm 10x Research. The company’s third-quarter earnings, due October 30, are projected to show a $3.8 billion gain from fair-value accounting of its Bitcoin holdings. This profitable outcome could position Strategy for index addition, revitalizing investor interest in the world’s top corporate Bitcoin holder.

| COINOTAG recommends • Professional traders group |

| 💎 Join a professional trading community |

| Work with senior traders, research‑backed setups, and risk‑first frameworks. |

| 👉 Join the group → |

| COINOTAG recommends • Professional traders group |

| 📊 Transparent performance, real process |

| Spot strategies with documented months of triple‑digit runs during strong trends; futures plans use defined R:R and sizing. |

| 👉 Get access → |

| COINOTAG recommends • Professional traders group |

| 🧭 Research → Plan → Execute |

| Daily levels, watchlists, and post‑trade reviews to build consistency. |

| 👉 Join now → |

| COINOTAG recommends • Professional traders group |

| 🛡️ Risk comes first |

| Sizing methods, invalidation rules, and R‑multiples baked into every plan. |

| 👉 Start today → |

| COINOTAG recommends • Professional traders group |

| 🧠 Learn the “why” behind each trade |

| Live breakdowns, playbooks, and framework‑first education. |

| 👉 Join the group → |

| COINOTAG recommends • Professional traders group |

| 🚀 Insider • APEX • INNER CIRCLE |

| Choose the depth you need—tools, coaching, and member rooms. |

| 👉 Explore tiers → |

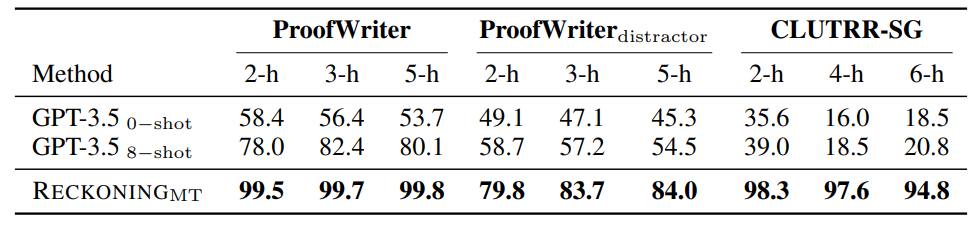

Strategy Bitcoin buying, Strategy NAV 30-day average, 1-year chart. Source: 10x Research

How Has the Slowdown in Bitcoin Purchases Affected Strategy’s Valuation?

The slowdown in Bitcoin buying has strained Strategy’s market net asset value (mNAV), pushing it below critical thresholds alongside other digital asset treasury firms. mNAV measures enterprise value against crypto holdings; ratios above 1 enable share issuance for asset accumulation, while below 1 hinders growth. Firms like Strategy, Bitmine, Metaplanet, Sharplink Gaming, Upexi, and DeFi Development Corp have all dipped under this level in 2025, limiting their ability to expand Bitcoin reserves amid broader market pressures. According to data from Standard Chartered, mNAVs for these entities have faced consistent declines since June. Expert analysis from 10x Research highlights that despite these challenges, Strategy’s position remains resilient, with upcoming earnings offering a pathway to recovery. “Capitulation always feels like the end—until it quietly marks the beginning,” notes the 10x Research report, emphasizing the potential for renewed momentum.

Investor sentiment toward Strategy remains subdued, described as “washed out” by 10x Research, yet the October 30 earnings release stands out as an obvious catalyst. This comes against a backdrop of a $19 billion market correction that has unwound much of the company’s NAV premium, leading to $18 billion in investor losses. Still, volatility trends suggest a shift, positioning the market for liquidity influx at this cycle stage.

| COINOTAG recommends • Exchange signup |

| 📈 Clear interface, precise orders |

| Sharp entries & exits with actionable alerts. |

| 👉 Create free account → |

| COINOTAG recommends • Exchange signup |

| 🧠 Smarter tools. Better decisions. |

| Depth analytics and risk features in one view. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| 🎯 Take control of entries & exits |

| Set alerts, define stops, execute consistently. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🛠️ From idea to execution |

| Turn setups into plans with practical order types. |

| 👉 Join now → |

| COINOTAG recommends • Exchange signup |

| 📋 Trade your plan |

| Watchlists and routing that support focus. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| 📊 Precision without the noise |

| Data‑first workflows for active traders. |

| 👉 Sign up → |

Digital asset treasuries’ mNAVs have been under broad pressure since June. Source: Standard Chartered

Frequently Asked Questions

What Factors Could Influence Strategy’s S&P 500 Inclusion Decision in December 2025?

