Sui price consolidates as open interest falls, signaling weakening downside momentum

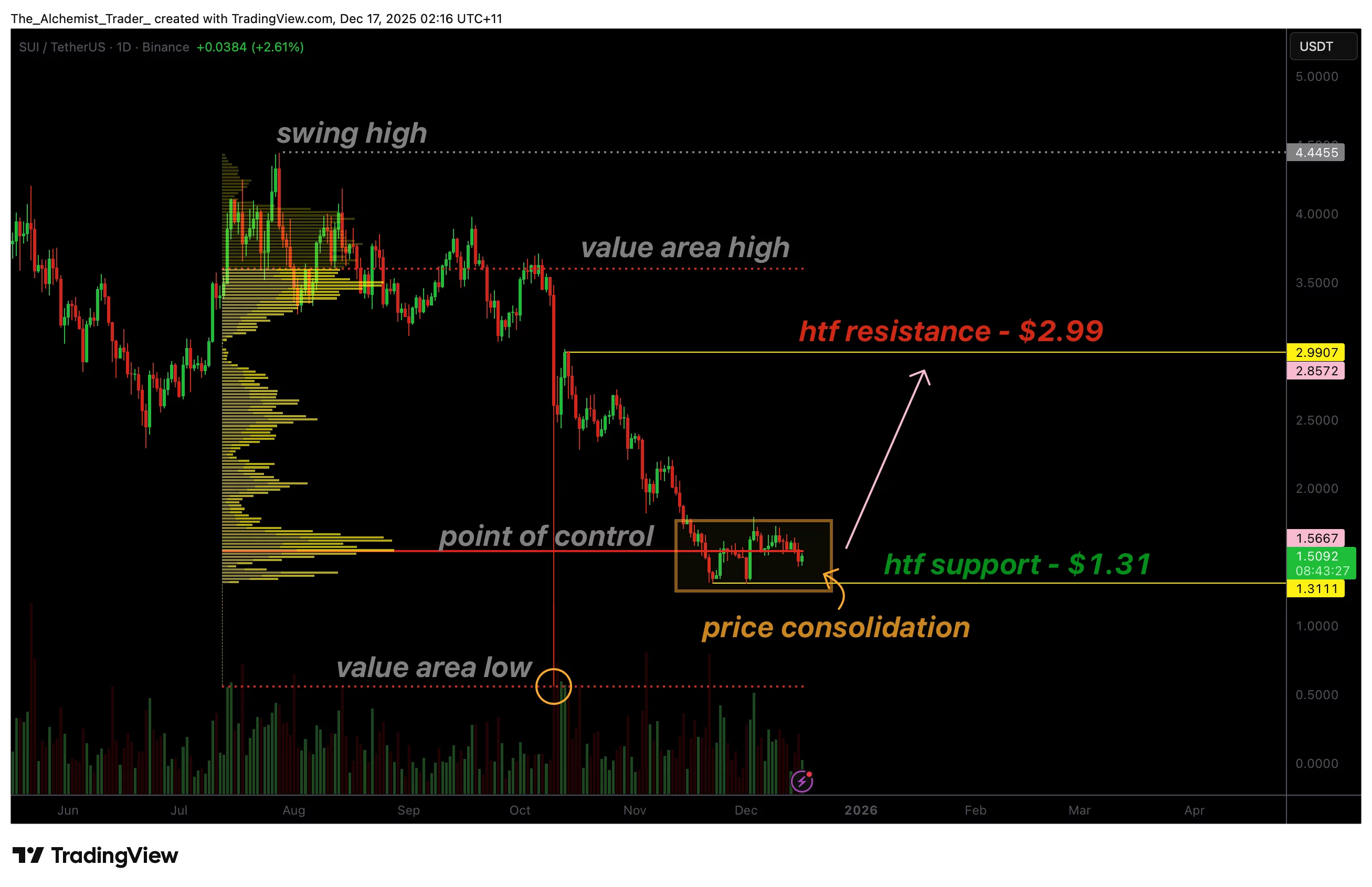

Sui price consolidates at key support near $1.31 as falling open interest signals fading bearish momentum and raises the possibility of a developing trend reversal.

- Sui holds key $1.31 support aligned with the Point of Control.

- Declining open interest signals fading downside momentum.

- Reclaim above POC could open a move toward $2.99 resistance.

Sui (SUI) price is showing early signs of stabilization after a prolonged period of downside pressure, as price action consolidates around a critical high-time-frame support level. This consolidation is occurring alongside a noticeable decline in open interest, a combination that often signals weakening downside momentum rather than renewed selling pressure.

While confirmation of a trend reversal is still pending, the current structure suggests that sellers may be losing control as the market searches for a base.

Sui price key technical points

- Sui consolidates at $1.31, a key high-time-frame support aligned with the Point of Control (POC).

- Open interest is declining, signaling reduced bearish participation and weakening downside momentum.

- The next major resistance is at $2.99, the level that must be reclaimed for trend-reversal confirmation.

Sui’s recent price action marks a notable shift in behavior compared to earlier phases of the downtrend. After an aggressive sell-off, the price has now stalled and begun to consolidate around the $1.31 support level, an area reinforced by the Point of Control (POC).

This confluence is important because the POC represents the price level at which the highest trading volume has occurred, often serving as a magnet for price during periods of equilibrium.

The halt in downside momentum at this level suggests that selling pressure has been absorbed, at least temporarily. Rather than continuing lower, Sui is forming a tight consolidation range, indicating that market participants are reassessing value.

From a market-structure perspective, this behavior is consistent with the early stages of a potential bottoming process, even as SAGINT partners with Sui on a new tokenization initiative, adding a fundamental backdrop to the evolving technical setup.

One of the most telling signals supporting this view is the decline in open interest. A decline in open interest during consolidation typically reflects the unwinding of leveraged positions, particularly on the short side.

This reduction in speculative exposure weakens downside momentum and often precedes either a range-bound phase or a trend reversal. In Sui’s case, the decline in open interest aligns closely with the observed price stabilization, reinforcing the idea that bearish conviction is fading.

Importantly, falling open interest does not automatically imply bullish continuation. Instead, it suggests that the dominant downtrend is losing strength. For a confirmed reversal to develop, Sui would need to see renewed participation from buyers, reflected by a re-expansion in open interest alongside impulsive upside price action.

The next major level to watch is $2.99, which represents the nearest high-time-frame resistance. This zone previously served as a key structural area and would likely constitute the first major test for any bullish continuation. A reclaim of the POC followed by acceleration toward this resistance would signal that new demand is entering the market.

Until then, Sui is likely to remain in a short-term consolidation phase. Such phases are common after strong trends, as markets digest prior moves and redistribute positions. The current structure resembles a bottoming formation, but confirmation will depend on how price behaves during future tests of support and whether volume and open interest begin to expand on upside moves.

What to Expect in the Coming Price Action

Sui is likely to continue consolidating around the $1.31 support in the near term. A reclaim of the Point of Control and a renewed rise in open interest would strengthen the case for a bullish rotation toward $2.99. Until then, price remains in a developing bottoming structure with downside momentum significantly weakened.

Ayrıca Şunları da Beğenebilirsiniz

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Samsung To Unveil New AI-Connected Living Lineup at CES 2026