Best XRP Buy Zone? Analyst Breaks Down The Key Levels

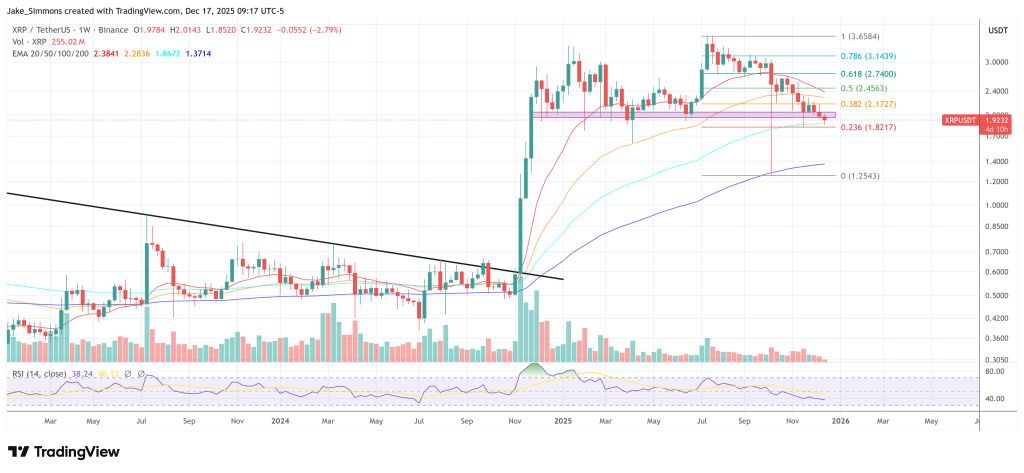

Will Taylor, founder of CryptoinsightUK, frames XRP’s “best buy area” as a risk-to-reward question, not a certainty call. In his latest YouTube video from Dec. 17, he argues that XRP is trading back in the lower portion of a well-defined range, which is typically where entries make the most sense for range traders—because invalidation levels are clearer and upside targets are structurally defined.

“We’re at the bottom of the range […] this area, the bottom of the range, and the bottom of the range has been quite wide,” Taylor said. “So, I’d say between like $2.01, then all the way down to about $1.60. This has been the best area to enter […] for the last […] basically year and a bit.”

And his emphasis is that it’s attractive because the trade is measurable, not because it’s guaranteed. “Does this mean we can’t break down further? Does this mean we can’t lose support? No, that’s not what I’m saying at all,” he added. “But what I am saying is if you use range trading, if you want to know the best areas for risk-to-reward, we’re at them now.”

On lower timeframes, Taylor said XRP has already swept much of the downside liquidity, leaving a smaller pocket below that could still get tagged. He pointed to ~$1.83 as the remaining area of interest.

“XRP has taken most of this red liquidity to the downside. There’s a small pocket of liquidity below us still at $1.83,” he said. And crucially, that level is not academic for him — it’s tied to his own stop placement and whether the market is likely to wick lower before any sustained move up.

“This is something that I’m considering […] as to whether to move my stop loss below this liquidity down at like say $1.79,” Taylor said. “My stop loss [is] $1.834 at the minute. Do I take it to say like $1.79 […] give us […] the bottom of this wick as potential support and that liquidity. That’s a potential discussion.”

The Upside Trigger For XRP

Taylor’s near-term bullish trigger is a reclaim of ~$2.07. His reasoning is positioning-driven: he thinks the market has built a meaningful amount of short exposure during the drawdown, and a move back above that level could force covering.

“When you start to get a buildup of […] lower highs like this, all it takes is a bit of momentum to break us above,” he said. “So, say for XRP, if we start to get back above $2.07, you probably should see price squeeze to $2.58-$2.60 quite quickly […] as we squeeze out all of this […] open interest that’s been adding in as price has been coming down.”

Taylor’s XRP view is nested inside a broader “crypto is mispriced” thesis. When comparing crypto’s market cap performance against a basket of traditional assets, he argues that crypto has decoupled sharply since the Oct. 10 crash, while sentiment has deteriorated.

“Crypto has like decoupled from every other asset class […] crypto is about the only asset that has decoupled this hard,” he said. “I personally believe this is a deep value zone […] we’re clearly mispriced versus other assets.”

He also repeatedly leaned on the idea that positioning is skewed: rising open interest into downside, negative premium, and funding flipping between positive and negative — conditions that can set up a squeeze if price starts reclaiming levels.

“I think a lot of the market generally is setting up for a bit of a short squeeze to the upside,” Taylor said. “And I think that people are overly negative and […] the sentiment’s overly bearish compared to where the price is.”

At press time, XRP traded at $1.92.

Ayrıca Şunları da Beğenebilirsiniz

Avantis Announces $80M AVNT Rewards in Season 3

Zoetis to Participate in the 44th Annual J.P. Morgan Healthcare Conference