Strategy’s potential S&P 500 inclusion hinges on its Q3 2025 earnings performance, expected to report around $3.8 billion in Bitcoin-related gains. A profitable quarter would elevate its eligibility, with 10x Research estimating a 60%-70% success rate for the December 19 decision. Broader market recovery and sustained Bitcoin holdings will also play key roles in demonstrating financial stability to index criteria.

Why Has Strategy Slowed Its Bitcoin Purchases, and What Does It Mean for Investors?

Strategy acquired just 778 Bitcoin in October 2025, a 78% drop from September’s 3,526 BTC, due to mNAV pressures and funding constraints below the key threshold of 1. For investors, this signals caution amid volatility, but 10x Research views it as a cycle turning point where liquidity could return, potentially sparking outsized gains. It underscores the need to monitor earnings for signs of renewed accumulation strategies.

| COINOTAG recommends • Traders club |

| ⚡ Futures with discipline |

| Defined R:R, pre‑set invalidation, execution checklists. |

| 👉 Join the club → |

| COINOTAG recommends • Traders club |

| 🎯 Spot strategies that compound |

| Momentum & accumulation frameworks managed with clear risk. |

| 👉 Get access → |

| COINOTAG recommends • Traders club |

| 🏛️ APEX tier for serious traders |

| Deep dives, analyst Q&A, and accountability sprints. |

| 👉 Explore APEX → |

| COINOTAG recommends • Traders club |

| 📈 Real‑time market structure |

| Key levels, liquidity zones, and actionable context. |

| 👉 Join now → |

| COINOTAG recommends • Traders club |

| 🔔 Smart alerts, not noise |

| Context‑rich notifications tied to plans and risk—never hype. |

| 👉 Get access → |

| COINOTAG recommends • Traders club |

| 🤝 Peer review & coaching |

| Hands‑on feedback that sharpens execution and risk control. |

| 👉 Join the club → |

Key Takeaways

- High Inclusion Odds: Strategy faces a 70% chance of S&P 500 entry by year-end, driven by strong Q3 gains and despite current headwinds.

- mNAV Challenges: Multiple firms, including Strategy, struggle with ratios under 1, curbing Bitcoin buys but not derailing long-term potential per 10x Research.

- Cycle Shift Insight: Recent slowdowns align with crypto’s liquidity resurgence phase—investors should prepare for volatility and opportunities ahead.

Conclusion

In summary, Strategy S&P 500 inclusion in 2025 holds strong promise at 70%, bolstered by projected Bitcoin accounting gains and market cycle dynamics, even as slowdowns in purchases and mNAV strains persist. Insights from 10x Research and S&P Global Ratings underscore the firm’s pioneering role in corporate crypto adoption. As earnings approach, stakeholders should watch closely for catalysts that could propel Strategy forward, signaling broader acceptance of digital assets in traditional finance.

| COINOTAG recommends • Members‑only research |

| 📌 Curated setups, clearly explained |

| Entry, invalidation, targets, and R:R defined before execution. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🧠 Data‑led decision making |

| Technical + flow + context synthesized into actionable plans. |

| 👉 Join now → |

| COINOTAG recommends • Members‑only research |

| 🧱 Consistency over hype |

| Repeatable rules, realistic expectations, and a calmer mindset. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🕒 Patience is an edge |

| Wait for confirmation and manage risk with checklists. |

| 👉 Join now → |

| COINOTAG recommends • Members‑only research |

| 💼 Professional mentorship |

| Guidance from seasoned traders and structured feedback loops. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🧮 Track • Review • Improve |

| Documented PnL tracking and post‑mortems to accelerate learning. |

| 👉 Join now → |

Source: https://en.coinotag.com/strategy-may-join-sp-500-by-year-end-despite-slowing-bitcoin-buys/