👨🏿🚀TechCabal Daily – Court freezes Kenya’s US healthcare deal

TGIF!

The wild story of the day is Disney agreeing to invest $1 billion in Uncle Sam’s OpenAI and allowing the AI company to use its Disney characters on Sora, its video creation tool. Maybe Bob Iger is trying to get ahead of whatever comes next in the Netflix-Paramount-Warner brouhaha swirling around Hollywood’s future.

And to all who call everything AI slop and fear the worst, I hate to break it to you, but your worst fears might be coming true soon in the entertainment industry, at least on the content creator level. As for me, I’m keeping an open mind and will be munching popcorn, cheering the creator who’d prompt the best Tarzan and Mulan crossover on Sora. And who knows if Character AI might also get the same privilege? I need a Jedi training routine.

Hol’up, somebody call Bob, I’m cooking!

—Emmanuel

- Quick Fire

with Beverly Ezebuike

with Beverly Ezebuike - Privacy concerns over Kenya-US health deal

- Standard Bank backs Safaricom Ethiopia

- Who secured the bag?

- World Wide Web 3

- Job Openings

features

Quick Fire  with Beverly Ezebuike

with Beverly Ezebuike

Beverly Ezebuike, fintech and blockchain marketing expert

Beverly Ezebuike, fintech and blockchain marketing expert

Beverly Ezebuike is a global fintech and blockchain marketing expert and recognised thought leader, with a track record of driving large-scale marketing operations that have generated over $50 million in profit for brands. She holds a Master’s in Digital Marketing, with Distinction, from the University of Northampton and certification from the Digital Marketing Institute (DMI).

- Explain what you do to a 5-year-old.

I lead global marketing operations for FinTech and Blockchain brands, helping them grow and make more revenue through partnerships and community-driven marketing. Over the years, I have built and executed strategies that helped me source, negotiate, and close high-value deals with affiliates, brands, influencers, and communities. Those efforts have driven over $50 million in profit and brought more than 500,000 new members into different communities, which is something I am incredibly proud of. My track record has helped me stand out in the tech space and consistently deliver exceptional results for the brands I work with.

- What’s the hardest part about growing a fintech brand in Africa?

The hardest part of growing a fintech brand in Africa is building and sustaining trust. Since stepping into the payments industry at Binance, I have seen how trust can either make or break a brand. Too many stories of platforms going bankrupt or shutting down while holding customers’ funds have left people very cautious.

In September 2024, I moved to the UK to study for a Master’s degree in Digital Marketing, graduating with distinction. During my research, I compared how marketing is done in the European fintech and blockchain sectors versus Africa, and developed strategic approaches to close some of the gaps. One of the most notable findings was that many African fintech brands struggle to get users to trust them in the early stages.

Working at Binance, Kuda Bank, and now Raenest, I engage with thousands of customers very often, and I get to see clearly how crucial trust is. The moment users feel their funds or data are not safe, they are ready to move to a competitor without looking back. I always tell organisations that once you win trust and build a genuine community around your brand, you are already hundreds of steps ahead in the market, and that is exactly what I prioritise at Raenest.

- What’s the biggest myth about digital payments or fintech marketing you’d like to bust?

The biggest myth definitely has to be when people say that fintech platforms are only safe for moving money, not keeping it. That’s simply not true. Many payment platforms have evolved into trustworthy financial ecosystems that serve millions daily. It’s important, especially for older generations, to acknowledge how far digital payments have come and how reliable they’ve become.

- If you could wave a magic wand and fix one thing about Africa’s fintech and broader tech ecosystem, what would it be?

It would be the fragmented payment system across the continent. After studying Europe’s fintech landscape (since I moved to the UK), where cross-border payments are seamless, I’ve often imagined how transformative it would be to replicate that simplicity in Africa.

While stablecoins and new solutions are helping, the fragmented infrastructure still limits user experience and business growth. If that system could be unified, Africa’s financial ecosystem would progress rapidly. So yes, if I could wave a magic wand, I’d fix that.

Powering African Businesses Through the Busiest Season of the Year.

Your peak season needs fast and reliable payments. Collect, pay, and settle across Africa in the right currencies without delays. Create your Fincra account in 3 minutes.

