NEAR Protocol (NEAR) Faces Decline, Technical Setup Suggests $2.35 Target

- NEAR price continues to decline with steady downside pressure.

- Weekly performance shows deeper losses as bearish sentiment persists.

- A falling wedge pattern signals a possible bullish reversal ahead.

- Indicators still favor sellers, keeping short-term caution in play.

NEAR Protocol (NEAR) remains on a downward trajectory as selling pressure continues to weigh on price action. Over the past 24 hours, the token has slipped by around 3.09%, while on a weekly scale, NEAR has extended losses further, dropping nearly 7.88% over the last seven days.

At the time of writing, the token is trading at $1.46, accompanied by a 24-hour trading volume of approximately $112.27 million, which reflects a 1.17% decline within the same period. Meanwhile, the market capitalization stands close to $1.88 billion, marking a further decrease of almost 3.11% as bearish sentiment persists.

Also Read: NEAR Protocol Eyes Bullish Turn After Solana Network Listing

Falling Wedge Setup on the 4-Hour Chart

NEAR is trading inside a large falling wedge on the 4-hour chart, forming consistent lower highs and lower lows while price compresses near the apex. This pattern traditionally signals a bullish reversal when momentum strengthens. The price currently hovers around $1.50–$1.52, indicating gradual stabilization while defending short-term support at around $1.48.

A confirmed breakout above the wedge resistance line and close above the $1.60 levels may trigger the continuation move higher. The initial levels for the bullish response may be seen at $1.70, $1.90, while $2.10 is a significant level acting as resistance. A likely target level following the breakout from the forming wedge may be cited at $2.25-$2.35, establishing a 45% potential gain.

Weakening bullish momentum could see a test of further support levels at $1.48 and then $1.40, and eventually a structural support level of $1.32, where a trend test takes place below it. There is presently less volatility and consolidating price action, indicating a looming breakout point. NEAR maintains a positive bias while supported by the wedge support area.

Indicators Reflect Bearish Momentum

RSI on the NEAR daily chart remains around 35, which remains below the middle level of 50. A level this low indicates strong sell pressure, which means that buying support remains weak. A lack of renewed advances above the middle line shows dominance by the sellers.

MACD analysis reveals that the line is placed below the signal line. Also, the histogram is held close to the negative zone. It is noted that red candle wicks are constantly shrinking in size. However, the moment will come when a strong crossover will be formed. This will make the indicator of the token turn towards a meaningful recovery.

Also Read: Binance Coin Holds Near $830 as Amazon AWS Supports BNB Payments

Ayrıca Şunları da Beğenebilirsiniz

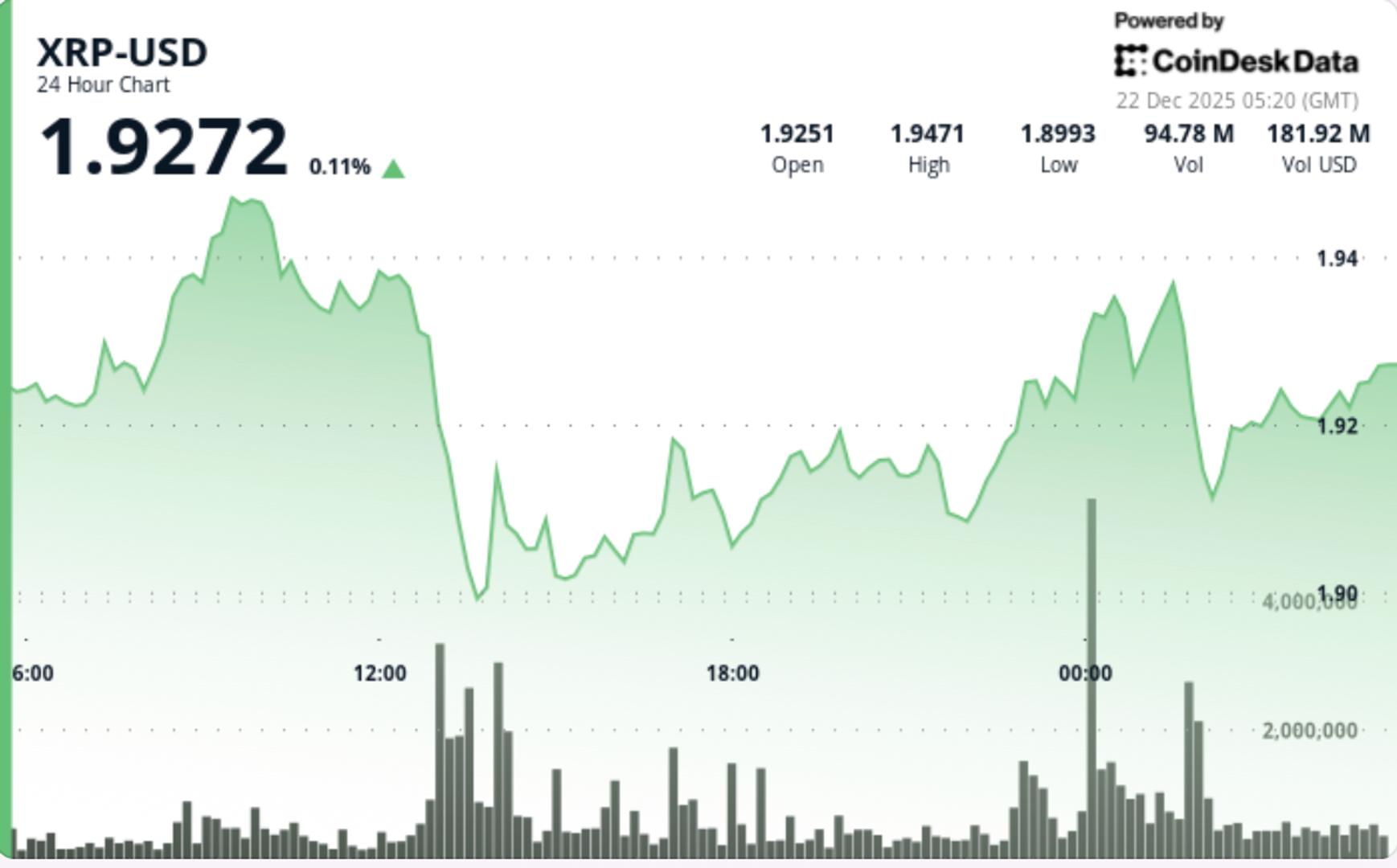

XRP weakens after repeated price-action failures near $1.95

Copy linkX (Twitter)LinkedInFacebookEmail

Shiba Inu’s (SHIB) Price Prediction for 2025 Points to 4x Growth, But Mutuum Finance (MUTM) Looks Set for 50x Returns