TON Price Prediction: TON Holds $2.26 — Why ConstructKoin (CTK) Ranks Among the Best Presale Crypto 2025

Toncoin (TON) is trading near $2.26, holding onto recent gains as traders weigh macro momentum against network fundamentals. With TON’s market cap hovering in the multi-billion range and on-chain activity stable, investors are balancing exposure between proven infrastructure tokens and early presales promising asymmetric returns. One of the presales attracting attention this cycle is ConstructKoin (CTK) — a ReFi (Real Estate Financing) protocol analysts are listing among the best presale crypto 2025 opportunities.

TON technical snapshot

TON’s consolidation around $2.26 shows healthy support after recent rallies. Traders watch $2.10 as a short-term cushion and see $2.45–$2.60 as the next tier of resistance should broad risk appetite continue. TON benefits from strong developer attention and messaging-layer use cases, but the market’s search for diversification is driving flows into novel utility sectors — namely ReFi.

Why “Best Presale Crypto 2025” matters for CTK

Presales are noisy — some succeed, many fail. The winners combine product traction, compliance, and measurable pilot activity. ConstructKoin’s presale is structured across 10 phases (starting at $0.1 → $1, $100M target) and built to tie funding to execution. That starts CTK in a different class compared to speculative token launches: it’s aimed at building a viable financing protocol that institutional counterparties can evaluate and trust.

CTK vs. TON (and others): different risk / reward profiles

Toncoin is a network asset with established liquidity and ecosystem services. CTK is a presale token focused on routing capital into real-world property development. Consider this simple framework:

-

TON: blockchain-native utility, medium volatility, strong network effect.

-

CTK (presale): higher early-stage risk, higher asymmetric upside if pilot financings and lender integrations scale — but requires execution on legal/compliance fronts.

For traders hunting the best presale crypto 2025, CTK represents an asymmetric bet with a clearly defined use case: milestone-based financing, compliance tooling, and lender dashboards aimed to attract institutional flows.

Why TON holders should watch CTK

Stable network tokens like TON often serve as an on-ramp for capital looking for yield and diversification. As investors stabilize positions in TON, some allocate a portion of their risk budget into presales with real-economy utility. ConstructKoin’s ReFi thesis — enabling verified developer onboarding, automated drawdowns, and auditable reporting — directly targets the friction that keeps large capital pools sidelined from direct real-estate financing. If CTK validates pilot deals and shows repeatable cashflow mechanics, it can attract liquidity from conservative crypto investors who want exposure beyond L1 service tokens.

Founder credibility & execution

ConstructKoin’s roadmap centers on verifiable milestones and institutional-ready tooling. Founder Chris Chourio has emphasized that CTK will prioritize compliance, auditability, and lender-grade reporting — three areas critical to convincing banks and funds to pilot on-chain financing workflows.

Risks & catalysts

Primary catalysts: announced pilot financings, signed lender partnerships, successful audits, and milestone-driven press releases. Risks: regulatory variance across markets, partner execution, and the time needed to scale real-world integrations.

Final take

Toncoin offers network stability and developer traction, but the presale category is where buyers hunt asymmetric returns. ConstructKoin (CTK) — structured as a disciplined, milestone-driven presale — is one of the best presale crypto 2025 ideas for investors seeking exposure to real-world financing on-chain. If CTK executes against its pilot and compliance roadmap, the token could become a core play for crypto portfolios diversifying beyond pure L1 exposure.

Name: Construct Koin (CTK)

Telegram: https://t.me/constructkoin

Twitter: https://x.com/constructkoin

Website: https://constructkoin.com

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

You May Also Like

Technical Setup for RECKONING: Inner Loop Gradient Steps, Learning Rates, and Hardware Specification

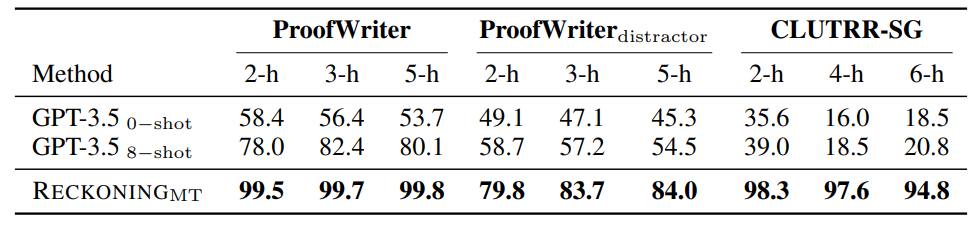

The Strength of Dynamic Encoding: RECKONING Outperforms Zero-Shot GPT-3.5 in Distractor Robustness