policy

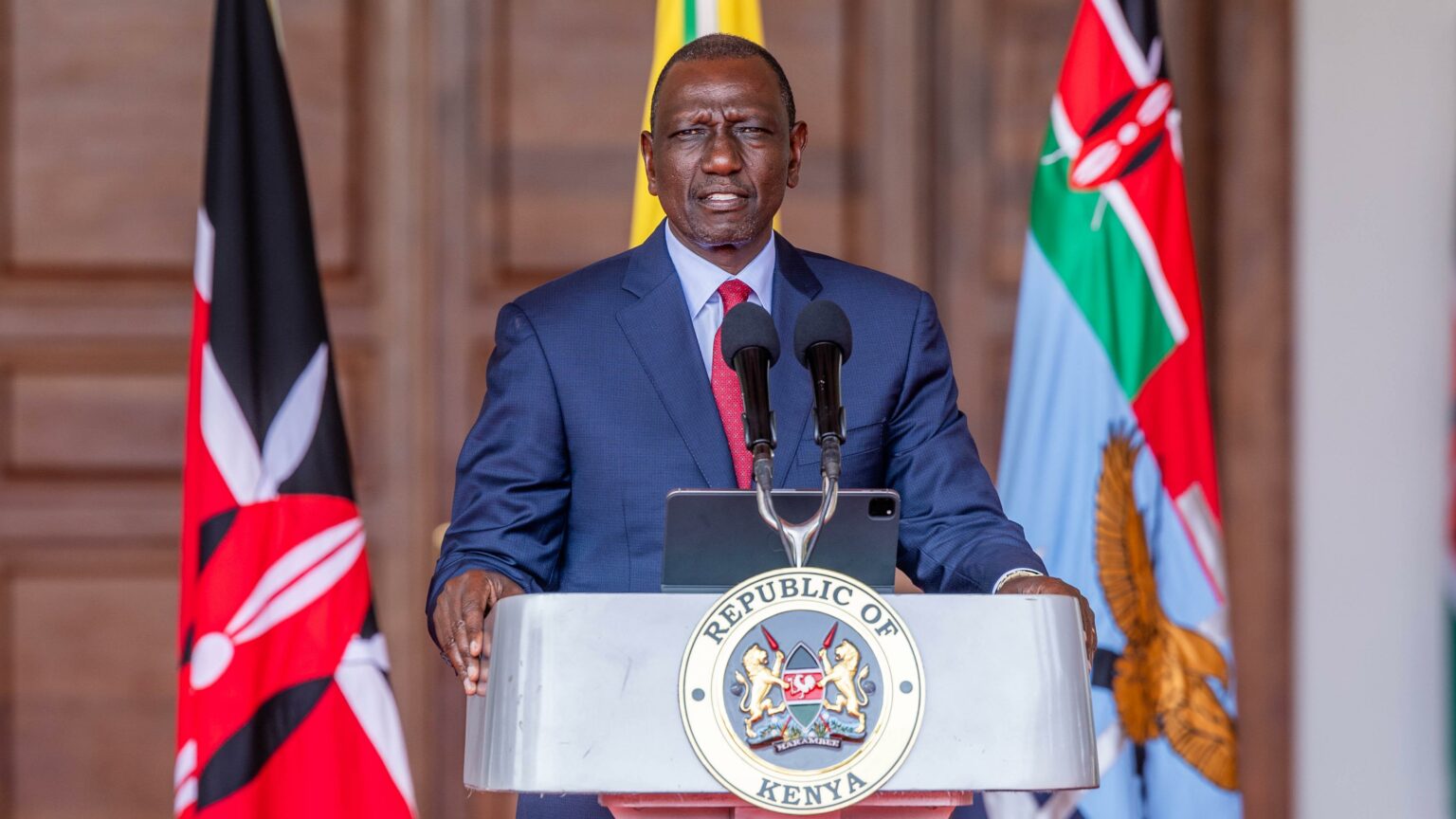

Kenya-US $2.5 billion health deal paused over data privacy concerns

Kenya’s President William Ruto. Image source: PSCU

Kenya’s President William Ruto. Image source: PSCU

Kenya’s $2.5 billion health pact with the US was pitched as a reset in how the two countries work together on health; a clean break from the old USAID-style setup. For two decades, most US support flowed through USAID contractors that ran big chunks of Kenya’s HIV, tuberculosis (TB) and supply chain systems. When those funds were cut or redirected, Kenya was left scrambling to rebuild platforms it did not fully control. The new deal was meant to fix that by shifting to a government-to-government model where Kenya co-leads, co-finances, and keeps its systems on home turf.

That promise is now on hold. A High Court order on Thursday has paused anything in the agreement that touches Kenyans’ health data after consumer lobby group Consumer Federation of Kenya (Cofek) sued. Cofek argued that the Kenyan government did not explain where the data would sit, who would access it, and how records like HIV and TB histories would be protected. It also claimed the state skipped proper public participation. The judge found enough merit to freeze implementation until February.

Government officials say the pact is safe and that the attorney general vetted every clause. The US has not commented yet, but critics say the timing is awkward. Kenya is still rebuilding digital health systems weakened by the earlier USAID exit and risks ceding strategic control “if pharmaceuticals for emerging diseases and digital infrastructure (including cloud storage of raw data) are externally controlled.”

Yet, Kenya is not an isolated case. On Wednesday, Uganda signed its own US health deal worth up to $1.7 billion ($2.3 billion total package) under the same “America First” template. With donors funding over half of Uganda’s health budget, its dependence is deeper.

For Africa, the real question is whether these new arrangements strengthen its sovereignty or simply dress up old power dynamics in new language. Kenya’s court case will set the tone.

Enjoy smooth payments while you’re home this Detty December

Coming home for Detty December? Enjoy smooth payments every day with your Paga US account. Send money to any bank instantly. Don’t miss out, get started now.

companies

Standard Bank backs Safaricom Ethiopia with $138 million expansion loan

Image Source: Bloomberg

Image Source: Bloomberg

On December 10, Standard Bank, South Africa’s largest bank by assets, partnered with Safaricom Ethiopia, a subsidiary of the telecom giant, providing $138 million in funding for the telecom company’s rollout and expansion in Ethiopia. Standard Bank acted as the sole arranger, lender, facility agent, and adviser on the deal.

State of play: Safaricom Ethiopia has over 10 million active users after just four years, but expanding coverage still requires heavy investment in towers, fibre, distribution, and spectrum. The telecom has been on a capital-raising run after securing approval from the Kenyan Capital Markets Authority (CMA) to raise a $308 million debt in November.

Safaricom closed the first tranche of its bond raise on Wednesday, after receiving an oversubscribed KES 20 billion ($154 million).

Raising an additional bank loan from the lender spreads those rollout costs over time, reduces pressure on Safaricom’s Kenyan balance sheet, and signals to Ethiopian regulators that regional capital, not just global investors, supports the market’s liberalisation.

Between the lines: The telecom company is in the middle of a lot of drama: it is in the process of getting acquired by Vodacom, pressures from the Kenyan government to split its business three-way has also intensified, yet it marches on, raising more money for infrastructure projects.

For Standard Bank, the deal is part of a strategy to sit at the centre of cross‑border infrastructure and digital projects, earning transaction, FX, payments, and capital-markets business as the ecosystem grows. For Safaricom, it unlocks funding for its expansion while maintaining financial flexibility.

Ethiopia is one of the last major under‑penetrated telecom markets on the continent, with internet usage still below one‑fifth of the population despite millions of new users added in recent years. So, for the lender, it’s a chance to back a high-growth market, with potential for long-term returns as digital adoption expands across the country.

Stay up to date with Paystack news!

Subscribe to Paystack for a curated dose of product updates, insights, event invites and more. Subscribe here →.

Insights

Funding Tracker

Image: TechCabal Insights

Image: TechCabal Insights

Ageiro, a South African AI startup, raised $3 million to advance its AI platform. The investors were not disclosed. (Dec 9)

Here are the other deals for the week:

- BasiGo, a Kenyan e-mobility startup, secured an undisclosed funding from Proparco. (Dec 5)

- MM LEKKER, a Beninese agritech startup, secured $800,000 investment from Sahel Capital’s Social Enterprise Fund for Agriculture in Africa. (Dec 9)

- Ezeebit, a South African fintech startup, raised $2.05 million in a seed funding round, led by Raba Partnership and Founder Collective, with participation from Terry Angelos (ex-Visa), Anton Katz (Talos), Nadir Khamissa (Hello Group), David De Picciotto (ex-Revolut), and Chris Harmse (BVNK). (Dec 10)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go,what is the future of digital health in Nigeria? Find out here.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| Bitcoin | $92,273 |

+ 2.28% |

– 10.71% |

| Ether | $3,243 |

+ 1.30% |

– 6.00% |

| XRP | $2.02 |

+ 0.92% |

– 15.36% |

| BNB | $887 |

+ 2.21% |

– 7.54% |

* Data as of 06.19 AM WAT, December 12, 2025.

JOB OPENINGS

- VertoFX —Customer Experience Analyst, Reconciliation Associate — Hybrid (Nairobi, Kenya)

- VertoFX —Sales Director, Risk & Compliance Officer — Hybrid (Cape Town, South Africa)

- Deel —Senior Risk Analyst — Remote (Nigeria)

- Migo —Growth & Product Marketing Analyst — Lagos, Nigeria

- Piggyvest —Product Marketing & Communications Lead — Lagos, Nigeria

- Busha — Business Development Manager, Reconciliation and Settlement Analyst (Fiat & Crypto) — Hybrid (Lagos, Nigeria)

- Trust Wallet — Android Engineer, Frontend Engineer, Talent Acquisition Specialist — Remote

- Paystack —Senior Full Stack Engineer — Cape Town, South Africa

- Paystack — Business Development Partner — Lagos, Nigeria

- Flutterwave — Treasurer, Africa — Lagos, Nigeria

- Big Cabal Media —Senior Financial Analyst, Junior Sales Analyst — Hybrid (Lagos, Nigeria)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

- The Married Scientists Torn Apart by a Covid Bioweapon Theory

- Africa’s PR costs are soaring; ex-CNN anchor Zain Verjee has an AI fix

- Value laptops for Nigerian students and budget users in 2025

Written by: Emmanuel Nwosu

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Scoops: breaking news from TechCabal

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

Ayrıca Şunları da Beğenebilirsiniz

Vanguard Exec Says Bitcoin Is Like 'A Digital Labubu'

Why Blockchain Privacy And Surveillance Will Define The Next Era Of Crypto Regulation